As Legal Business was unpacking the 2018/19 financial results of the UK’s top 100 law firms, the Office for National Statistics reported that Britain’s economy had shrunk for the first time since 2012. The 0.2% fall in output in the second quarter of 2019 was the latest in a series of ominous signs for a nation that appears, at the time of writing, on course for a cliff-edge exit from the European Union amid a chaotic political landscape and falling currency.

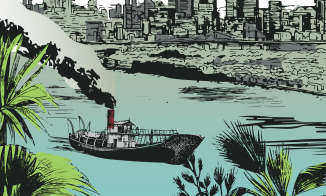

As Legal Business went to press, a row was raging over government moves to prorogue Parliament in the run-up to the 31 October deadline to exit the EU, threatening constitutional wrangles and a no-deal Brexit. A nation famed for exporting democracy, its strong institutions and a stable business environment is looking more Banana Republic than Britannia resurgent by the day. Continue reading “LB100 Overview: Apocalypse soon?”