As the world faces economic uncertainty, rising costs, and inflation, the tech scene in Israel offers optimism and relief. Lee Saunders of Nishlis Legal Marketing comments

Ancient Greeks and Romans once described unicorns as extremely quick and light on their feet, with a horn that was highly prized by merchants and investors. It is a characterisation to be applied to today’s ‘unicorn’ companies – start-ups worth over US$1bn. A disproportionate number of unicorns grow in Israel and have helped the country to weather recent storms.

Tel Aviv: seventh best start-up ecosystem

This February, Bloomberg reported over 1,000 unicorns globally, and Israel – with just 0.1% of the global population – accounts for some 8%. Tel Aviv was ranked seventh in an annual survey of the world’s most attractive ecosystems for start-ups by US research firm Startup Genome. In 2021, Tel Aviv’s start-up ecosystem was valued at US$120bn, and scored three US$1bn exits. According to Forbes, 2021 saw 42 new Israeli unicorn companies registered, more than double the number in 2020, and the trend continues.

‘At the moment, we’re seeing increased activity at the seed level, new start-ups being formed and new funding available to early stage ventures.’

Yair Geva, Herzog Fox & Neeman

The number of unicorns is rapidly heading towards the 100 mark, with a total value of over US$250bn. Also, the city’s average time for a company to exit was seven years, quicker than the global average of 9.4 years. Funding for seed rounds, Series A rounds and total venture capital were all far higher than the global average.

Israeli technology companies raised all-time high of US$26.6bn in 2021, over twice that of 2020

The huge financing deals and large VC funds chasing the next successful investment have raised the value of companies and created unicorns at an unprecedented rate. The US$25.6bn Israeli firms raised from VC is roughly the same as India, with a 100 times larger population, as well as the UK, the leading innovator in Europe, and half that of the European Union, with more than 400 million people.

‘At the moment, we’re seeing increased activity at the seed level, new start-ups being formed and new funding available to early stage ventures. We are also seeing Israeli unicorns acquire foreign and local targets that are less optimistic about growth in current conditions or that have remained limited to specific features or single product offering,’ adds Yair Geva, head of Start-ups and Emerging Companies at Herzog Fox & Neeman (HFN).

But what drives Israel’s disproportionate success?

Israel’s tight-knit entrepreneurial community, strong research and development, educated population and government support, has helped it produce the most start-ups per capita of any country, with nearly 3,000 in Tel Aviv alone. Moreover, every successful ecosystem has institutions which took a leading role in its creation. In many cases, it is either a university, an accelerator or a massive corporation. In Israel, it is the army, which became one of the world’s top start-up accelerators, by accident.

‘Deals are driven by the potential technological edge, though investors are expected to be now more cautious.’

Amit Steinman, S. Horowitz & Co

There is a tradition and mentality geared towards innovation, where success stories attract more talent and failures generally do not discourage, but encourage additional attempts. There are students taking computer science and cyber-security courses at school with a view to being drafted to Israel’s elite technological military units.

Leading multinationals, growth and early-stage global VCs are now identifying Israel as an unparalleled place of talent and successful innovation. In addition to multinationals such as Google, Meta, Amazon, Intel, Motorola, Medtronic, and many others opening hubs in Israel, now prominent VCs such as Insight Partners, Tiger Global, Blackstone and the Vision Fund are putting people on the ground.

