In a move that may come as a surprise to detractors of the Magic Circle firm’s US ambitions, Linklaters today (8 January) announced it has expanded its New York M&A offering with the hire of a six-lawyer team from Shearman & Sterling.

Revolving Doors: US losses for Paul Weiss, A&O and Shearman while Asia dominates hiring market

Leading a quiet week of hires for the new year, White & Case has hired Taurie Zeitzer, the co-head of Paul Weiss’ M&A group in New York.

Recognised as a leading lawyer by the Legal 500, Zeitzer will join White & Case as co-head of the global private equity industry group. Her key clients include private equity house Apollo Global Management where she advised on its $5.2bn acquisition of aluminum products maker Arconic last year. Earlier in her career, she served as a partner at both Kirkland & Ellis and Latham & Watkins. Continue reading “Revolving Doors: US losses for Paul Weiss, A&O and Shearman while Asia dominates hiring market”

The Electronic Transactions and Data Protection Law in Lebanon: Empowering Lebanese companies in the digital age

In an era marked by rapid advancements in technology and an ever-expanding digital landscape, the significance of robust legal frameworks governing electronic transactions and data protection cannot be overstated. For Lebanese companies, the enactment of the Lebanese Law No. 81 of 2018 related to electronic transactions and personal data (Law No. 81/2018 or ‘Law’) represents a pivotal moment in their journey towards adapting to the demands and opportunities of the digital age. This legislation not only addresses the critical need for legal clarity in electronic transactions but also establishes essential safeguards for data protection in an environment characterised by evolving cyber security threats and heightened concerns about privacy.

Lebanon, like many nations worldwide, has been experiencing a digital transformation that has reshaped the way businesses operate, communicate, and engage with their customers. E-commerce, online banking, and digital marketing have become integral components of the Lebanese business landscape, offering companies new avenues for growth and innovation. However, the absence of comprehensive electronic transactions regulations had left many enterprises navigating this digital terrain without clear guidelines, resulting in uncertainty and potential legal risks. Continue reading “The Electronic Transactions and Data Protection Law in Lebanon: Empowering Lebanese companies in the digital age”

New year’s (dispute) resolutions

From AI to ESG and class actions, top London litigators predict the hottest litigation trends for 2024

If the view of London litigators on the coming year could be summarised in a single word, it would be ‘more’. Continue reading “New year’s (dispute) resolutions”

Revolving doors: Departures from Clifford Chance and Linklaters as US firms continue to snap up talent in London

Paul Weiss continued to cut a swathe through the London market this week with a double partner hire from Clifford Chance. The US firm brought over Legal 500 private equity leading individual Christopher Sullivan, who led the UK private equity practice at CC, and acquisition finance partner Taner Hassan, who joins as head of European leveraged finance.

The hires are the latest in a flurry of London recruitment for Paul Weiss, which is targeting some of the top corporate and finance practices in London to build out its nascent English law offering following earlier recruits from Kirkland & Ellis and Linklaters. Continue reading “Revolving doors: Departures from Clifford Chance and Linklaters as US firms continue to snap up talent in London”

Sponsored Q&A: Morgan Lewis

1. What are the key regulatory changes that have impacted the banking and finance legal market in the UAE in the past year?

In 2023, the United Arab Emirates (UAE) banking and finance legal market has witnessed significant regulatory changes that now effectively require that banks secure loans with tangible assets (in addition to, or even rather than, personal guarantees). This has implications for existing transactions, as personal guarantees alone may no longer suffice, potentially resulting in borrowers and guarantors attempting to challenge existing deals that are not secured by other assets. Banks must now adapt their lending practices to ensure compliance with these new regulations, considering a more focused approach to selecting suitable securities that facilitate enforcement, but at the same time avoiding over-collateralisation (which, as recent court practice suggests, may also be an issue). Continue reading “Sponsored Q&A: Morgan Lewis”

Paul Weiss hits CC for private equity partner duo as magic circle offensive continues

Showing no signs of winding down for Christmas, Paul Weiss has continued its aggressive London recruitment drive with the double hire of Clifford Chance private equity partner Christopher Sullivan and acquisition finance partner Taner Hassan. Continue reading “Paul Weiss hits CC for private equity partner duo as magic circle offensive continues”

Revolving doors: Paul Weiss makes another key London hire as firms bolster disputes and finance teams

In a continuation of Paul Weiss’ impressive recruitment efforts in London, Nicole Kar has joined the US firm as a partner, according to a source familiar with the situation.

Recognised in The Legal 500 Hall of Fame for her expertise in competition law, Kar has dedicated more than twenty years of her career to Linklaters, joining the firm in 2001 and most recently heading up its antitrust and foreign investment practice.

