The world’s largest law firms are continuing to get bigger. Last year the combined number of lawyers across the Global 100 rose to almost 150,000, with Dentons – the world’s largest by headcount – housing more than 10,000 globally.

But while these international giants now cater to most commercial legal needs, in most corners of the globe, groundbreaking new analysis of the views of the people these firms care about most – their clients – has found conclusive evidence that smaller, specialist practices are outstripping them on quality of service.

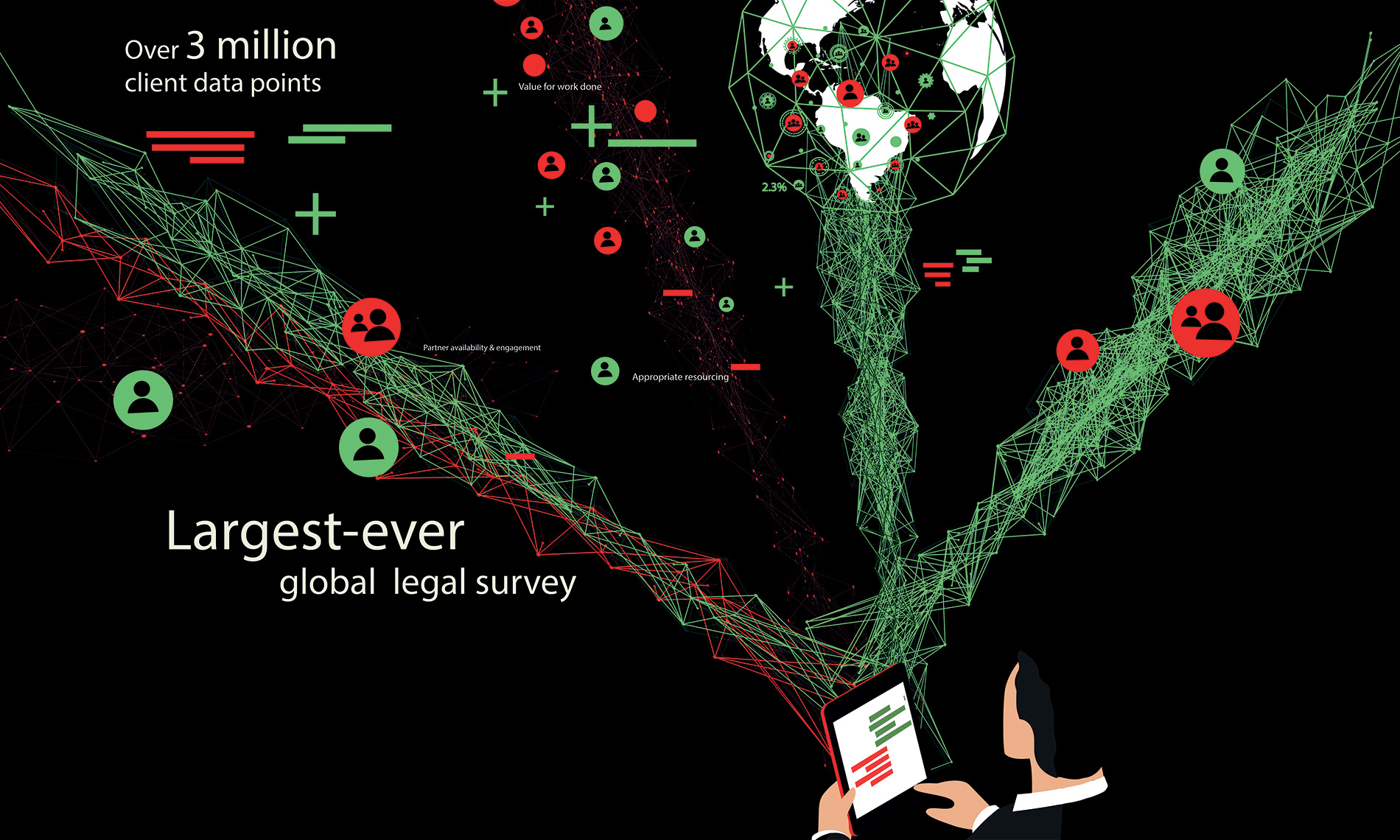

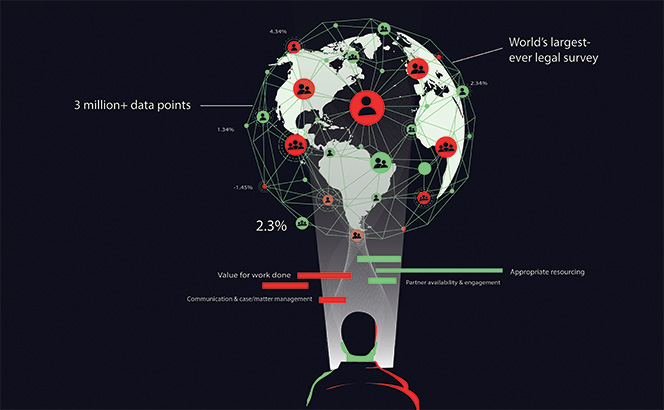

This is one of many standout findings from Legalease’s new Analytics research – the world’s largest ever legal survey of its kind, which has gathered and compiled ratings for more than 1,000 law firms, covering the full spectrum of the market – from the biggest international names through to the smallest boutiques.

To compile the research, more than 60,000 UK clients rated their firms on a range of business-critical criteria, including partner engagement, resourcing, billing and communication, with over 600,000 client scores collected. The sheer scale of the resulting data allows for unprecedented insight into how consumers of legal services really view the service they get from their law firms.

The analysis provides objective, statistically verifiable data on UK law firm client services, as well as a conclusive case that bigger is not always better – but what else does the data tell us about how clients perceive the service they receive from their law firms?

Client service score

Specialist knowledge

‘Instructing a non-specialist can be like asking a GP to have a go at heart surgery – for a specialist matter, clients need the right specialist lawyer,’ argues Iain Wilson, managing partner of media and litigation boutique Brett Wilson, summing up the choice facing many clients.

While the biggest firms in the market continue to rack up revenues from clients drawn to their brand power and global reach, Legalease’s Analytics data provides hard evidence that smaller specialists are doing a better job of giving clients what they actually want.

The survey findings – which encompass three million data points – provide an unparalleled picture of how clients rate the service on offer across all different categories of firms operating in the UK market, including the Global Elite, the Legal Business 100 (LB100) and national and regional players throughout the entire country.

Law firms were assessed on criteria grouped by three themes – lawyer/team quality; sector/industry knowledge; and billing and efficiency. More than 230 million calculations were run to crunch this data, which has been combined to provide a single Client Service Score for every firm.

