A&O Shearman

Matt Townsend

Alongside acting as global co-head of A&O Shearman’s environmental and sanctions practice, Matt Townsend is also one of the founding members of the firm’s global ESG group. With nearly 30 years of experience in environmental and climate law, Townsend is a leading advisor on a wide range of sustainability and regulatory matters, spanning climate change, carbon trading, supply chain risk management, and circular economy programmes. Recently, he played a key role in advising credit providers on the financing of the NEOM Green Hydrogen Project in Saudi Arabia, one of the world’s largest commercial-scale green hydrogen facilities.

His leadership in sustainability matters extends beyond his client work. He serves on multiple industry and advisory bodies, including the City of London Law Society’s environmental working group and the Financial Markets Law Committee’s ESG working group. He is also a member of the Legal Sustainability Alliance’s executive committee and an advisory board member for the European Bank for Reconstruction and Development on ESG guidelines for the CEE region. A regular commentator on emerging climate and sustainability trends, Townsend remains an influential voice in shaping global ESG standards.

Bevan Brittan LLP

Nathan Bradberry

Nathan Bradberry heads up Bevan Brittan LLP’s infrastructure practice and is a leading advisor in environmental sustainability and decarbonisation projects. With over 12 years of experience in carbon capture, emissions trading, and district energy solutions, Bradberry has played a pivotal role in multi-billion-pound public-private partnerships, including the £12bn Bristol City Leap project aimed at decarbonising Bristol through a 20-year initiative.

His expertise extends to advising on groundbreaking projects involving municipal energy supply companies, and biomass, solar, and wind energy. Recently, he hosted the 2024 Energy From Waste Conference, where he led discussions on heat networks and carbon capture.

Leading the firm’s environmental sustainability group and responsible business programme, he is a frequent contributor to legal discourse on sustainable infrastructure through seminars, webinars, and articles.

Burges Salmon

Ross Fairley

Ross Fairley chairs Burges Salmon’s renewable energy team and its net zero services, advising developers, investors, and public sector clients on clean energy contracts and regulations.

Recently, he was part of the team advising Bristol City Council on its City Leap initiative involving the appointment of a partner for a 20-year joint venture that will deliver up to £1bn of investment in low carbon energy infrastructure in Bristol and support its aim of becoming a carbon neutral city by 2030.

Fairley’s expertise spans a wide range of technologies, including wind, hydrogen, biomass, wave and tidal, solar, and geothermal energy. In addition to his legal work in these areas, he chairs Renewable UK’s Strategy Forum and is deputy chair of the UK Hydrogen Energy Association.

A prominent speaker on clean energy issues, he also acts as mentor in the Entrepreneurial Women in Renewables scheme and serves as a trustee for Avon Wildlife Trust.

Freeths LLP

Kirstin Roberts

Kirstin Roberts at Freeths LLP heads up the firm’s waste & sustainability practice, part of the broader clean energy team. She is a leading expert in the waste and renewables industry, advising companies on waste reduction, re-use, recycling, and sustainability policies. As a fellow of the Chartered Institution of Waste Management (CIWM), she guides publicly listed companies, local authorities, and energy-from-waste businesses on waste regulation, sustainability policies, and compliance with waste-related laws. Her expertise includes waste permitting, circular economy initiatives, and landfill operations.

Roberts is also a prominent speaker, regularly hosting webinars and training sessions on topics such as end-of-waste regulation and circular economy practices, as well as publishing articles on sustainability issues, including the beverage industry’s struggle to meet net-zero targets and the ban on single-use plastics.

Freeths LLP

Clare King

Clare King heads up the clean energy, waste & sustainability practice at Freeths LLP and co-leads relationships with major energy clients such as Centrica PLC, ENGIE, and Statkraft. A specialist in clean energy projects, particularly battery storage, she led the team advising Cambridge Power on one of the UK’s largest battery deals, and regularly advises developers, investors, and joint ventures on the commercial, regulatory, and transactional aspects of renewable energy, energy storage, and cleantech projects.

With King’s deep technical knowledge across a range of clean energy technologies, including CHP, bioenergy, and carbon credits, she remains at the forefront of large-scale, innovative projects.

She is also a frequent industry speaker, and as part of the firm’s membership with The Chancery Lane Project, she has been responsible for drafting sustainability clauses to introduce sustainability provisions into clients’ supply chains.

Freeths LLP

Penny Simpson

Penny Simpson leads Freeths LLP’s environmental group and chairs its natural capital group, part of the firm’s broader ESG team. With over 20 years of experience, she is a leading authority in natural environment and natural capital law, advising developers, energy companies, and public bodies on regulatory and transactional matters. A pioneer in the natural capital economy, Simpson has been instrumental in helping landowners enhance biodiversity for offsetting. Notably, she secured a landmark victory in 2022’s Harris vs Environment Agency, shaping post-Brexit environmental law. A sought-after expert in complex environmental cases, she also advises on regulatory compliance, health and safety law, and represents clients facing proceedings from environmental agencies.