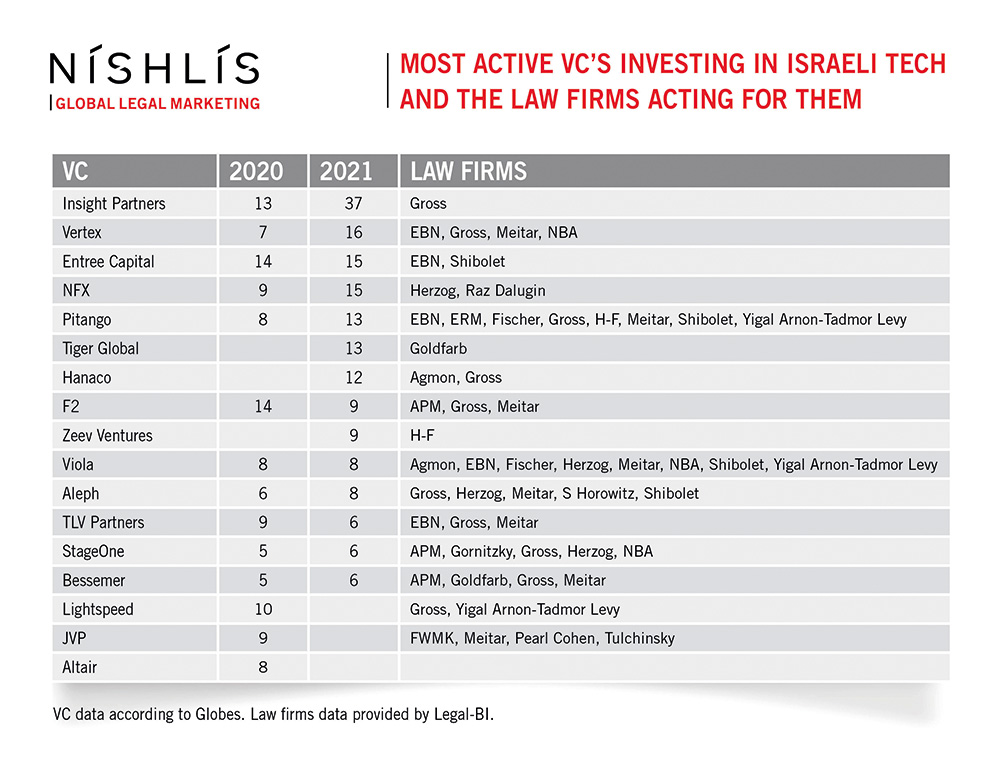

Who is investing?

According to a report by Start-Up Nation Central, an Israeli non-profit in the technology sector, the most active foreign investor in Israeli companies in 2021 was Insight Partners, a New York-based firm that invested in 49 rounds in 2021, up from 17 in 2020. The company’s portfolio includes Israeli success stories like Wix and Monday.com, as well as Shopify and Twitter. American investment firm Tiger Global Management participated in 16 funding rounds in Israeli start-ups in 2021, up from just three in 2020. Foreign VC funds make up four of the top ten most active funds in Israel, according to the report. ‘We are also seeing substantial contribution by existing investors in the financing rounds who wish to maintain their holdings in companies they had previously invested in,’ pointed out Yael Benyayer, partner at EBN. ‘Many, many new funds are closing, new deals are being announced every day,’ adds Jeremy Lustman, partner at DLA Piper. ‘The Israeli market is still on fire, relative to others, but just not at the height we were a few months back.’

Some caution has naturally set in

‘These are unique times for Israeli tech, which has demonstrated to date, and in line with historical performance, a high level of resilience to market conditions, but that is naturally facing market challenges similarly to all tech companies,’ says Herzog’s Geva. Strategic and financial investors are still looking at Israeli technology and other sectors but with caution.

‘As before, deals are driven by the potential technological edge, though investors are expected to be now more cautious,’ says Amit Steinman, corporate partner at S. Horowitz & Co. ‘This is particularly true with respect to assumptions about business models and they hold a more realistic view on synergies, as well as a careful view of capital costs, given these changing conditions.’

