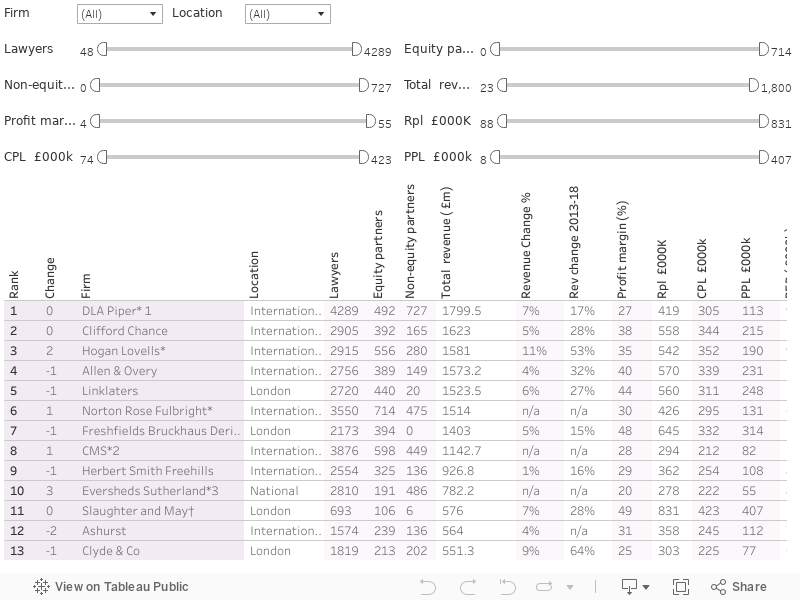

Brexit negotiations stalling, trade wars looming, the high street hit by a raft of collapses – at first sight, there is plenty to suggest the UK has taken a trip back in time. Yet for those with a finger on the pulse in the City, it will come as no surprise to find this year’s Legal Business 100 (LB100) speaks of a standout year for Britain’s legal elite. Turmoil has mattered very little against the backdrop of booming transactional activity, interest rates near historic lows and the cheap pound.

While commercial lawyers spoke with wary optimism of healthy markets in the summer of 2017, caution progressively turned into bemused enthusiasm as the City realised it was living through its busiest winter for years during a period that seemed to resemble the Winter of Discontent. By spring, some were hailing the best financial year since the banking crisis. This year’s survey confirms that there is some substance to such claims. Continue reading “The LB100 overview: Crisis? What crisis?”