Extending her engagement beyond this work portfolio, Simpson is a member of the Chartered Institute of Ecology & Environmental Management and an active member of UKELA’s Nature Conservation Working Group. She also regularly conducts training on key environmental issues, including European Protected Species Law and Habitat Regulations Assessments.

Hausfeld & Co. LLP

Ingrid Gubbay

Ingrid Gubbay is a distinguished litigator and campaign lawyer, focusing on environmental, human rights, and climate law. She leads the human rights and environmental team at Hausfeld & Co. LLP, and actively contributes to the Global Climate Litigation network. She also serves as a legal trustee of the Sea Rangers, a Dutch environmental enterprise focused on marine protection.

Having been appointed as a visiting research fellow at the British Institute of International and Comparative Law (BIICL), Gubbay teaches climate litigation, engaging in projects around corporate accountability and transitional justice. Her work on climate change litigation and championing the role of lawyers in tackling global warming have gained her wide-spread recognition.

A passionate advocate, she frequently delivers speeches and publishes extensively on environmental litigation, climate justice, and corporate environmental liability.

Leigh Day

Martyn Day

Martyn Day, co-founder of Leigh Day, is a renowned expert in international, environmental, and product liability law. He has represented communities in high-profile cases, including Zambian claimants affected by pollution from a large open cast mine in the Copperbelt. Since 2022, he has been representing hundreds of thousands of UK claimants in the emissions scandal, targeting car manufacturers accused of manipulating NOX emission tests.

Day’s engagement extends to several memberships and his thought leadership on environmental issues: He is the director of Greenpeace Environmental Trust and routinely publishes, gives lectures and participates in seminars on environmental topics. He and his work regularly feature in the media, and he recently co-authored a guide on environmental action.

Lux Nova Partners: Sandy Abrahams

With a career spanning over 15 years, Sandy Abrahams at Lux Nova Partners is a distinguished expert in clean and low-carbon energy projects. Specialising in the development of clean energy initiatives both in the UK and internationally, she has played a pivotal role in pioneering projects such as the first utility-scale wind farm in the Middle East and utility-scale solar farms in Jordan.

Besides her project work, Abrahams is deeply involved in policy development and industry innovation and has been instrumental in advancing transformational models for distributed and decarbonised energy generation, advising on projects such as Clean Energy Prospector’s renewable energy generation models.

She also serves as a director of Flex Assure (which establishes standards in the flexibility market) and has been appointed to the UK PACT roster of experts, contributing to global climate change expertise through the DFID-funded programme. Her international work includes hybrid solar-storage projects in Kenya, off-grid renewable electricity models, and capacity-building efforts with the International Renewable Energy Agency (IRENA) across West Africa.

Her influence and thought leadership is further evident in her membership of UKELA’s Climate Change & Energy Working Party.

Lux Nova Partners

David Short

David Short at Lux Nova Partners leverages over 25 years of experience in commercial, technology, IP, data protection, and environmental law to advise businesses navigating the net-zero transition in matters ranging from clean energy projects to nature-based solutions.

Short has been instrumental in guiding two of the UK’s most significant biodiversity and nature restoration projects, the Wendling Beck Environment Project in Norfolk and Iford Estate in West Sussex. He also played a key role in developing GE Capital Real Estate’s sustainability programme, is an assessor for the Green Heat Networks Fund, and provides strategic advice to industry bodies including the Better Buildings Partnership (where he sits on the steering group for the Green Leases Working Group), Renewable Energy Assurance, and the Green Finance Institute.

A thought leader in the sustainability space, Short is also a member of the Green Finance Institute’s Zero Carbon Heating Taskforce, and serves pro bono as sustainability and climate change adviser to the Wessex Multi Academy Trust. He helps guide the Trust’s leadership in the development and implementation of its sustainability strategy, mentoring grassroots Eco Leaders across 12 schools in Dorset.

Lux Nova Partners

Tom Bainbridge

Founding partner of Lux Nova Partners, Tom Bainbridge is a recognised leader in the clean energy sector. With an over two-decade long track record in energy and district heating schemes, he continues to play a key role in shaping the heat market: Recently, he led the legal work for the UK Government’s Heat Networks Investment Project (HNIP) and Green Heat Networks Fund (GHNF), delivering substantial public funding to support low-carbon heat networks. His experience spans landmark projects, including the first utility-scale wind farm in the Middle East and one of the world’s first carbon-financed biomass refueling projects.

Also beyond his legal work for clients, Bainbridge remains actively involved in advancing clean energy: He sits on the Board of the UK Emissions Trading Group, is a member of the Association for Decentralised Energy, and has served as chair of UKELA’s Climate Change & Energy Working Party and the Heat Trust. He has provided expert testimony before Parliamentary Select Committees and the National Audit Office on energy and environmental policy.

Bainbridge is also the founder of business consulting company Road from Rio, which provides strategic advice on net zero pathways.