The overall Client Service Score is calculated by combining the ratings of three key areas of a firm’s business: lawyers/team quality; sector/industry knowledge; and billing and efficiency, as well as consistency of client feedback.

Many boutique and specialist firms outscored their larger rivals on this metric (see table right for the top 20), making up one third of the top 50 ranked firms. The average Client Service Score for boutique firms is 1.5% above the benchmark average for all firms – conversely, all other large firm categories (Global Elite, LB100 and Major US) fall below this marker.

The top-rated specialists are spread across a range of sectors, including property, private client and media, as well as civil liberties and disputes – an area that has seen a surge of boutiques set up in recent years.

Boutique firms score 3% ahead of the benchmark average for sector and industry knowledge, and what unites many is experience gained working in their specialist areas outside of private practice and a conviction that this grounding combined with a tight focus positions them better than larger rivals. Boutiques are also the top-rated category of firms for profile in their given sector – scoring more than 2% above the national average.

Better billing

Specialists also score highly for billing and value for money, with the data demonstrating the weight that clients place on the greater flexibility, transparency and value on offer at smaller firms. On value for money, boutiques rate 6% above the benchmark score for all UK firms, while the UK top ten are almost 7% below the average.

Value for work done

As Michael O’Kane, senior partner at crime and disputes outfit Peters & Peters, explains: ‘At big firms, fees are more rigid; if cases aren’t very profitable, then management will want answers. Here, we have huge flexibility in what we charge a client – all it requires is a quick email to the finance committee, and there’s only four of us on that. If a client says it’s too expensive, we can write off money and we don’t have to go through a huge rigmarole of justification – clients really appreciate this.’

Conditional fee arrangements, fixed fees and retainers are just some of the examples of more flexible billing arrangements that small firms – unburdened by the overheads and sprawling partnerships of their larger counterparts – have greater scope to offer to clients. Boutiques score 4% above the UK average for billing transparency, while large UK, US and global firms are all rated below average.

Ian Pittaway, senior partner of pensions boutique Sacker & Partners, says monthly retainers have been a regular feature for a number of clients over the past decade as part of an effort to build client trust. ‘It’s sometimes over, sometimes under, but this takes billing out of the equation and reflects the confidence clients have in a long-term relationship.’

