Addleshaw Goddard looks at the impact of technology on future planning

Involving a disputes lawyer in your business shouldn’t start when you get into a dispute

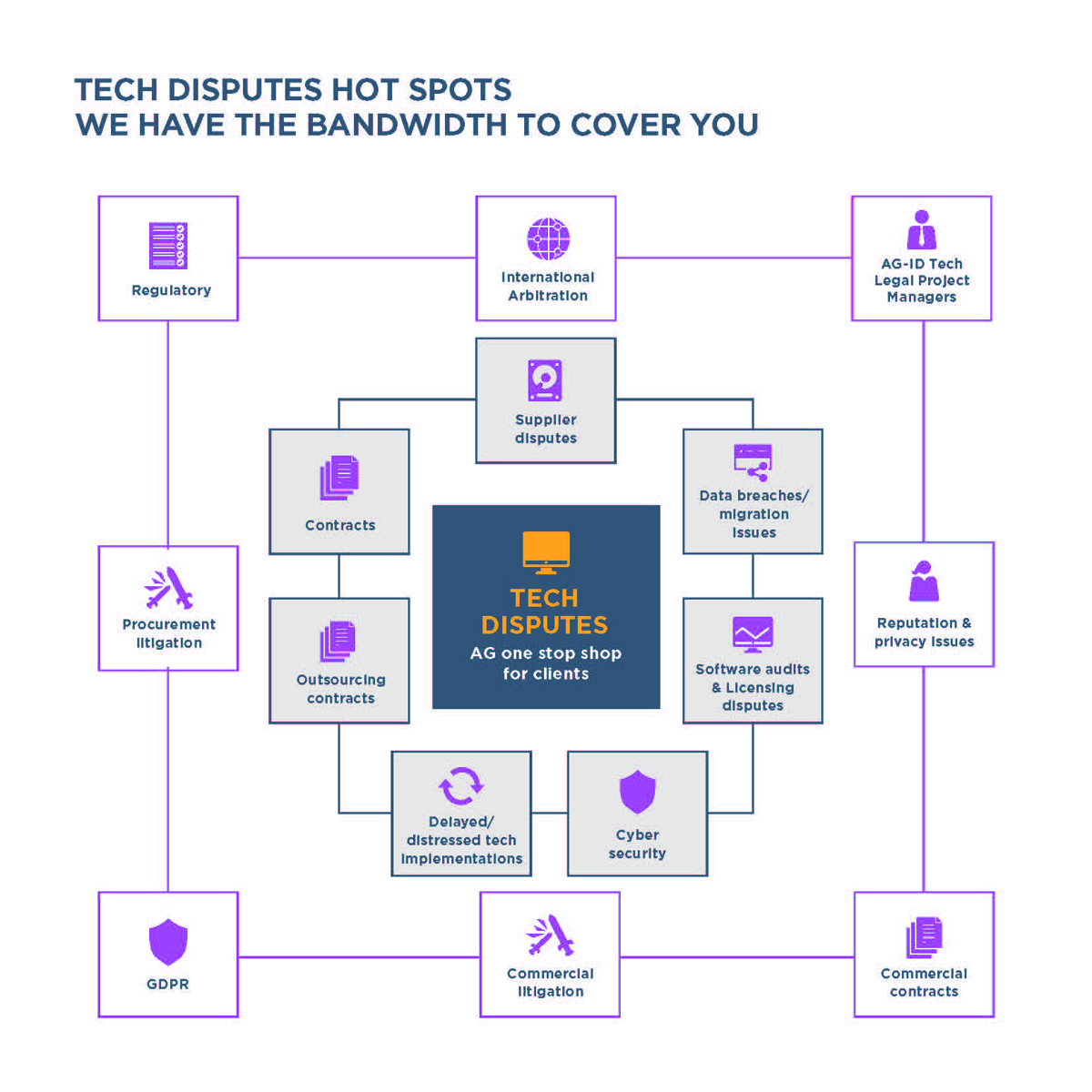

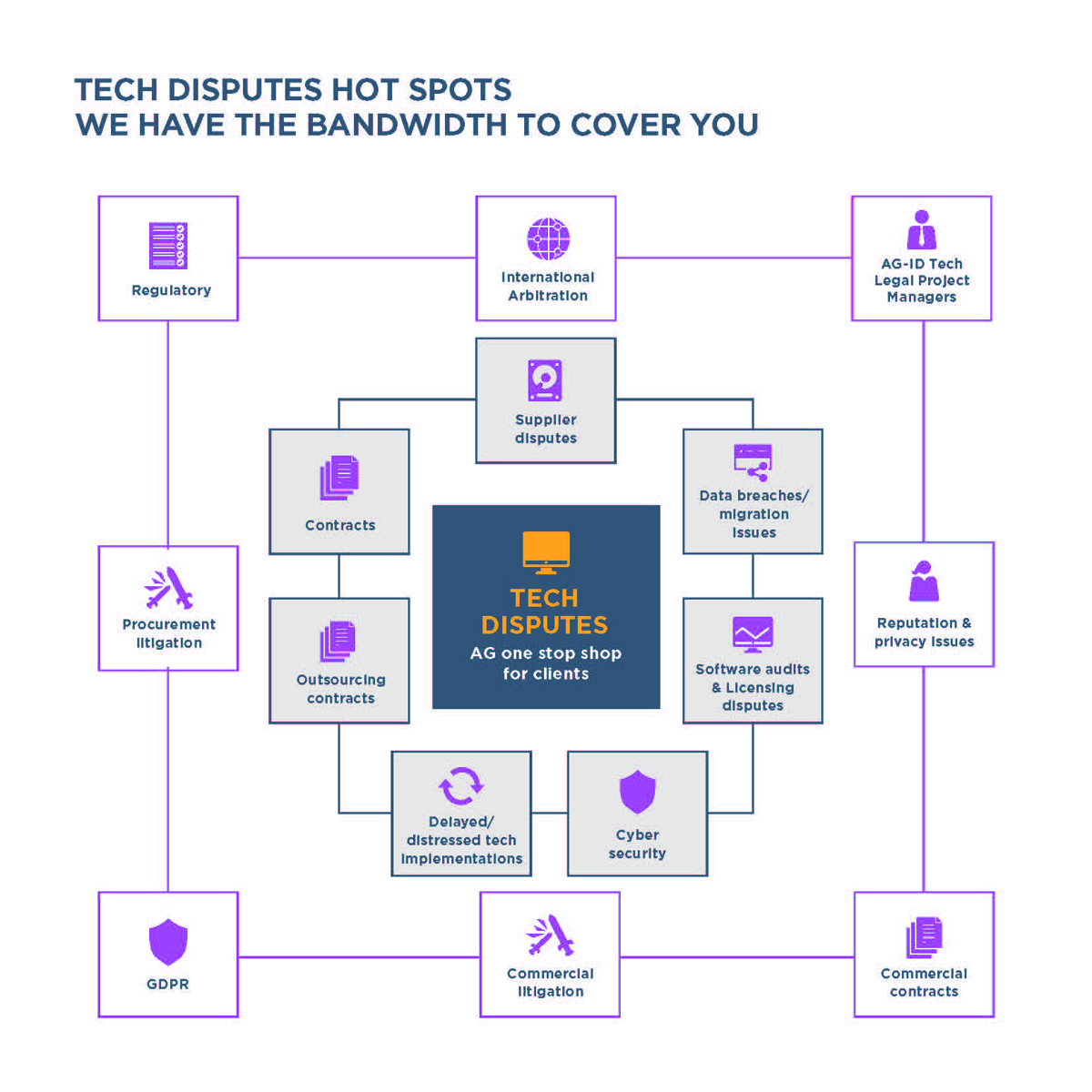

If you are in business, you are a technology business – this is the reality of the modern marketplace. From the smallest pop-up shop to FTSE 100 entities, technology is at the core. Digitalisation and automation are now woven through every aspect of business, whether front-end customer engagement, supply chains, outsourcing, back-end administration or compliance and audit functions. And this trend will continue; recent data shows many businesses are planning to spend between 20% and 50% of their investment capital on digital projects.

With that opportunity comes risk: increasingly, the prospects and viability of a business are tied to its tech.

Your business needs to be alive not just to the benefits that new technologies will bring to your operations, but also to the challenges inherent when introducing it and, once implemented, your increasing reliance on it. As your business becomes ever-more dependent on technology (with the rise of 5G, artificial intelligence, machine learning, cloud storage, big data and blockchain), so the scale of the risk to your business increases if that technology fails. Several companies have made unwanted headlines over high-profile tech disasters.

