LB100 law firms

The firms that appear in the Legal Business 100 (LB100) are the top 100 law firms in the UK (usually LLP partnerships but also some alternative business structures – see footnotes), ranked by gross fee income generated over the financial year 2019/20 – usually 1 May 2019 to 30 April 2020. We call these the 2020 results. Where firms have identical fee incomes, the firms are ranked according to highest profit per equity partner (PEP).

Sources

An overwhelming majority of firms that appear in the LB100 co-operate fully with its compilation (see ‘Transparency’, opposite) by providing our reporters with the required information. A limited number of firms choose not to co-operate officially with our data collection process and in these circumstances we rely on figures given to us by trusted but anonymous sources and estimates taken from previous years’ LLP accounts.

Law firm structures

We recognise that, as firms have expanded globally, they have developed a number of ways of structuring their businesses, for instance using Swiss Vereins, European Economic Interest Groupings, and partial and full profit-sharing models. For consistency’s sake, we now publish the global, firm-wide financials for all of the firms in the LB100, regardless of how they internally structure themselves or share profits. So the turnover, profitability, PEP and headcount figures published are all global, firm-wide figures, except where noted.

A number of firms (see footnotes) do not operate LLP partnerships and do not have equity partners. For the purposes of the main table, no profit figures are provided for these firms and readers should refer to stock exchange reports for a clearer picture of profitability and dividend payments. Therefore, the profits and partner numbers of these firms are excluded when calculating LB100 or peer group averages for PEP.