Mishcon De Reya

Alexander Rhodes

Head of Mishcon Purpose, Alexander Rhodes is an experienced litigator who specialises in complex multi-jurisdictional disputes and in providing strategic ESG advice to businesses transitioning to more sustainable and resilient practices. He has worked closely with governments and global leaders, focusing on balancing environmental conservation with human development in support of the UN Sustainable Development Goals.

A thought leader in environment, climate change, biodiversity, and human rights, Rhodes regularly contributes to academic research and recently wrote an article on the role of law in driving sustainability.

A recognised conservationist, he was the founding CEO of Stop Ivory and led the Secretariat for the Elephant Protection Initiative, playing a pivotal role in combatting the illegal ivory trade. He currently serves as Chairman of Tusk Trust and is a Fellow of the Royal Geographical Society and the Zoological Society of London (ZSL).

Norton Rose Fullbright

Caroline May

A highly respected environmental and health and safety lawyer, Caroline May serves as chair of Norton Rose Fulbright’s environment, planning, and health and safety practice across Europe, the Middle East, and Asia. With over 30 years of experience, she has become a recognised leader in her field, offering specialised expertise in sustainability and ESG corporate reporting. Appointed as Norton Rose Fulbright’s first sustainability partner, May plays a key role in shaping the firm’s global sustainability strategy, helping businesses navigate complex ESG regulations including the CSRD, ISSB standards, and the EU Deforestation Regulation.

A prominent sustainability thought leader, May holds several influential roles: She chairs the Law Society of England & Wales’ Climate Change Working Group, is a director of leading sustainability NGO Aldersgate Group, and co-chairs the Legal Sustainability Alliance. Additionally, she chairs the firm’s sustainability committee for EMEA, guiding its internal initiatives towards net zero.

May regularly presents at major events, including the ESG and Sustainability Reporting Summit in Berlin and the World ESG Summit, and contributes to environmental initiatives such as The Language of Green Demystified, which simplifies ESG concepts for legal professionals.

Simmons & Simmons

Sonali Siriwardena

As global head of ESG at Simmons & Simmons, Sonali Siriwardena leads the firm’s strategy on environmental, social, and governance matters across all practice areas and offices. Her deep expertise in ESG allows her to support clients, including those with a global presence, in navigating the complex regulatory and policy landscape; she advises them on regulatory developments and risks, while also helping them leverage business opportunities in the rapidly evolving ESG space.

Beyond her legal work, Siriwardena holds key leadership roles in several ESG-focused organisations. She is a member of the UK Financial Conduct Authority’s ESG Advisory Committee, helping shape the UK’s ESG regulatory framework. She also serves as a board member of the UK Sustainable Investment and Finance Association (UKSIF) and the Blue Marine Foundation (BMF), a leading ocean conservation charity, and is an active member of the City of London Law Society (CLLS) ESG Committee.

Travers Smith LLP

Heather Gagen

As head of Travers Smith LLP’s dispute resolution practice as well as ESG and impact group, Heather Gagen specialises in complex disputes involving environmental damage, human rights, and product liability litigation. Her practice focuses on advising clients on corporate risk management, particularly regarding business and human rights issues, and broader ESG-related risks. With a deep understanding of the evolving ESG landscape, she provides strategic guidance to clients navigating the increasing legal and reputational challenges associated with sustainability, human rights, and environmental responsibility.

Gagen is also a recognised thought leader in the ESG space, frequently speaking at industry conferences and seminars on emerging trends and regulatory developments. In July 2024, she co-hosted a seminar with leading Japanese law firm Nishimura & Asahi, where she discussed emerging ESG trends in the UK and Europe, further cementing her reputation as an expert in this evolving field.

Travers Smith LLP

Simon Witney

Simon Witney is a senior consultant and chair of Travers Smith LLP’s ESG and impact group, with over 25 years of experience in sustainable finance, corporate governance, and private markets. He has advised private equity and venture capital firms, as well as the UK Government, on complex regulatory, transactional, and fund formation matters.

Throughout his career, Witney has been a prominent writer and speaker on company law, corporate governance, and ESG-related issues, including in the private equity space. His contributions include co-leading the firm’s internal ESG and Sustainable Finance Academy and helping to shape important ESG policies. He is a member of the BVCA’s Accounting, Reporting and Governance Committee, the UK Sustainable Investment and Finance Association (UKSIF) Policy Committee, and the ESG Committee of the City of London Law Society (CLLS). In addition, he serves on Invest Europe’s taskforces for the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD).

Travers Smith LLP

Jonathan Gilmour

Jonathan Gilmour heads up the derivatives and structured products (DSP) practice at Travers Smith LLP with a specialisation in advising clients on carbon trading, green bonds, and other ESG financial instruments. Navigating the complexities of ESG-related financial products, he works closely with industry bodies to develop policy and regulation in this field.

