High-profile deals in the insurance, real estate and software sectors have been keeping advisers busy this week, as leading US and UK firms advised on high-profile mandates.

The trend of increasingly ambitious private credit deals broke new ground in recent days, as a host of City firms advised on the refinancing of The Access Group. The transaction, speculated to value in the region of £3.2bn, is the largest European private debt financing in history as well as the region’s largest ever unitranche facility.

A provider of business management software to mid-sized enterprises across the UK and Asia Pacific, The Access Group was also subject to further investment by its shareholders, Hg Capital and TA Associates. Following the new investment, the company is set to become one of the UK’s biggest software providers.

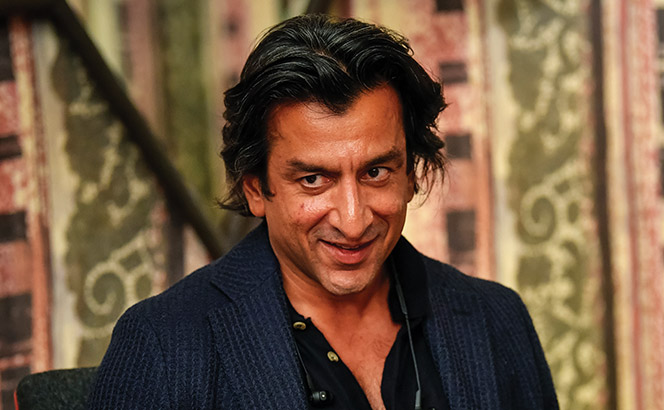

A team from Kirkland & Ellis’ London office advised The Access Group on the refinancing. Neel Sachdev (pictured) led the deal team alongside Kanesh Balasubramaniam, with tax partners Tim Lowe, Art Ward and Christine Lehman and regulatory specialist Thomas Woodhead also advising.

Speaking to Legal Business, Sachdev hailed the transaction as reflecting a profound shift in the market: ‘This is the year of the private credit financing! For a credit fund to finance such a large transaction, and for 13 of them to do it, is a big step. Historically, such a large transaction couldn’t have been financed without a rating and banks underwriting the debt package.

‘Banks are struggling to compete with private credit groups. They used to be able to offer cheaper rates, but the volatility in the market at the moment means there is no longer certainty and that remains the case.’

Travers Smith’s London practice assisted The Access Group with the further investment by existing shareholders. Private equity and financial sponsors duo Genna Marten and Emma Havas led on the transaction with the support of tax partner Hannah Manning, as well as head of incentives and remuneration Mahesh Varia.

Shearman & Sterling advised the financing sources to The Access Group with a team comprising City partners Sanjeev Dhuna, Rahul Chatterji and Marwa Elborai.

The Access Group’s existing shareholders, including Hg and TA Associates, were represented by Latham & Watkins. London Corporate partner Paul Dolman led the team, while Nicola Higgs oversaw the regulatory aspects.

Linklaters also advised the shareholders. The deal team was led by financial sponsors partner Alex Woodward who was supported by Peter McCabe.

Elsewhere, Kirkland was also involved as insurance broking group Howden acquired international risk advisor TigerRisk Partners. The transaction, which is still subject to regulatory approval, sees Howden swell to a $30bn gross premium business with an enterprise value exceeding $13bn.

Weil advised longstanding client Howden on the deal. Private equity partner Jonathan Wood led the team in London, while Raymond Gietz led the New York group which included compensation and benefits partner Amy Rubin, banking partner Damian Ridealgh, and tech and IP specialist Dennis Adams. In Washington DC Vadim Brusser and Devon Bodoh advised on antitrust and tax respectively.

Wood told Legal Business: ‘Howden has grown phenomenally over the last ten years through acquisitions and team hires. The company is very focused on employee share ownership, so whenever it makes acquisitions, it considers bringing the team into the Howden equity structure. Howden and TigerRisk are also regulated businesses in a number of jurisdictions. All of that adds extra layers of complexity around the deal.

‘We’ve advised Howden for a long time. We originally advised General Atlantic when they made an investment in the company, and we got to know the Howden team. We then advised on Howden’s acquisition of R K Harrison in 2015, which was quite transformational. From there, we have acted for the company in five major transactions.’

Kirkland advised Flexpoint Ford as the seller and TigerRisk as the target company. Chicago corporate duo Mark Fennell and John Kosir were the key partners.

Finally, FTSE 250 listed companies Shaftesbury Plc and Capital & Counties Properties Plc (Capco) have announced a recommended all-share merger. The two companies have a combined £5bn real estate portfolio, with assets in many of the capital’s most famous locations including Covent Garden, Carnaby Street, Chinatown and Soho.

The transaction, which will bring together two of London’s biggest landlords should it complete, is one of the largest public M&A deals announced so far this year. Following the merger, Shaftesbury shareholders will own 53% of the new entity, and Capco shareholders the other 47%.

A team from Hogan Lovells’ London office represented Shaftesbury. Corporate partner Nicola Evans led on the transaction with the support of Anthony Doolittle.

Capco was advised by Herbert Smith Freehills. The team featured partners from the London M&A and equity capital markets teams, including Alex Kay, Heidi Gallagher, Stephen Wilkinson and Michael Jacobs.