Eye of the storm: General Counsel take the lead in crisis management

Corporate crises have long called for General Counsel (GC) to apply their legal expertise and judgement.

But, with the rise of cyberattacks and data breaches, a greater focus on environmental, social and governance issues, class actions and the emergence of more powerful artificial intelligence, GCs are contending with more frequent and varied crises.

GCs are also playing a larger role in helping businesses navigate such events. Instead of simply being asked for legal opinions, they find themselves and their offices leading the coordination of internal response teams. They are also being asked to have a view about the ‘right’ path forward for the company – one that considers both ‘hard’ and ‘soft’ law standards and wider community and stakeholder expectations.

To explore how companies are approaching these issues, the Ashurst Leadership Centre convened a roundtable in partnership with The Legal 500 in Sydney in November 2023. The event was attended by 15 GCs from Australia’s largest companies and Ashurst partners and communications experts.

The discussion was facilitated by Lea Constantine, Partner, Head of Region – Australia.

Download and view the report offline

Eye of the storm: General Counsel take the lead in crisis management

Corporate crises have long called for General Counsel (GC) to apply their legal expertise and judgement.

But, with the rise of cyberattacks and data breaches, a greater focus on environmental, social and governance issues, class actions and the emergence of more powerful artificial intelligence, GCs are contending with more frequent and varied crises.

GCs are also playing a larger role in helping businesses navigate such events. Instead of simply being asked for legal opinions, they find themselves and their offices leading the coordination of internal response teams. They are also being asked to have a view about the ‘right’ path forward for the company – one that considers both ‘hard’ and ‘soft’ law standards and wider community and stakeholder expectations.

To explore how companies are approaching these issues, the Ashurst Leadership Centre convened a roundtable in partnership with The Legal 500 in Sydney in November 2023. The event was attended by 15 GCs from Australia’s largest companies and Ashurst partners and communications experts.

The discussion was facilitated by Lea Constantine, Partner, Head of Region – Australia.

Download and view the report offline

‘The firm is in excellent shape’: Boies Schiller elects new chair

Partners at Boies Schiller Flexner have elected New York-based litigator and white-collar defence and internal investigations partner Matthew Schwartz as chair. Schwartz will step into the role from 1 January 2025 to serve for a three-year term.

He will take over from current chair and co-founder David Boies, who has held the position since the firm was established in 1997 and was elected to serve a final one-year term for 2024. Boies will remain a member of the executive board and will continue his active trial practice. Continue reading “‘The firm is in excellent shape’: Boies Schiller elects new chair”

Shearman partners overlooked in Allen & Overy leadership race

In a move that may not come as a surprise to most, Allen & Overy (A&O) has unveiled a list of contenders for the managing and senior partner roles, with no Shearman & Sterling partners in the race.

Private capital group co-chair and global banking practice co-head Philip Bowden (pictured) is among three lawyers vying for Wim Dejonghe’s crown as senior partner, alongside global projects, energy, natural resources and infrastructure board head David Lee and Abu Dhabi capital markets partner Khalid Garousha, who stepped into the role of interim managing partner in July following Gareth Price’s shock departure earlier in the month. Both Bowden and Lee are based in the firm’s London office. Continue reading “Shearman partners overlooked in Allen & Overy leadership race”

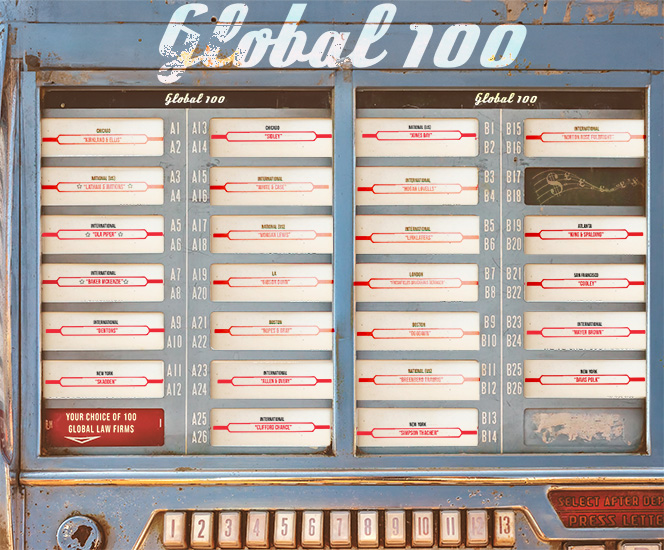

Global 100: When the music stops – it’s time for the global elite to play a different record

It has long been a peccadillo of business publishers to measure financial performance in five-year increments and for this, our final issue of the year, it seems churlish to break with tradition now.

