‘Harsh’, ‘comparing apples and pears’, or ‘the sensible thing to do’?

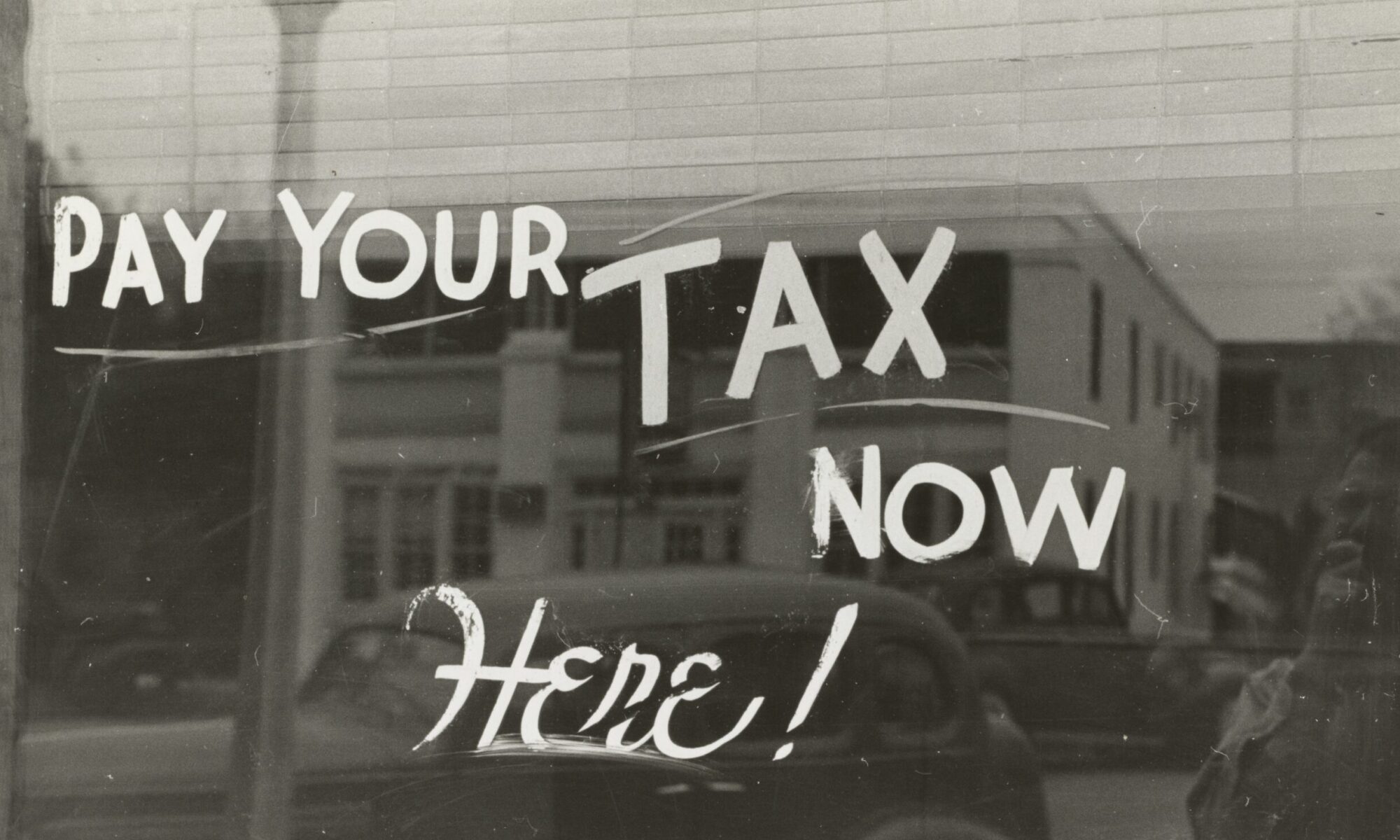

Partners and experts have given their views on reports that Chancellor Rachel Reeves is expected to introduce a new tax on limited liability partnerships (LLPs) – and opinions are mixed, to say the least.

Partners in LLPs are not currently eligible to pay employers’ national insurance contributions (NICs), currently levied at 15%, as they are self-employed.

Under proposals reportedly mooted as part of the upcoming budget, however, partners would be required to pay NICs, with rates set slightly lower than 15%, according to reporting in The Times.

The policy could amount to a roughly 7% effective increase in tax for partners, and is forecasted by the Centre for the Analysis of Taxation (CenTax) think tank to affect 190,000 UK partners, and raise a total of £1.9bn.

Liesl Fichardt (pictured right), head of Quinn Emmanuel’s London international tax and regulatory disputes practice, told LB that the proposal overlooks fundamental differences between partners and employees: ‘They’re comparing apples with pears. Being a partner in an LLP structure is not the same as simply being employed by a company. There are other responsibilities that partners have. It’s a very different animal.’

Another tax partner at an international firm pointed to remuneration differences between LLPs and other structures that he believes justify different tax treatments.

