US firms have dominated transactional recruitment this week while UK-headquartered peers have focused on bolstering their disputes capabilities.

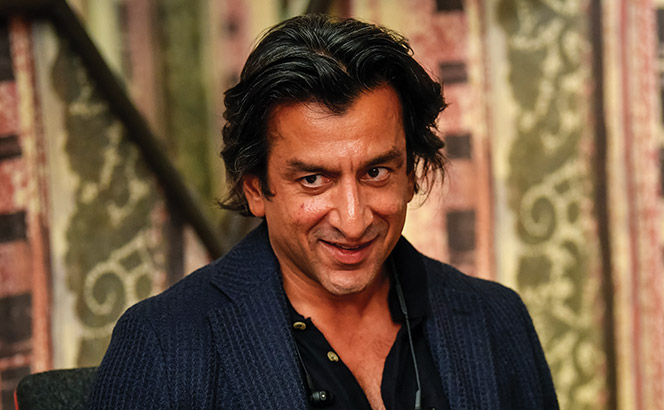

Paul Hastings continues its auspicious London growth trajectory, which saw its City revenue surge 41% in 2021/22, with a dual partner hire. The firm announced the addition of Jason Brooks to its structured credit team this week following the arrival of private equity partner Tom Cartwright last week. Continue reading “Revolving Doors: Paul Hastings adds two as McDermott boosts energy expertise”