Gilmour is actively involved in several key industry bodies: He is a member of the Governance Committee of the UK Voluntary Carbon Market (VCM) Forum and participates in the UK Sustainable Investment & Finance Association’s (UKSIF) Green Taxonomy Advisory Working Group and Industry Development Committee. Additionally, he serves on the UK Board of the Global Alliance of Impact Lawyers.

Gilmour’s commitment to sustainable financial practices is also reflected in his dedication to pro bono work. He supports organisations such as the Impact Investing Institute, the Green Finance Institute, and the UN Principles for Responsible Investment (UN-PRI), helping advance the agendas of impact investing and green finance.

Irwin Mitchell

Keith Davidson

An environment and sustainability partner at Irwin Mitchell, who previously served as environment commissioner for Greater Manchester and founded environmental firm ELM Law, Keith Davidson is one of the UK’s foremost authorities on contaminated land and environmental liability. Dedicated to addressing environmental and climate change challenges, he played a key role in establishing the firm’s Net Zero Hub, offering clients expert guidance on net zero strategies and carbon literacy training.

Davidson’s frequent publications on sustainability and net zero topics include a recent article around reporting scope 3 emissions in the UK’s corporate real estate sector. He is also a prominent industry speaker on net zero, ESG, and PFAS issues, recently sharing his expertise in climate due diligence, PFAS liability risks, and contaminated land liability in a Manchester Law Society webinar.

Davidson’s contributions to the field are further highlighted by his roles as a member of the Law Society’s Climate Change Working Group, the Chartered Institution of Water and Environmental Management (CIWEM) contaminated land panel, and PFAS working group.

Macfarlanes

Rachel Richardson

Rachel Richardson serves as the head of ESG at Macfarlanes, where her engagement extends to co-leading the firm’s ESG working group and chairing the ESG steering committee. In these roles, she provides expert advice on ESG matters, develops internal policies, and oversees the firm’s ESG training and public policy initiatives.

Her legal practice is centred on ESG guidance and training, with a notable focus on sustainable finance. Her expertise in this area is underpinned by her certificate in sustainable finance from the Cambridge Institute for Sustainability Leadership. Specialising in nature-based solutions, biodiversity, and carbon credit generation and utilisation, Richardson also often leads cross-practice ESG initiatives, including B-Corp accreditation.

She recently collaborated with the UN PRI and the Alternative Credit Council on the UN PRI’s Responsible Investment DDQ for Private Debt Investors. She is also a prominent thought leader, regularly authoring articles on topics such as corporate sustainability and ESG reporting. Besides leading the firm’s ESG-related podcasts, she also speaks regularly at industry events and conferences on topics such as ESG and greenwashing.

Michelmores

Ben Sharples

Ben Sharples heads up Michelmores’ natural capital practice and is a distinguished expert in agricultural law. Besides handling contentious matters in this field, he advises clients on carbon sequestration, payments for environmental services, and sustainability issues. His recent work includes advising the Forestry Commission on evaluating the environmental benefits of halting traditional agricultural activities on a site near the River Stour to prevent leaching.

Alongside his legal practice, Sharples is a pioneer in natural capital policy. He authored a practical guide to payments for environmental services, published by Law Brief Publishing, which serves as a comprehensive resource for understanding the diverse opportunities available in the environmental services market.

In 2024, Sharples delivered a full day of lectures on natural capital issues to an audience of 240, further demonstrating his commitment to advancing knowledge and practice in this crucial area.

TLT

Maria Connolly

Alongside her role as head of the real estate and future energy team at TLT, Maria Connolly is also the executive board sponsor for the firm’s sustainability strategy. In this capacity, she set the ambitious target for the firm to become a carbon-neutral organisation by 2025 and engaged Carbon Intelligence to develop a robust sustainability programme. She has also established several key partnerships with organisations such as Forest Green Rovers, the Green Britain Foundation, The Chancery Lane Project, and Action Net Zero.

Connolly advises on a broad range of property matters including the acquisition of subsidy-free and operational sustainable energy generation and green infrastructure projects. Her expertise in sustainable energy is evident in her involvement in numerous wind, solar, biomass, and hydro projects.

Beyond her legal work, she acts as mentor for the RegenSW Entrepreneurial Women in Renewable Energy programme and has been appointed to the City of London Law Society Energy Committee. She is also a frequent speaker at industry events, discussing topics such as subsidy-free project modelling, electric vehicle charging infrastructure, and multi-technology projects.

Womble Dickinson

Richard Cockburn

Richard Cockburn serves as the head of Womble Dickinson’s energy group and is a leading figure in the renewable energy sector. His expertise spans a diverse range of projects, including onshore and offshore wind farms, renewable heat, solar, wave and tidal energy. Currently, Cockburn is engaged with progressive organisations to drive practical advancements in the energy transition, focusing on initiatives such as carbon capture and storage projects in the North Sea and various UK hydrogen projects.