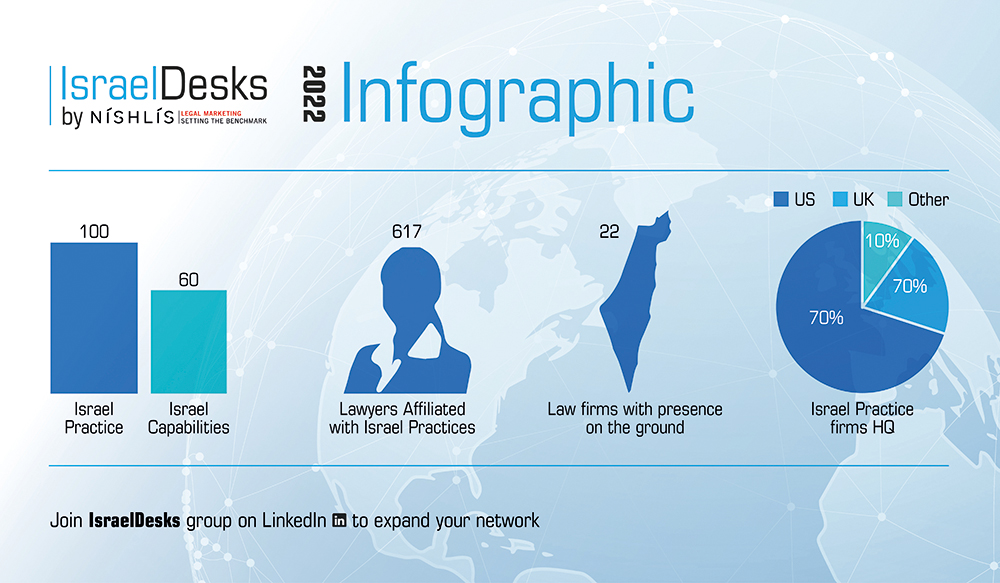

Global law firms are noticing this impact. ‘There are approximately 160 international law firms active in Israel-related work, with 100 of these firms having an official Israel practice and 22 with presence on the ground,’ said Idan Nishlis, chief executive of Nishlis Legal Marketing.

‘In 2022, economic uncertainty and rising interest rates have contributed to a significant slowdown in the global capital markets, with the technology industry among the most heavily impacted,’ adds Lee Hochbaum, M&A partner at Davis Polk in New York. ‘However, given the track record of recent Israeli companies and the surplus of human capital, Israeli companies seem well positioned to capitalise when the markets reopen.’

Douglas Getter, head of Dechert’s US corporate practice in Europe and London, adds: ‘We continue to see strong interest in the Israeli tech sector, particularly related to financial services, payments and security, data collection, medical and non-regulated defence, but the downturn, rising interest rates and collapsing multiples have slowed things down on the sell-side as potential sellers adjust to the new reality, and on the buy-side as investors have become more cautious.’

‘Deals are driven both by groundbreaking technologies and by the ability to acquire high-level solutions that meet company needs faster and more economically.’

Dr. Kfir Luzzatto, The Luzzatto Group

Yariv Ben-Ari, partner, at New York based Herrick, Feinstein, adds: ‘In light of rising interest rates and prevailing economic concerns, we have been working with our Israeli clients to identify market segments that will present opportunities for well capitalised buyers to transact across the US. While some lenders are more conservative, we have seen continued growth particularly where there are existing relationships with banks and PE funds.’

Amir Zolty, partner at Lipa Meir & Co, adds: ‘We don’t see a rush to invest. Yet, VCs and CVCs keep investing in promising start-ups with strong teams, be it at lower/more realistic valuations. We also see deep pocketed PEs looking for bargains at this day and age.’

And yet, many tech sectors are particularly hot Israeli hi-tech start-ups cover all spheres of life, from technologies that will protect computers and smart phones, to digital medicine that finds innovative ways to treat patients all the way to a lab made hamburger that will revolutionise what and how we eat, and multinationals and VCs remain very interested.

‘We have witnessed a surge in interest in the food-tech industry, with skyrocketing fundraising.’

Yael Benyayer, EBN

‘Deals are driven both by groundbreaking technologies and by the ability to acquire high-level solutions that meet company needs faster and more economically,’ points out Dr. Kfir Luzzatto, president of The Luzzatto Group.

Notable M&A transactions in 2022 span the range of sectors. They include Intel’s purchases of Israel’s Tower Semiconductor for US$5.4bn and Israeli computing tech start-up Granulate for about US$650m. Google also bought Israeli threat detection firm Siemplify for US$500m, and Qualcomm of the US acquired Cellwize Wireless Technologies, an Israeli maker of cloud and AI software that can speed up deployment of 5G networks, for around US$350m.