‘It would seem harsh to have all the downsides of being self-employed and to have to pay the equivalent of employer’s NICs’

He highlighted that partnership profits are taxed on accounting profits, which are usually higher than actual distributions, meaning partners may pay tax on money they haven’t received. Additionally, he stated that required capital contributions, which might be around 10%, are taxed immediately, even though the partner only accesses the funds upon leaving the firm.

He added that, as partners are self-employed and receive distributions from profits rather than a fixed salary, their income is precarious: ‘You don’t know if you will receive a profit or a loss.’

Elizabeth Small, a tax partner at Forsters, noted disadvantages of self-employment such as withdrawing payments through the year on account of profits which may not materialise, and so being at risk of paying back in year distributions, or having given bank guarantees, potentially putting the family home on the line, and being liable for amounts that are not covered by insurance.

‘It would seem harsh to have all the downsides of being self-employed,’ she said, ‘and for the partnership to have to pay the equivalent of employer’s NICs.’

The sensible thing to do

On the other hand, former Clifford Chance partner and founder of tax think tank Tax Policy Associates Dan Neidle (pictured right) told LB that the equalisation of treatment is ‘the sensible thing to do.’

He gave short shrift to the argument that, as self-employed workers, law firm partners’ earnings are insecure: ‘If you’re an employee in a small startup, your position is inherently more precarious than a partner at A&O Shearman. It’s ridiculous, and frankly insulting, to compare the two. So why should the employee pay more tax? Let’s cut the special pleading. Total bollocks.’

Neidle acknowledged that concerns about the impact on the legal profession carry more weight with him, pointing to a September report by CenTax which, while supportive, estimates that behavioural responses to the policy would trim around 20% off the expected tax take.

‘Let’s cut the special pleading. Total bollocks’

He suggested that some older partners might retire and return as consultants, while others could consider relocating overseas — ‘and not just to Dubai’. Countries such as Belgium, he said, could offer a more favourable tax environment: ‘It’s been said to me that a partner working in London gets taxed more than just about anywhere else.’

Another tax partner also believes the change could drive away highly paid financial services workers: ‘When you look at asset managers, hedge funds, and the like, a 7% increase is so significant that it could make people reconsider whether the UK is right for them.’

Meanwhile, Small points to other possible effects that might stem from the tax change: ‘It might slow down partnership promotions and would also be an additional cost, which would either need to be passed on to clients, absorbed by the partners, or offset through savings else: including employing fewer staff.’

Corinne Staves, a partner at CM Murray specialising in partnership law, is one of many to suggest that the move could lead to partnerships incorporating, a move which she said may ‘supercharge’ private equity investment in professional services, as it is much easier for PE firms to invest in firms with a corporate structure.

‘The devil will be in the detail, and it could be a nasty devil or a good one’

Fichardt stressed, however, that any rush to judgement should be put on ice until such details are made available: ‘We have yet to see the details. The government would need to introduce legislation, and we will need to see how that would work in practice. The devil will be in the detail, and it could be a nasty devil or a good one. We don’t know yet.’

She cautions, however, that the targeted tax could make the UK’s famously byzantine tax system even more unwieldy: ‘There is huge room to simplify,’ she said. ‘We already have one of the most complex and burdensome tax systems in the UK.

‘Targeting certain groups will never fix that problem and my concern is that this will make it even worse.’

Pinsent Masons saw revenue rise by 4.7% to a new record high of £680m over the year, a result senior partner Andrew Masraf (pictured) described as cause for celebration – while also acknowledging the scope for improvement.

Pinsent Masons saw revenue rise by 4.7% to a new record high of £680m over the year, a result senior partner Andrew Masraf (pictured) described as cause for celebration – while also acknowledging the scope for improvement. National firm Blake Morgan, which has six offices across the UK, boosted PEP by 8% to £349,000 in 2024-25, against a 4.6% increase in revenue; however managing partner Mike Wilson (pictured) said PEP could have been higher still, but for the firm’s strategy of investing profit back into the business.

National firm Blake Morgan, which has six offices across the UK, boosted PEP by 8% to £349,000 in 2024-25, against a 4.6% increase in revenue; however managing partner Mike Wilson (pictured) said PEP could have been higher still, but for the firm’s strategy of investing profit back into the business. At Hogan Lovells, which put in one of the strongest performances of the international firms, with PEP up 9.1% to £2.4m, global corporate and finance head James Doyle (pictured) stressed the importance of adaptability in a fast-changing marketplace.

At Hogan Lovells, which put in one of the strongest performances of the international firms, with PEP up 9.1% to £2.4m, global corporate and finance head James Doyle (pictured) stressed the importance of adaptability in a fast-changing marketplace.

Response rates for London referees saw a double-digit increase this year, with rising by almost 12% to a new record high of more than 31,000.

Response rates for London referees saw a double-digit increase this year, with rising by almost 12% to a new record high of more than 31,000.