Billing: Transparency

Reno Antoniades of media firm Lee & Thompson adds that boutiques have picked up work in part due to increased cost-consciousness from clients. ‘As a smaller practice, there’s a certain flexibility we can allow ourselves; a lot of bigger firms don’t have that.’

This flexibility extends to freedom from firm-wide edicts that can make it harder for some lawyers at bigger firms to be as responsive to client needs as they would like.

‘As a smaller practice, there’s a certain flexibility we can allow ourselves; a lot of bigger firms don’t have that.’

Reno Antoniades, Lee & Thompson

Experience of life at a smaller firm and the greater involvement in the commercial side of the business that can come with this can also help lawyers develop more rounded expertise that can help these firms better understand how to serve clients.

Emma-Jane Weider, who recently took over as managing partner of private client boutique Maurice Turnor Gardner, recalls the lessons learned when she helped set up the firm in 2009, when Allen & Overy’s private client team spun off into a separate entity.

‘We launched in the middle of the financial crisis, and we didn’t know what was going to happen, but in a way we were very lucky. It made us better businesspeople. At a larger firm, you don’t always get that exposure to the business side of things. I remember when the very first bill was paid, it was very exciting – those experiences help you understand good financial management.’

Partner availability

Another key factor that the Analytics research highlights specialist firms as scoring more highly than their larger peers in is partner availability and engagement, where they rate on average 2.5% above the national benchmark, far ahead of the UK’s 50 largest firms, which lag below average.

Partner availability & engagement

Those within boutiques argue that one factor behind this is that they are much less likely to delegate work to junior lawyers.

Pittaway adds: ‘Our clients like being advised by the leaders in that field, not one lawyer from a firm of 1,000 partners, 50 offices and 100 service lines. We’re competing with the big full-service players, but the advantage we have is our stronger focus on the market, which gives every lawyer in the firm a better understanding of what matters to clients.’

The big guns

But while specialist firms may have generally outperformed their larger rivals, some of the largest firms operating in the UK also received strong scores, with UK leaders including Slaughter and May, Hogan Lovells, Clifford Chance, Linklaters and Herbert Smith Freehills among the highest-rated larger UK performers by Client Service Score (see Rankings below).

The top-rated UK firms among the UK top 25 by revenue include Clyde & Co, DAC Beachcroft and Bird & Bird.

Looking at the top large performers overall, however, the research shows a clear leaning towards the perceived strength of the US firms in London when it comes to client service, compared to some of their key UK rivals.

Across the top 150 firms ranked by Client Service Score, 15 American firms from Legal Business’ Global London top 50 table appear in the list. In contrast, only eight of the largest 50 UK firms by revenue feature, with the rest of the top 150 dominated by specialist firms and regional players.

On average, boutiques beat the average Client Service Score – all other large firm categories (Global Elite, LB100 and Major US) fall below this marker.

Turning attention specifically to the top end of the market – the Global Elite firms with PEP of more than £1m – Slaughters and Hogan Lovells are the only UK firms to sit within the top ten global leaders by Client Service Score.

This ranking is instead dominated by large US players such as Weil, Gotshal & Manges, Kirkland & Ellis, Latham & Watkins and Simpson Thacher & Bartlett.

And the same trend extends when looking more broadly at the performance of US firms in London. Those outside the Global Elite receiving high scores for their client service include Goodwin Procter and Proskauer Rose, as well as Morrison & Foerster and Arnold & Porter Kaye Scholer.

Even here within the larger firms, some believe it is their industry focus giving them the edge.

Samantha Lake Coghlan, who co-chairs Goodwin’s London office, comments: ‘We have a strategy of being dominant in select client industries, serving both the innovators and investors in these industries and where they converge. This allows us to have deep expertise and market knowledge in the areas that matter to clients.’

‘We have a strategy of being dominant in select client industries – this allows us to have deep expertise and market knowledge in the areas that matter to clients.’

Samantha Lake Coghlan, Goodwin Procter

The findings also provide evidence that the aggressive recruitment efforts of US firms in recent years have strongly resonated with clients. In a lateral market that has been dominated by firms such as Latham and Kirkland cherry-picking big-name partners from the Magic Circle, it is unsurprising that one of the perceived strengths for US firms is their star rainmakers, with the Global Elite coming out as the top-rated category of firms based on quality of partners, scoring more than 2% above the benchmark average.