His thought leadership is prominently featured in the firm’s publications on energy and sustainability, with notable contributions including articles on the UK’s pathway to a hydrogen economy and the broader green transition.

Cockburn also serves as a member of the Association of International Energy Negotiators, further reflecting his active involvement and influence in the energy sector.

Weightmans

Simon Colvin

Simon Colvin leads Weightmans’ national environment team and its energy and utilities sector. Applying his knowledge from developing the firm’s own internal ESG programme, he guides clients in establishing their ESG frameworks and policies. He also serves in a non-executive capacity on a client’s ESG committee.

Colvin’s experience ranges from advising on the development of a biodiversity net gain programme for rural landowners and acting for a developer on the construction of an Ecotown to advising landowners and developers on solar, wind and hydro schemes. He also has expertise in green leases, government subsidy schemes on renewables, and the EU ETS, CRC scheme and climate change agreements.

His thought leadership extends to regular speaking engagements and publications on the aforementioned topics, including a column in the Environmentalist and a quarterly legal update webinar for the Institute of Environmental Management and Assessment on greenwashing.

His commitment to the sector is underscored by his membership of The Chartered Institution of Wastes Management and his active involvement in the Broadway Initiative’s net zero programme and the development of the Environment Act 2021 with DEFRA.

Shoosmith

Chris Pritchett

Chris Pritchett is co-head of Shoosmiths’ national sustainability team and a prominent leader in renewable energy, mobility, battery storage, and EV charging matters. Drawing on over 20 years of experience, Pritchett, previously head of energy & future mobility at Foot Anstey, provides expert advice to funders, asset owners, developers, and contractors on renewable energy projects, including the trading and procurement of renewable power.

An ardent advocate for innovation in energy and mobility, Pritchett is passionate about advancing new commercial models to accelerate the transition to net zero, encompassing voluntary carbon offset schemes, local energy markets, and a range of data-driven flexibility projects.

His contributions extend to shaping energy policy; he was a steering group member of the Government’s Energy Data Task Force and chaired the Electricity Storage Networks Markets and Revenues Group.

A frequent speaker and panellist at leading sustainability and net zero conferences, Pritchett recently led a discussion at the Automotive Summit 2024 on sustainable energy policies and their impact on the automotive sector. He also moderated a session on alternative rooftop space for large-scale solar at the Solar Media Limited UK Solar Summit.

Sharpe Pritchard

Steve Gummer

Steve Gummer is head of net zero at Sharpe Pritchard LLP, where he spearheads the water, infrastructure, and energy team with a focus on regulated and net zero projects. Leveraging his extensive experience, he provides expert advice to investors, utilities, and government entities on complex projects across the nuclear and water sectors. He is particularly skilled in regulated asset base delivery models and regulated electricity projects, power purchase agreements, and various energy solutions, including solar PV, nuclear power, offshore wind, and hydrogen. Regulators and central government bodies including Ofwat, the Department for Energy Security and Net Zero, and the Department for Business and Trade have sought his advice.

Gummer is also the driving force behind the firm’s Green Goals campaign and GreenSteves project, which aim to highlight how public bodies can address the climate crisis and support them in achieving their net zero goals.

Additionally, he is a regular contributor to monthly articles and webinars and supports initiatives such as Net Zero Catapult by providing free advice on energy issues. His frequent speaking engagements cover a range of topics related to energy and sustainability.

Pinsent Masons

Michael Watson

Michael Watson heads up Pinsent Masons’ climate and sustainability advisory practice, playing a pivotal role in guiding a dedicated team towards advancing the firm’s comprehensive ESG initiatives. Overseeing the curation of the firm’s ESG-focused products and services, his responsibilities include spearheading the firm-wide learning and development agenda on ESG matters, providing expert guidance on achieving net zero and sustainability targets, and ensuring that strategic initiatives are aligned with the most current climate and sustainability standards. Watson has also been a driving force in helping the firm significantly enhance and expand its impact investment practice and credentials.

In addition to his internal responsibilities, Watson is a well-regarded commentator on sustainability issues. He has provided expert insights on the sustainability disclosure standards published by the International Sustainability Standards Board (ISSB), further underscoring his role as a key voice in the ongoing dialogue about effective sustainability practices and reporting standards.

Pinsent Masons

Stacey Collins

A leading authority in transactional construction and engineering solutions for the energy, industrial, and infrastructure sectors, Stacey Collins at Pinsent Masons frequently advises clients on climate change, net zero, and sustainability strategies, with a particular emphasis on carbon capture and low-carbon hydrogen projects.

He manages crucial client relationships across the energy sector, including with Drax Group and Ameresco, and advises on major UK energy projects such as Carlton Power’s low-carbon hydrogen initiatives and Viridor Energy’s carbon capture programmes.