The enormous amount of cash flowing into Israeli ‘Silicon Valley’ has rocketed, and continues to pour into various segments of the hi-tech sector, among them enterprise IT and data infrastructure, fin-tech, cyber security, data, and bio-med companies – the hottest sectors in recent years.

About 65% of the total funding went to companies in these sectors, compared to 52% in 2020. In fact, In March 2022, Glilot Capital, one of Israel’s leading VC funds, raised US$220m for its fourth Seed fund, to invest in young companies in the fields of cyber security, enterprise software and developer tools.

Global law firms in Israel-related M&A transactions, 2021 (by value)

Source: Legally Israel 100 – IsraelDesks League Tables

Global law firms in Israel-related M&A transactions, 2021 (by volume)

Source: Legally Israel 100 – IsraelDesks League Tables

Cyber out in front

Israel’s unicorns span a range of verticals, among the most vibrant – cyber security.

‘As Covid-19 has further advanced the shift from in-person interactions to the online-realm, Israeli cyber security enterprises, which offer tools and technologies for safeguarding organisations and their critical systems and sensitive information, continue to be a centre of attraction and focus for various local and global investors, including VC and private equity funds,’ adds EBN’s Benyayer. In December 2021, Japanese investment giant SoftBank co-led a US$400m investment in Israeli cyber security firm Claroty. Cyber security company SentinelOne completed its NYSE offering in June 2021 at a value of US$9bn, one of the year’s striking IPOs, while other proactive Israeli cyber unicorns include Armis, Cybereason, BigID, Cato Networks, and Axonius.

Fintech and Big Data remain robust

‘AI and Fintech are here to stay and grow, and still attract investors,’ adds Lipa Meir’s Zolty. In fintech, there is also a large presence of unicorns: eToro is the Israeli-founded insurance company that had a valuation of US$10.4bn in 2021. There is also Forter, Next Insurance, Rapyd, Riskified, Melio, Lemonade and Payoneer, which went public in 2020 and 2021 respectively, and just in March 2022, Capitolis joined the unicorn club, cementing Israel’s position as a leader in fintech.

‘One of the hottest areas currently is Web3 and specifically, infrastructure technologies supporting Web3 applications. Other areas that continue to attract significant capital and top-tier investors are developers and dev-ops platforms,’ adds HFN’s Geva.

‘Big data continues to be a hot commercial field, with aspects of how to collect, verify and utilise the data coming into play,’ agrees Kobi Ben-Chitrit, M&A and hi-tech partner at Yigal Arnon – Tadmor Levy, the firm’s name since this year’s landmark merger of Yigal Arnon and Tadmor Levy, today the third largest law firm in Israel. He adds: ‘Businesses are becoming ever more reliant on data in their operations, and being agile enough to collect and process data in real time has become a significant competitive advantage. In a recent transaction, we assisted IBM in acquiring an Israeli data observability start-up called Databand.’

‘Israeli companies benefited from the extremely active global capital markets in 2021, with technology companies in particular attracting significant foreign investment capital and a number of Israeli companies — including ad-tech platform Taboola — taking the opportunity to list in the US, often via SPAC business combinations,’ adds Davis Polk’s Hochbaum, M&A partner at Davis Polk in New York. In addition to Taboola, the vibrant ad-tech sector includes unicorns – AppsFlyer, SimilarWeb and ironSource, which just announced a merger with US games developer Unity, with a joint value of US$13bn.

‘Businesses are becoming ever more reliant on data in their operations, and being agile enough to collect and process data in real time has become a significant competitive advantage.’ Ben-Chitrit, Yigal Arnon – Tadmor Levy

Pharmaceutical, life science and healthcare service companies continue to attract investors, fuelled by innovations in biotechnology and patient services and ongoing digitisation. Israel has a high-quality public healthcare system – with the nation’s medical records stored in a centralised database. Within this, medical devices is key. ‘This industry is still hot and Israel is at the forefront. The medical device industry will continue to witness the integration of AI and that is another area where Israeli companies excel,’ explains Guy Ben-Ami, who leads Carter Ledyard & Milburn’s Israeli cross-border practice.