In contrast, UK firms come out on top for quality of associates. Backing the arguments of the specialist firms about the greater fee flexibility their models afford them, neither large UK nor US firms score well for billing or value for money, with specialist firms and mid-size UK firms faring significantly better.

The research also makes it possible to benchmark performance across specific UK regions and practices, and in the coming months, Legalease will be providing more insight and analysis into the other types of firms rated most highly by clients.

If you would like more information on how your firm is perceived by clients, please contact amy.mcdermott@legal500.com

Rankings

Legalease’s research is based on responses from more than 60,000 clients, who rated more than 1,000 firms on the service they offer. The scale of the data that has been gathered allows for a comprehensive breakdown of all sections of the UK market – below are the top ten rated firms across a number of key groupings, listed in alphabetical order.

Methodology

Legalease’s new Analytics research is the world’s largest-ever legal survey of its kind, gathering and compiling ratings of more than 1,000 law firms

More than 60,000 UK clients rated their firms on a range of business-critical criteria, with over 600,000 client scores collected

Worldwide, the survey findings encompass three million data points, providing an unparalleled picture of how clients rate the service provided by all different categories of law firms across the globe. The UK data is a subset of that global data pool

All scores are statistically validated. This is the only survey of the legal sector that meets statistical standards (other surveys are based on data-samples that are too small to be statistically relied on). The scores in this report (and in individual firm reports) are guaranteed to be valid (typically >95% plus or minus 3%)

Reports on individual UK firms, and on 20+ UK practice areas, are available. Global 100 reports are available for 20+ practice areas worldwide

For information on accessing Analytics reports, please contact Amy McDermott, head of sales, The Legal 500 Series on amy.mcdermott@legal500.com

What the clients say

Peters & Peters

Their advice is practical, creative and informed by a deep understanding of the criminal, regulatory and business landscape. Some of their partners are former senior prosecutors, which gives them incredibly valuable insight into law enforcement decision-making.

Their advice is practical, creative and informed by a deep understanding of the criminal, regulatory and business landscape. Some of their partners are former senior prosecutors, which gives them incredibly valuable insight into law enforcement decision-making.

Signature Litigation

The practice is nimble and addresses client needs very well. They do not overstaff engagements but ensure the appropriate team for a particular engagement.

The practice is nimble and addresses client needs very well. They do not overstaff engagements but ensure the appropriate team for a particular engagement.

Wiggin

Besides their technical knowledge and sector expertise, their significant strength is that they really do roll their sleeves up for you. This makes them a natural extension of our in-house team.

Besides their technical knowledge and sector expertise, their significant strength is that they really do roll their sleeves up for you. This makes them a natural extension of our in-house team.

Maurice Turnor Gardner

There is no other private client law firm in London which provides its advice with such profound intellectual clout yet in a personable manner.

There is no other private client law firm in London which provides its advice with such profound intellectual clout yet in a personable manner.

Venner Shipley

Easy to communicate with – they get answers quickly and in a form a layman can understand.

Easy to communicate with – they get answers quickly and in a form a layman can understand.

Lee & Thompson

They combine the world-class expertise of a big law firm with the individual approach of a more boutique firm.

They combine the world-class expertise of a big law firm with the individual approach of a more boutique firm.

Deighton Pierce Glynn

Although the team is small, its members are leaders in their fields, whether in the areas of immigration, foreign affairs, healthcare or social policy.

Although the team is small, its members are leaders in their fields, whether in the areas of immigration, foreign affairs, healthcare or social policy.

Glovers Solicitors

Excellent knowledge and expertise in a unique sector of work – a solid group of top-quality solicitors, who are commercially minded, with all work handled by an experienced solicitor and not passed down to juniors in disguise.

Excellent knowledge and expertise in a unique sector of work – a solid group of top-quality solicitors, who are commercially minded, with all work handled by an experienced solicitor and not passed down to juniors in disguise.

Leigh Day

An enormous depth of talent – the individual members work as a team, and pool their knowledge and experience. The team has a culture of compassion and support for clients.

An enormous depth of talent – the individual members work as a team, and pool their knowledge and experience. The team has a culture of compassion and support for clients.

Brett Wilson

A boutique firm, which provides a service comparable to that of any of the leading solicitors which practise in this field. Their expertise, along with their small size and transparency on fees, means that they are excellent value for money.

A boutique firm, which provides a service comparable to that of any of the leading solicitors which practise in this field. Their expertise, along with their small size and transparency on fees, means that they are excellent value for money.