Stacey’s influence extends beyond his transactional expertise. He co-drafted the NEC’s X29 Climate Change clause and is deeply involved in various decarbonisation taskforces, including those led by Government departments and the UN’s Industrial Deep Decarbonisation Initiative. He also serves on the ICE’s Decarbonisation Board and was the sole legal contributor to the Carbon Reduction Code for the Built Environment, developed by the Cambridge Centre for Smart Infrastructure and Construction’s Achieving Net-Zero taskforce.

A prominent speaker and writer on sustainability, Stacey hosted a roundtable at the UK CCUS & Hydrogen Decarbonisation Summit.

Pinsent Masons

Hayden Morgan

Hayden Morgan heads up Pinsent Masons’ sustainability advisory practice, bringing over 25 years of experience in corporate sustainability and sustainable finance. Recognised as a leader in developing global sustainable finance standards, he has significantly influenced the field for financial and corporate clients.

As the global convener for the ISO standard ‘Sustainable Finance: Principles and Guidance’ (ISO 32210), he led the development of the first global sustainability standard for financial organisations, published in 2022. He also spearheaded the creation of the Sustainable Infrastructure Label, launched at COP26 by the CEO of HSBC, as part of the global Finance to Accelerate the Sustainable Transition (FAST) Infrastructure initiative.

Morgan also played a pivotal role in establishing the UK Green Investment Bank (later Group), where he designed and implemented the green impact and sustainability framework during his tenure as director from 2013 to 2020.

In 2020, he founded Morgan Green Advisory, a consultancy dedicated to promoting a sustainable, lower-carbon future, which was subsequently acquired by Pinsent Masons in 2023.

Morgan is also a fellow of the Institute of Environmental Management and Assessment.

Cleary

Maurits Dolmans

Cleary’s Maurits Dolmans is a true leader on the intersection of sustainability regulation with UK, EU, and international competition law. He leverages this vital insight to help enable the legal sector’s collaboration in mitigating global climate and biodiversity risks, assisting Net Zero Lawyers Alliance members with sustainability-related antitrust agreements and concerns concerning the UN Race to Zero, UN Climate Champions, and the Science-Based Targets initiative.

Dolmans provides a leading voice within the firm’s thought leadership output, co-authoring memorandums into topics including the UK CMA’s green agreement guidance and the European Court of Human Rights’ decisions on landmark climate change cases.

Evidencing his leading reputation in the business community, he has co-authored journal articles, including the impact of the KlimaSeniorinnen case for future climate tort litigation, and wrote for the New York University of Law on how antitrust law must not stand in the way of positive climate action. An expert on emerging ESG topics, Dolmans’ speaking posts include a presentation on the business case of climate action for the International Chamber of Commerce’s COP28 summit.

Clyde & Co

Wynne Lawrence

Wynne Lawrence founded Clyde & Co’s climate risk and resilience practice group and coordinates the team’s advice on emerging sustainability risks and corporate ESG requirements. As a longstanding insurance and reinsurance disputes specialist, she is a key advisor to insurers on climate liability risk exposures and leads the firm’s bespoke seminars and workshops, which are aligned with the Bank of England’s Climate Biennial Exploratory Scenario, for clients across the insurance, transport, and resource sectors.

Lawrence plays a key role within the firm’s external sustainability engagement, supporting its involvement with the Net Zero Lawyers’ Alliance and authoring the firm’s series of reports into climate change and biodiversity liability risks.

Reflecting her reputation as a thought leader on the insurance industry’s engagement with climate challenges, Lawrence sits on the International Underwriting Association’s Climate Change and ESG committees.

Clyde & Co

Nigel Brook

Clyde & Co reinsurance team head Nigel Brook is a key partner to the industry in its green transition journey. As co-lead of the firm’s global climate risk & resilience practice, he advises clients on ESG and climate issues including duties of care, liability, and governance.

Brook is also a leading voice within the firm’s thought leadership output, co-authoring insights into topics including environmental due diligence regimes, greenwashing litigation trends, and the potential impact of the KlimaSeniorinnen case regarding states’ obligations to mitigate climate change.

Supporting the business community in engaging with corporate climate advocacy, Brook spoke during the UN Global Compact Network UK’s webinar on stakeholder disclosures, discussing how businesses can best report on climate policy engagement activities in order to meet stakeholder expectations while avoiding legal and reputational risks.

CMS

Laura Houët

Global co-head of the CMS ESG taskforce, Laura Houët is a notable advisor to international fund houses and financial institutions on green investment strategies, sustainability regulation and reporting, and climate transition governance. Helping deeply integrate a green consciousness within its internal operations, she also sits on the firm’s sustainability board committee, which helps pursue and coordinate practical steps toward reducing its carbon footprint.

Houët is a thought leader within the firm on ESG matters, co-authoring insights on topics including how industry bodies interact with ESG ratings regulation, the European Securities and Market Authority’s guidelines on ESG and sustainability-related fund names, and the FCA rules into greenwashing and sustainability disclosure requirements.