Revisiting our Global 100 coverage from 2018 calls to mind a time capsule, with some of the contents uncannily familiar and others belonging almost to a bygone era. Continue reading “Global 100: When the music stops – it’s time for the global elite to play a different record”

Global 100 2023: Main table

Below you will find our Global 100 main table which provides key financials for the top 100 firms. Continue reading “Global 100 2023: Main table”

M&A stages tentative comeback but dealmakers remain hamstrung by uncertainty

‘The biggest issue for the market is uncertainty’, says Richard Youle, who has headed Skadden’s London office since July. ‘Whether that’s in relation to the current geopolitical landscape, higher interest rates, inflation, or navigating tougher stances by regulators – we’re seeing people take longer to think about transactions and execute them. There’s also a mismatch of expectations – sellers are looking for 2022 prices, while buyers are looking for a reduction.’

Indeed, this view is borne out by the data. According to Refinitiv, worldwide M&A activity for the first three quarters of 2023 is down 27% compared to the same period last year, to a ten-year low of $2trn. There are some positive signs. Q3 2023 saw activity dip 16% on Q2. But four of Refinitiv’s top ten highest-value global deals were announced between June and September, and the months since then have seen further high-value activity. Still, these points notwithstanding, Q3 2023 remains the slowest Q3 since 2012. Continue reading “M&A stages tentative comeback but dealmakers remain hamstrung by uncertainty”

Global 100 Overview: Spinning around

The contrast between last year’s Global 100 report and this year’s could hardly be starker. Last year saw firms blow away even optimistic predictions to post extraordinary results. Total revenue increased by 15% to $147.5bn – more than double the previous year’s already impressive rise of 7%. Average profit per equity partner (PEP), meanwhile, shot up 19% to $2.37m.

This year, gross revenue increased by just 1% to hit $149.2bn, while average PEP dropped by 3% to $2.29m. Last year, we deemed a firm to be struggling in relative terms if it did not put both revenue and PEP up by 10% or more. This year, double-digit increases are far rarer: only eight firms increased revenue by 10% or more, and only two – Gibson Dunn (see analysis) and Polsinelli – managed double-digit increases in both revenue and PEP. Continue reading “Global 100 Overview: Spinning around”

Global 100 firms expand notably in core areas as Paul Weiss vs Kirkland rumbles on

The lateral hiring market in November was once again dominated by comings and goings between Paul Weiss and Kirkland & Ellis, as well as big moves between Global 100 rivals in Europe.

Just when the market thought Paul Weiss had eased up on its hiring spree in the run-up to Christmas, the firm announced it had hired John Patten, a partner in the London technology and intellectual property (IP) transactions practice of Kirkland. Continue reading “Global 100 firms expand notably in core areas as Paul Weiss vs Kirkland rumbles on”

Global 100 – Stories of the year

With law firm mergers and collapses, new office launches, a proliferation of strategic hiring and big-name changes in management, 2023 was a rocking year. Here are the headline stories of the last 12 months Continue reading “Global 100 – Stories of the year”

Global 100: White & Case: Global elite leader or missed opportunity?

‘Our ability to pitch top-ranked teams under both New York and English law, and where needed under the local laws to back that up, remains our USP,’ asserts Oliver Brettle, White & Case’s vice chair, underscoring what sets the firm apart.

Unveiling subdued financials this cycle, the firm’s London arm experienced a modest 1% revenue growth to $451m, contrasting sharply with the 18% and 12% revenue upticks witnessed in 2020 and 2021. Global turnover was also muted, declining by 1% to $2.83bn. However, it still signifies a substantial 57% increase over five years and outperforms the figures observed among Magic Circle peers.

Continue reading “Global 100: White & Case: Global elite leader or missed opportunity?”

Switzerland focus: Testing the mettle

In the words of Patrik Peyer, managing partner of Niederer Kraft Frey (NKF): ‘As the Swiss legal market confronts these multifaceted challenges, the resilience and adaptability of legal practitioners become crucial in shaping a forward-looking legal landscape.’

‘The legal market is always developing in parallel to the general economic situation,’ says Bär & Karrer’s Susanne Schreiber, who co-heads the firm’s tax team. In Q1, Switzerland’s annual inflation rate rose to a high of 3.4% in February, 0.6% up on December 2022. In Q2, things started to look up with rates decreasing to 2.6% in April. Since then, rates have been on a steady decline, remaining at 1.7% for both September and October 2023. Interest rates, too have stabilised. Since July 2023, the Swiss National Bank has kept its policy rate at 1.8%, providing a sense of stability to the Swiss economy. Following these economic trends, there are several trends practitioners have seen regarding the work that’s been done. For example, practice areas such as litigation and tax were extremely busy this year while areas like M&A and capital markets saw a decrease in deal volume compared to previous years. Banking and finance and real estate and construction remained stable throughout 2023. Continue reading “Switzerland focus: Testing the mettle”