Definitions

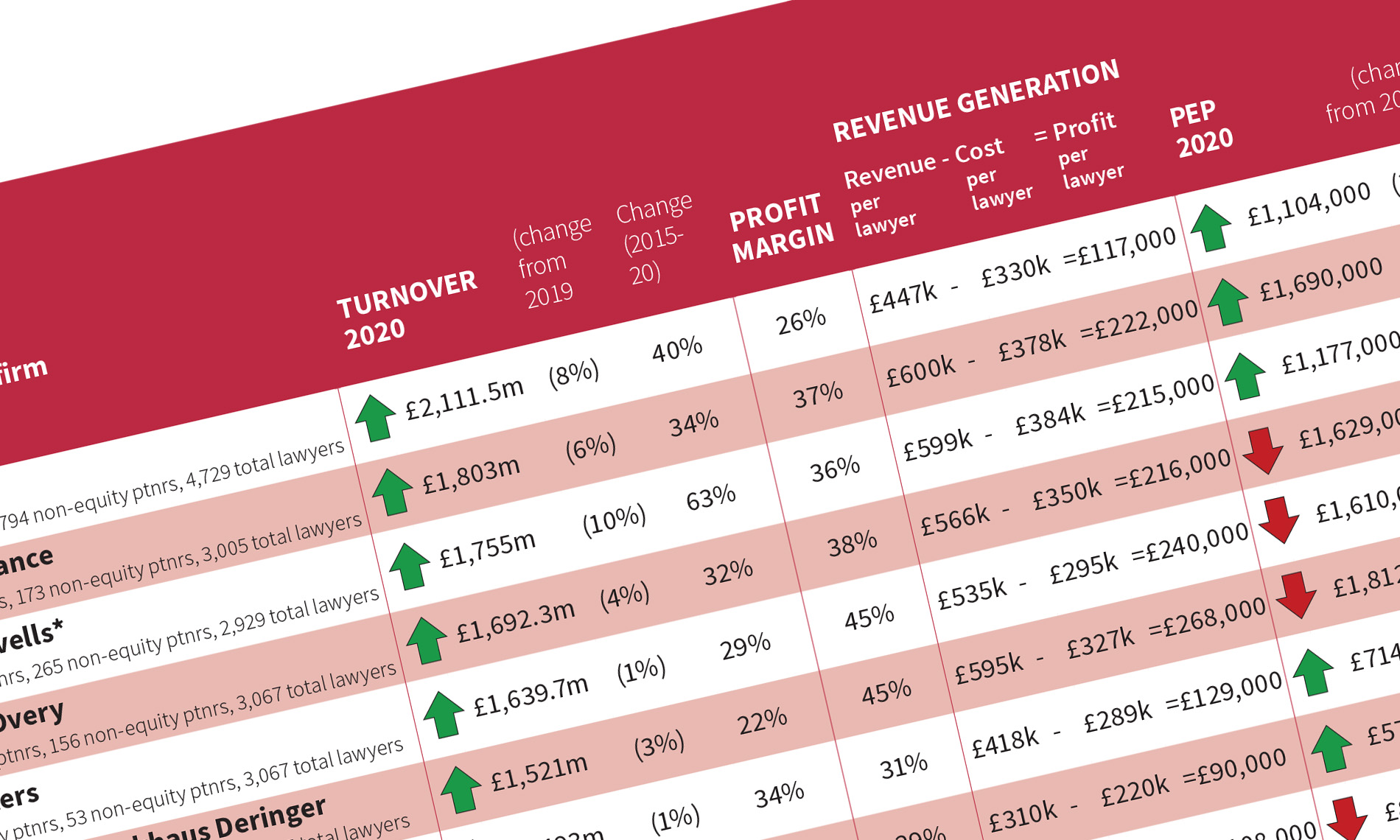

Turnover/revenue/gross fees

Revenue figures do not include VAT, disbursements, interest or anything other than the worldwide fees generated by firms for their work during the last financial year.

Net income

We define net income as the total profits that are available to be shared among full equity partners. We treat profit sharing with non-equity partners or fixed-share equity partners as an expense and it is therefore not included in the net income figure.

Total lawyers

Total lawyer numbers include partners, trainees, assistants, associates, of counsel and all other fully qualified lawyers but do not include legal executives, paralegals or other support staff. We ask firms for actual full-time equivalent headcount at the end of the last financial year. Lawyer and partner numbers are rounded up to the nearest whole number.

