The London office of Goodwin has seen revenue soar 63% in 2021/22 amid a surge in lateral hires over the year, the firm’s latest financial results reveal.

The City arm reported turnover of $161.8m, up from $99.1m last year. This striking gain follows the firm’s bullish revenue growth of 72% between 2015 and 2021.

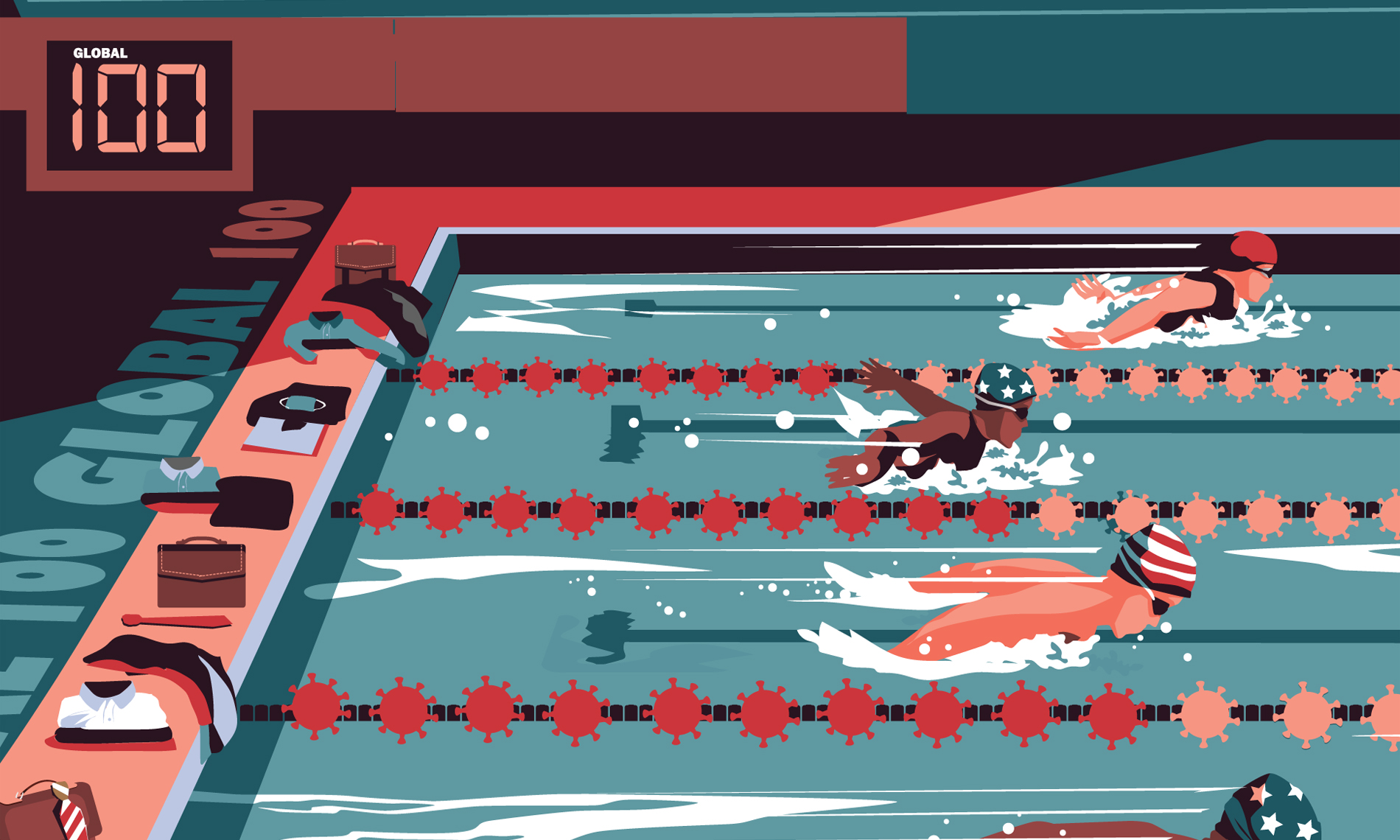

The Boston-bred firm’s global metrics tell a similarly auspicious story, with revenue just shy of $2bn at $1.97, up 33% from $1.48bn last year. Its global financials also put profit per equity partner (PEP) at $3.69m up 28% from $2.88m for 2020/21.

Impressively for an office little over a decade old, the London revenue made up 8.2% of the firm’s global turnover this year, up from just shy of 7% last year. Credit can be given in part to its 47% growth in headcount from 140 lawyers including 43 partners in the City on 1 March 2021 to 206 lawyers including 50 partners as of 7 March.

The hiring drive has focused on its five key industry-focused pillars, said Gemma Roberts, London co-chair: ‘The dramatic expansion we have seen across our UK and global business during 2021 has been fuelled by meeting the needs of our existing and new clients principally in the five industries we focus on: real estate, private equity, technology, life sciences and financial institutions. This demand has led to us continuing to add the top talent in the market – at all levels – across our groups, both organically and laterally.’

Among the laterals, the firm lured four partners from Kirkland & Ellis including private equity player Hugh O’Sullivan in April 2021, tax duo David Irvine and Dulcie Daly in May, and most recently, competition partner Sarah Jordan in March 2022.

Also in the private equity space, Geoff O’Dea joined from Baker Mckenzie, while the firm bolstered its tech and life sciences sector practice with the additions of data privacy expert Lore Leitner from Wilson Sonsini and capital markets partner Ariel White-Tsimikalis from Bryan Cave Leighton Paisner.

Rounding off the nine-partner hiring spree, litigator Hannah Field joined from White & Case in 2021 and real estate transactions guru Eric Lim joined from Baker McKenzie on 1 March this year. The firm also promoted three partners across its regulatory, tech and life sciences and tax teams.

These key industry focuses have also been the setting for its biggest deals over the year. In the private equity space, a team led by Roberts acted for GTT Communications on the $2.1bn sale of its infrastructure business to I Squared Capital.

The London life sciences practice teamed up with New York M&A lawyers to advise on Biocon Biologics’ $3.3bn acquisition of Viatris Inc.’s global biosimilars business. While in the real estate space, the London team acted on the structuring and establishment of Ares European Property Enhancement Partners III SCSp, which was oversubscribed with roughly €1.5bn of commitments.

Notwithstanding its growth, the firm remains transactions-heavy with 20 corporate partners compared to two in disputes. But as the private equity, tech and life sciences sectors continue to boom, Goodwin’s financials speak for themselves.