Planning for change

Most technology projects are intended as a catalyst for change within a business – whether to vital logistics and administration functions, the customer journey, or the business as a whole. Robust planning processes are essential from the beginning of such projects. All your stakeholders must buy in, so as to realise the changes you are seeking. And even with that planning and commitment in place, most IT implementation projects will often encounter time, money, resource and/or scope issues during their implementation.

Your business needs a clear strategy (commercial, technical and legal) to steer a course to success. And success will demand not just leadership and discipline from the senior management, but also a robust and holistic contract and implementation plan – covering everything from scoping, tendering, contact negotiation and signing, through to the ‘go-live’ and continued operation/upgrades and ultimately exit.

You need to think carefully about what you want to achieve with this new tech and how and when you want to achieve it. Are these deliverables understood by your providers and clearly set out in your contract? Are there sufficient incentives in your contract for the provider to deliver against the requirements and milestones? Will your operations, including your data, be sufficiently protected throughout this period of change?

Getting the right advice at the start could save a series of headaches (or worse) later on.

Planning for challenges

Inevitably, as with all projects, tech initiatives will see varying degrees of success. So you need to be prepared if, or more likely when, your project faces challenges. What levers do you have (contractual or otherwise) to get the project back on track?

And when a dispute materialises, the contract will be tested. Does it place escalation obligations on the parties that are constructive or distracting? Does it encourage co-operation or brinksmanship? How easy is it to withhold payment or services – or even terminate? What limitation and/or exclusion provisions apply? What about exit management? Having a clear strategy that can cater for both success and failure will be key in these circumstances.

Ultimately, you may need to bring or defend a claim. While this tends not to be a GC/board’s preferred option, the prospect of proceedings can sometimes be used strategically to achieve a final resolution, frequently without the need to go to trial.

Importantly, time is often a more critical factor in tech disputes than in many other forms of dispute. Technology evolves at a fast pace. Accordingly, in a dispute it can be vital for issues to be resolved before the existing tech on which the business presently depends becomes obsolete, or the market moves on and your investment (or even your whole operation) is sunk. Where timing is a factor, many businesses will want to consider alternative dispute resolution (ADR) before legal proceedings are commenced. This can include the new contractual adjudication scheme launched by the Society for Computers and Law, a three-month procedure that aims at swift settlement of tech disputes.

Even where a tech project has been implemented successfully, issues may arise later on. Such an issue could occur due to a security breach (eg, hacking incident) or human error (eg, accidental data disclosure). It is increasingly important for businesses to be as well drilled for tech incidents, such as a cyber-attack, as they are for a fire. Prompt action will be needed to secure your tech infrastructure, reassure your customers, regulators, workforce and investors, keep your supply chain intact, restore business critical operations, manage the media fallout and seek redress from the culprits. The extent to which businesses (even ‘big business’) are ready for this type of potentially business-critical risk varies greatly.

Planning for the future

The UK is the third-largest market for AI investment behind the US and China. A report by Microsoft last year showed 56% of businesses are adopting AI, and suggested every company may incorporate it in some form in the next five years. So, before too long, what we currently think of as ‘tech risk’ will just become ‘risk’. An office without email is unthinkable now, despite the fact that many senior executives began their careers in offices without much more than a single computer. It is likely the same will become true of AI, blockchain and many other ‘new technologies’.

Planning for success

As a business, you have a careful balancing act to manage. You will have to continue to evolve your IT systems to remain relevant and ahead of competitors, but you must also do what you can to ensure the new technology is implemented and operated in a way that is as low-risk as possible.

The success of your IT will increasingly go hand in hand with the fortunes of the business itself. Having tech issues resolved quickly and efficiently (and, yes, perhaps quietly), across all your operations and jurisdictions, will be essential.

Engaging the right advisers who can give the right guidance at the right time, taking a holistic view of the business (and not just tech) issues, with full-service capability to act across sectors and borders, and who are themselves tech competent and enabled, can save valuable resource, time and money – and potentially the business itself. And, while you can’t always plan for the unforeseen, having a strategy to deal with such risks will be invaluable in the event of unwanted interference in your business.

Return to the Disputes Yearbook 2020 menu

Subscriber Access

You must be logged in to view full premium content.

Links