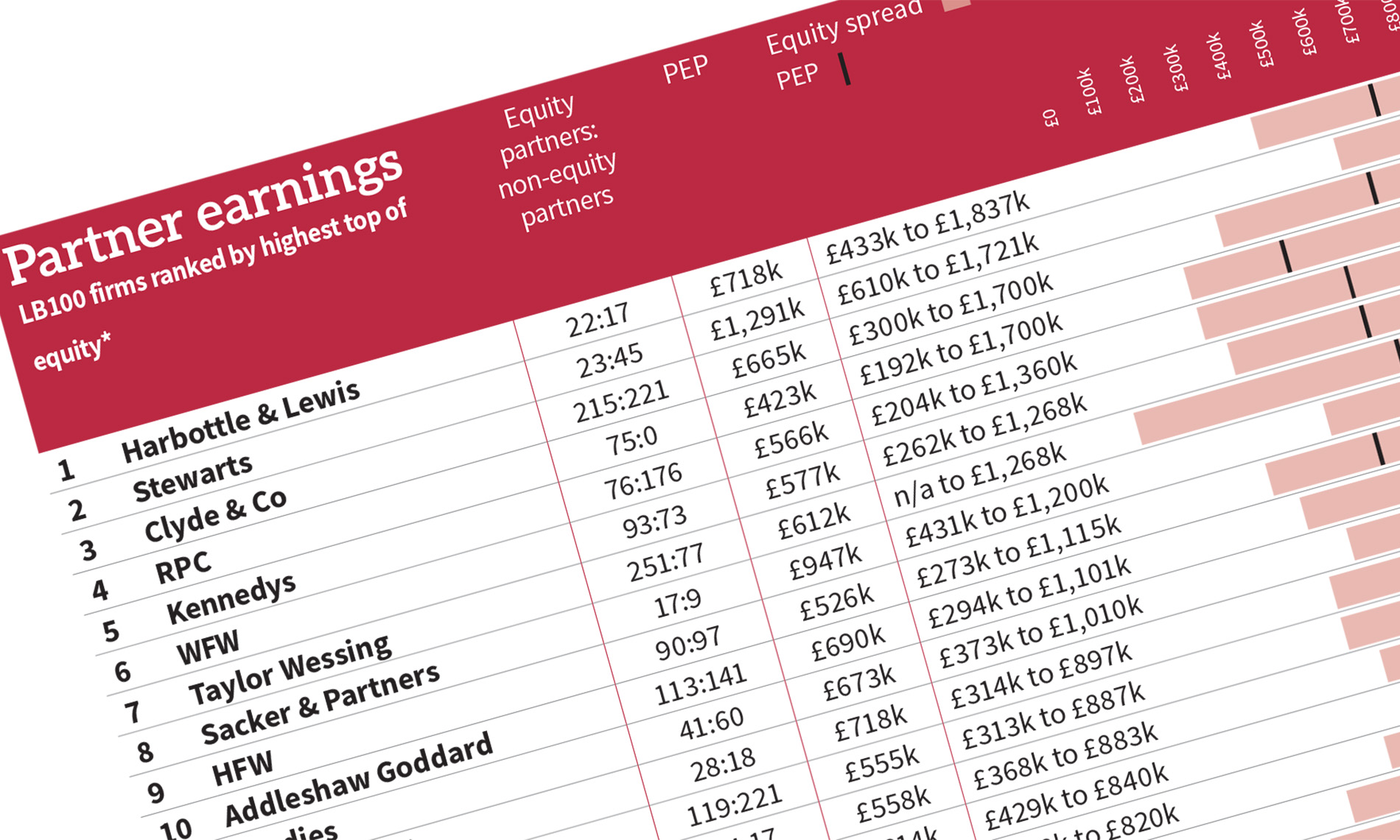

Equity partners

We define full-equity partners as partners that are full participants in the firm’s profits. Fixed-share equity partners are considered non-equity partners for the purposes of this survey.

Non-equity partners

Non-equity partners, be they fixed-share, salaried, or laterals on probationary periods, are those that are not full participants in the firm’s profits, though they may have voting rights.

How we crunch the numbers

Profit per equity partner

We calculate PEP by dividing net income by the whole number of full-equity partners (where applicable) at the end of the last financial year. PEP is an average figure used to benchmark the profitability of firms, which is not necessarily the same as saying that any partners take home this amount of money.

Revenue per lawyer (RPL)/profit per lawyer (PPL)

RPL is calculated by dividing turnover by the total number of lawyers at the end of the last financial year. PPL is calculated by dividing net income by the total number of lawyers.

Profit margin

Profit margin is net income as a percentage of turnover.

Change 2015-20

This figure is the simple percentage change in revenue between the 2014/15 financial year (as reported in the 2015 LB100) and the 2019/20 financial year.

Footnotes

- DLA Piper and Sacker & Partners operate a year-end to 31 December 2019.

- DWF is admitted to the main board of the London Stock Exchange and no longer operates as a conventional partnership. As such, profit is not distributed among equity partners and profit figures are not published in the main table.

- Osborne Clarke – as the firm operates separate profit pools, headcount and revenue figures are global, while PPL, profit margin and PEP are calculated according to UK net income and fee-earner numbers only.

- Irwin Mitchell does not operate a traditional law firm partnership, and partners are remunerated according to salaries and bonuses, not profit shares. The PEP figure is illustrative for the purposes of the LB100 and is not supplied by the firm.

- Slater and Gordon became the world’s first listed law firm in 2007. It does not operate a traditional law firm partnership and profit is not distributed among equity partners. As such, profit figures are not published in the main table.

- Gateley became the UK’s first listed law firm in 2015. Gateley does not operate a traditional law firm partnership and profit is not distributed among equity partners. As such, profit figures are not published in the main table.

- Keoghs does not operate a traditional law firm partnership and profit is not distributed among equity partners. As such, profit figures are not published in the main table.

- Knights is listed on the London Stock Exchange. The firm does not operate a traditional law firm partnership and profit is not distributed among equity partners. As such, profit figures are not published in the main table.

- Keystone Law is listed on the London Stock Exchange. The firm does not operate a traditional law firm partnership and profit is not distributed among equity partners. As such, profit figures are not published in the main table.

- Minster Law does not operate a traditional law firm partnership and profit is not distributed among equity partners. As such, profit figures are not published in the main table.

- Moore Barlow – South-East firms Moore Blatch and Barlow Robbins merged on 1 May 2020 to form Moore Barlow. The figures published here are based on Moore Blatch’s 2019/20 financial results prior to the merger, as the combined firm will have a total revenue of around £40m.

Click here to return to the Legal Business 100 menu

Transparency

We take the compilation of the LB100 very seriously. The overwhelming majority of firms featured co-operate fully with us to provide the relevant information on headcount, revenue and profit to ensure the figures we publish are accurate. Among the 100 firms featured in the survey, six declined to provide any financial information formally. These were: Slaughter and May, Fieldfisher, Hill Dickinson, Thompsons, Harrison Clark Rickerbys and Bates Wells.

A further eight firms, in addition to those in the footnotes above, did not disclose details of profit. These were: Norton Rose Fulbright, Gowling WLG, Stephenson Harwood, Browne Jacobson, Winckworth Sherwood, Devonshires, Payne Hicks Beach and Moore Barlow.