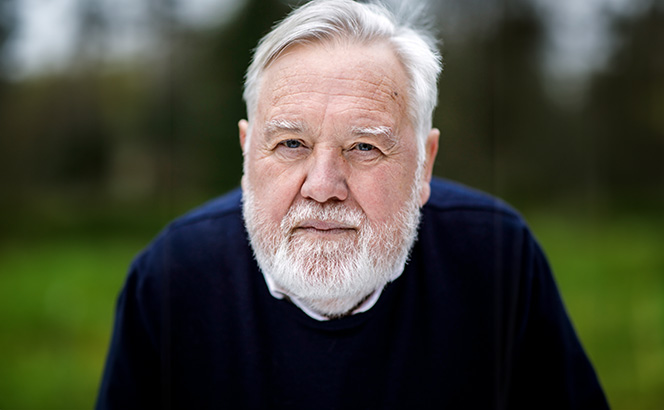

‘Have I told you my friend’s story about being a munchkin in The Wizard of Oz in Aberdeen in the 1980s? Phone me when you are bored.’ Such messages – as apparently apropos of nothing as they were impossible to ignore – were not uncommon from Professor Paul Quayle Watchman, former Freshfields partner and ESG guru who sadly passed away at the start of July.

Paul’s more irreverent missives were often intermingled with ‘serious’ work-related emails about ESG initiatives, the climate crisis and other subjects which were close to his heart. Another of the best reads: ‘I’m having a few days away at a spa hotel. I can’t loosen the knots. Help me Nathalie. Send scissors to Room 125. Better make it bolt-cutters.’ Paul always used good humour as an antidote to the more depressing side of modern life and for that, he earned a tremendous following, both professionally and personally.

Also entertaining were his thinly-veiled allusions to corporations with questionable ESG credentials – prime examples being ‘White Pebble’ and ‘The Naughty Chocolatiers Who Eat Children’.

Born in Airdrie, North Lanarkshire, and having had an early stint as a professional football player in Scotland, it is safe to say that Paul probably did not exactly fit the mould when in 1992 he joined Freshfields in the City from Brodies.

Paul is best known for his work on the revolutionary Freshfields Report alongside Paul Clements-Hunt, head of the UNEP Finance Initiative between 2000 and 2012, and now director of Mishcon Purpose at Mishcon de Reya.

‘His energy was extraordinary, and he was unrelenting in speaking up, calling out and sharing on topics that were important to him.’

The two first met on the ill-fated day in July 2005 of the London bombings, a day etched on the memory for the most harrowing of reasons. Clements-Hunt, who we have to thank for coining the now-ubiquitous term ‘ESG’, went to Freshfields’ Fleet Street offices in his capacity as a UN official working on the UNEP [United Nations Environment Programme] finance initiative, a partnership between the UN, banks, insurers and asset managers.

What happened next is well documented in the pages of Legal Business, but it led to the Freshfields Report, essentially the legal underpinning of the principles for responsible investment (PRI) that first gave gravitas to the idea that ESG considerations were intertwined with the fiduciary duties of investors. The report, which Clements-Hunt had described as ‘a hand grenade being rolled into the investment community’, was launched in October 2005 at the UN headquarters at a global meeting on finance. Then in 2006 Kofi Annan, secretary-general of the UN, launched the PRI at the New York Stock Exchange as the American markets opened. The impact of the report and the PRI has been seismic, not least on the business of law, which in recent years has become increasingly indivisible from ESG accountability and responsible corporate conduct.

Clements-Hunt recounts a fond anecdote about his friend Paul Watchman: ‘He was the raconteur’s raconteur par excellence. A few months after Paul’s beloved Janet died after a long illness, he pulled up outside a rural Cumbrian pub in an immaculate racing green E-type Jaguar. He’d had a few very hard months and was tired. Sitting in the sunshine in the pub garden with bankers and friends, Chris Bray, Richard Burrett and myself, we tempted PQW into a “best film ever” discussion. He got the vibe and ripped into an encyclopaedia download of the entire 20th Century movie back catalogue, covering actors, script, songs (singing some) and Hollywood gossip in a breathtaking recall of detail.

‘This was PQW revealing just one corner of his passionate mind. I’ve seen him do the same with every imaginable form of company, from high art and literature, to Rangers, Celtic, the whole of Scottish football, and the endless humour of the Glasgow shipyards. You did not dare get him started on the Highland Clearances and rotten landlords. PQW’s interest stretched far and wide as any of the lawyers who’ve worked with him over the decades know only too well.’

In November 2022, Paul Watchman joined specialist sustainability law firm Ben McQuhae & Co in the newly-formed role of global head of climate change and ESG transition.

Anyone who followed Paul on LinkedIn will resonate with Ben McQuhae’s recollections of Paul: ‘He was a social media machine. His energy was extraordinary, and he was unrelenting in speaking up, calling out and sharing on topics that were important to him. With over 12,000 followers, he enjoyed a big fan club. Paul was as popular as he was non-stop.’

And Paul’s spelling was often on the creative side, to say the least. ‘So many posts, so many memorable typos,’ reflects McQuhae. ‘I once asked why, given all the practice, he was so bad at typing. Paul explained that the problem was, when he typed in bed with his computer propped up on his knees – “I cannae see the keys”. Paul was a very funny man with a wicked sense of humour.’

Like many in the ESG and the legal community at large, McQuhae first met Paul on LinkedIn by way of a good natured spat over a post. Paul was always up for a very public scrap if he caught a whiff of greenwashing; of lawyers erroneously claiming to have ESG credentials. With that in mind, Paul’s endorsement: ‘The only firm that I found worldwide that walked the talk, and I was willing to join is Ben McQuhae & Co,’ carried even more weight.

McQuhae remembers waking up the morning after Paul joined the firm to more than 30 direct messages from him across four social media channels, reflecting, as anyone who knew him well can attest from the regular 5am WhatsApp messages, that he seemed never to sleep.

Paul will be remembered, not only as one of the most innovative legal minds of his generation, but also as a class act, a bon viveur, a man of integrity and a kind and generous friend. As the man himself would have said, perhaps after a witty anecdote about the time he spotted Sean Connery in the denture cream section of Boots, ‘Aye yours.’