Food-tech and ag-tech catch the eye

An increasing number of food-tech and ag-tech companies are indeed catching the investor eye. The US-based research firm, Startup Genome ranked Tel Aviv and Jerusalem fourth for ag-tech globally, trailing Silicon Valley, New York City and London in first place.

Benyayer of EBN agrees: ‘We have witnessed a surge in interest in the food-tech industry, with skyrocketing fundraising. We represented S2G Ventures and Manta Ray Ventures in the impressive US$347m Series B financing round in Future Meat Technologies Ltd, which developed a technology to produce lab-grown meat products, making it the largest single investment round in the cultivated meat industry.’ Also, the success of Beyond Meat and Impossible Foods shows that there is consumer demand for plant-based meat alternatives. There was also a US$105m investment in cultivated meat start-up Aleph Farms and MeaTech. Israeli food tech start-up Redefine Meat announced plans to commercially launch its plant-based alternative meat products abroad.

‘In the future, I expect to see focus on technology that supports the shift to hybrid work model (for example, facilitating remote on the job training).’ Dr. Ziv Preis, Lipa Meir & Co

‘Food and ag-tech are definitely getting interest from devoted VCs as well as government funding, motivated by public interest,’ agrees Ben-Chitrit, while Dr. Ziv Preis, head of tech, corporate and M&A at Lipa Meir & Co, adds: ‘I expect to see the continuation of certain sectors, which have been strong in the last two to three years, including ag-tech, food-tech, telehealth and intense use of applied artificial intelligence.’

Remote working demanding new tech

Preis adds: ‘In the future, I expect to see focus on technology that supports the shift to hybrid work model (for example, facilitating remote on the job training).’ As DLA’s Lustman adds: ‘Tech investment generally is still moving at a strong pace; some specific areas that seem to be on an upswing are HR-tech, which makes sense to me given the dramatic overhaul of the workforce in the wake of Covid.’

Growing interest for clean energy and climate-tech Dr. Luzzatto agrees: ‘Several fields are hot right now, particularly in food-tech and ag-tech, and we would also expect to see a growth in femtech, (technology supporting women’s health), climate-tech and other environmental technologies.’

‘The general public and governments in the Western world are increasingly motivated to support clean energy and sustainability tech initiatives, and the private investment world is picking this up,’ adds David Roness, M&A and hi-tech partner at Yigal Arnon-Tadmor Levy.

Israel is indeed home to more than 500 companies that deal with clean technology and specialise in sustainable agricultural technologies, clean energy concepts and electric vehicles. Israeli climate-tech companies raised US$2.2bn in 2021, 57% higher than the previous 2020 record, according to a comprehensive report, ‘Israel’s State of Climate Tech 2021’ by the Israel Innovation Authority and non-profit PLANETech.

Israeli exports of goods and services are projected to reach a record high of US$165bn in 2022, up 15% from 2021’s US$143bn in exports, itself a record, according to a July 2022 report by the Ministry of Economy and Industry – and technology lies at the heart of this. Israel’s tech firms saw exits jump an astonishing 520% in 2021 to an unprecedented US$81.2bn in value, shattering all previous funding records, according to an annual report by consultants PwC Israel.

Although 2022 is experiencing rising inflation, interest rates and economic uncertainty for all, the Israeli experience is that if the technology is unique, the team exceptional, and the solution helps to address a real-world problem, the sky remains the limit.

For more information, please contact:

Lee Saunders, head of English content, Nishlis Legal Marketing

E: lee@legalmarketing.co.il

Idan Nishlis, chief executive,

Nishlis Legal Marketing

E: nishlis@legalmarketing.co.il

Tel Aviv (main office)

28 Haarba’a St. Tel-Aviv (North Tower) 6473926

T:+972-72-338-7595