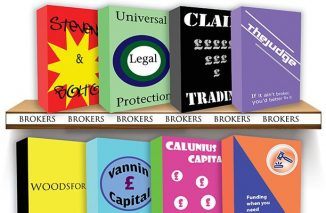

Fast-growing litigation funder Vannin Capital has appointed former Allen & Overy senior partner David Morley as chair ahead of a planned IPO on the London Stock Exchange.

The company announced today (10 September) that it planned to issue £70m of new shares and sell part of the shares held by existing shareholders in a float expected to take place in October. Continue reading “‘Litigation finance is here to stay’: Former A&O senior partner Morley joins Vannin ahead of IPO”