Owing to her strong reputation regarding ESG regulatory issues, Houët has spoken at events including the European Public Real Estate Association & FTSE Russell Sustainability Summit on the impact of the net zero transition, providing expert insight into the implications of the SDR. As a key voice in the ESG funds space, she was a judge for the Sustainable Investment Awards 2024.

CMS: Olivia Jamison

With over 20 years of environmental law expertise, Olivia Jamison at CMS is a key contact on UK and EU climate change law and policy, offering focused expertise into GHG emissions reductions, sustainability, biodiversity, and the low-carbon and circular economy. In offering a London and Dublin practice, and by leading the regional team which advises on the European Green Deal, Jamison is a valuable advisor to clients on how UK and EU green regimes interact and impact business practices, investments, and products.

Having initiated its UK and global commitment to the Science Based Targets initiative, Jamison takes up a leading role in managing the firm’s climate commitments by sitting on its global EST steering committee and sustainability committee. Helping ensure the partnership remains cognisant of sustainability best practice, Jamison presented on climate change risk and litigation at the firm’s global partners conference.

Complementing her legal insights into environmental emissions, plastics regulation, and waste reduction as part of the firm’s thought leadership offering, Jamison writes a quarterly legal article on environmental developments for the Chartered Institution of Waste Management.

CMS: Munir Hassan

CMS’ head of energy & climate change Munir Hassan is a specialist advisor on low-carbon and renewable energy projects and transactions, assisting across M&A, financings, project development, regulatory issues, and disputes. He brings familiarity across all technology segments and is particularly active in the offshore and onshore wind, solar, and biomass project segments.

Hassan is a thought leader on legal and policy reforms concerning the UK grid connection process and electricity market operation and was a lead author of the firm’s global guide on the renewable energy market. Helping build internal knowledge on emerging green topics, he spoke at the firm’s global partner summit on the role of AI within the climate crisis.

A highly sought-after advisor on sustainability topics, Hassan co-led the firm’s pro bono legal support for the COP28 summit, assisting the conference to launch partnerships and intergovernmental collaborations on sustainable finance, corporate, IP, and reputational matters. He also facilitated the Energy Leaders’ Roundtable Dinner at COP28, sparking an industry discussion across funding, reskilling, the role of data, and the necessity of consumer engagement in the energy transition.

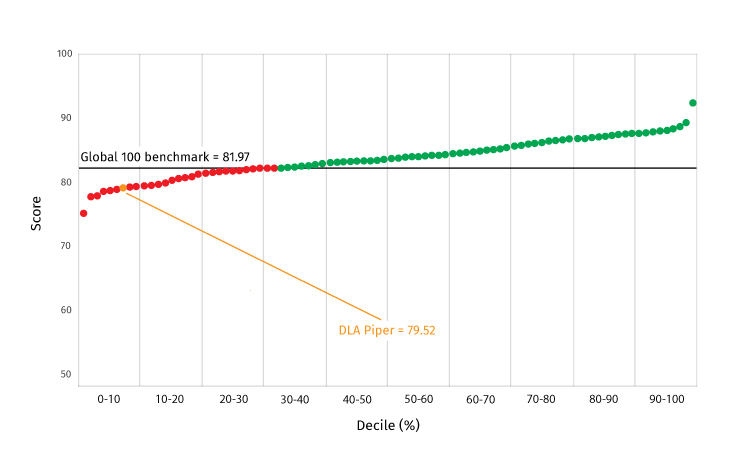

DLA Piper: Natasha Luther-Jones

Renewable energy expert Natasha Luther-Jones is international head of sustainability and ESG at DLA Piper has over 20 years’ experience in assisting domestic and international clients on transactional, development, construction, and operational mandates concerning energy transition projects.

Luther-Jones played a leading role in developing the firm’s international corporate PPA practice, which assists major companies such as H&M in procuring virtual and physical green power to underpin their sustainability objectives. Leveraging this experience, she led on the firm’s own cPPA with NextEnergy, which serves as a key and landmark pillar for its internal decarbonisation journey.

Elsewhere, Luther-Jones plays a key role within the firm’s green energy thought leadership offering, leading its global renewable energy and corporate PPA global guides while also hosting its climate transition podcast.

Attesting to her market-leading reputation on renewable power transactions, Luther-Jones spoke in 2024 on a panel at Solar Finance & investment Europe on realising the potential of the European PPA market, at the Women Powering Smart Energy forum on innovation in PPAs, and on a panel at client Nord/LB’s European Energy seminar on offtake optimisation.

Gowling WLG: Ben Stansfield

With deep experience on project consenting, environmental regulatory, and reporting matters, Gowling WLG’s planning and environmental law expert Ben Stansfield is a leading advisor regarding planning matters for major electricity infrastructure projects which make a marked contribution to the UK’s net zero transition.

Stansfield has built up expertise on ESG matters and demonstrates this through a vast thought leadership offering. Stansfield leads on articles covering topics such as ESG trends and environmental crimes, contributes to webinars which discuss trends including the impact of the UK Biodiversity Net Gain rules, and hosts insightful webinars on topics including the embedding of sustainability considerations within sport.

A regular contributor to industry events which seek to propel sustainability dialogue, Stansfield spoke at the Leisure Property Forum on how investor and customer pressure is pushing the real estate sector to improve its environmental impact, led a roundtable organised by the American Bar Association’s ESG and Sustainability Committee on how businesses can best embed sustainability into their supply chains, and wrote an article for the UK Environmental Law Association on the successes of COP28.

Herbert Smith Freehills: Silke Goldberg

As chair of the global ESG leadership team at Herbert Smith Freehills, Silke Goldberg is a leading advisor to major listed and private companies on transition plans, climate- and nature-related reporting and disclosure, greenwashing risk, and EU sustainability regulation. Goldberg pairs this expertise with over 20 years’ experience on international energy and climate change matters, serving as the firm’s corporate law lead on low-carbon infrastructure and green hydrogen projects.

Goldberg is a key thought leader across the gamut of sustainability matters, offering insights on topics including the European wind power sector, green claims, and the legal and commercial implications of biodiversity due diligence and reporting regimes.

Goldberg also makes a leading contribution to the industry discussion on crucial green issues, co-authoring an analysis of the business and investment implications of the UK Labour government’s plans to achieve a zero-carbon electricity system by 2030. Reflecting her leading reputation across sustainability law matters, she spoke at the COP28 Sustainable Innovation Forum on the role of the carbon market in reaching net zero.

Hogan Lovells: Adrian Walker

Hogan Lovells global board member and corporate and finance specialist Adrian Walker has long-time expertise leading on energy and infrastructure matters, focusing his practice on the delivery of projects which support sustainable businesses and leave a positive social impact. Walker continues this long-term purpose as the firm’s head of ESG and co-lead of the social impact and business integrity groups.

Alongside his longstanding experience in the development and financing of renewable energy projects, Walker takes a leading role in spearheading the firm’s diverse ESG client solutions, including helping launch its ESG Risk Reader, which supports companies in identifying and understanding relevant sustainability risks and building targeted and appropriate mitigation measures.

Walker is a notable thought leader across a diversity of sustainability topics, authoring insights into topics including the ESG requirements of China-based offshore wind supply chains. As a leading voice within the firm, he spoke at its 2023 ESG Game Changers summit, which offered C-Suite and ESG-suite participants insights into how to navigate ESG regulation and sustainability trends in order to drive positive change within their businesses.

Kirkland & Ellis International LLP: Rhys Davies

Rhys Davies, ESG & impact expert at Kirkland & Ellis International LLP, brings over 15 years of experience in advising private equity firms, public companies, and project sponsors on the design and implementation of ESG strategies. Supporting the delivery of vital global climate projects, he brings deep expertise on sustainable finance disclosures, green taxonomies, ESG reporting, climate change, and biodiversity loss.

Davies is a leading contributor to the firm’s thought leadership offering, co-authoring insights on topics including the Financial Conduct Authority’s sustainability disclosure requirements and the impact of the COP28 summit across transition finance, the carbon markets, and public- and private-sector decarbonisation commitments.

With a postgraduate certificate in Sustainable Business from the University of Cambridge and an FSA credential from the Sustainability Accounting Standards Board, Davies provides technical and commercial know-how to support clients’ green transition journeys. He leverages this perspective as a regular contributor to industry discussion, having moderated a panel discussion on climate strategy evolution at the PEI Infrastructure Investor Forum and speaking on global ESG regulation at the Society of Corporate Compliance and Ethics’ ESG and Compliance conference.

Maples Teesdale: Anastasia Klein

Head of ESG at Maples Teesdale LLP Anastasia Klein brings a particular interest in the impact of ESG on the commercial real estate market. She is an expert in ground-breaking green lease matters, assisting in their creation and drafting for major listed and sustainability-focused clients. As well as serving as a member of the British Property Federation’s Green Lease Working Group, Klein also spoke on the importance of environmental and social considerations at the BE News roundtable on the role of green leases within the built environment sector.

As part of her leading commitment to the decarbonisation of the built environment, Klein sits on the BE News ESG editorial advisory board, helping the industry commentator in its mission to build knowledge and best practice concerning sustainability trends. Making a further contribution to supporting the sector in building a greener future, she also spoke at Bisnow’s UK ESG Real Estate conference on how data measuring and effective leadership can best enable companies to achieve their carbon goals.

Mewburn Ellis: Eleanor Maciver

As sustainability champion at Mewburn Ellis, leading patent attorney Eleanor Maciver makes a marked contribution to the firm’s green transition journey, leading its environmental strategy and coordinating staff activity within its sustainability collaboration group. She is a thought leader on best practices surrounding law firms’ decarbonisation journeys, having written insights for the Legal Sustainability Alliance on the internal measures which best enable the delivery of its sustainability ambitions.

In her legal practice, Maciver supports emerging technology players in building their green products, specialising in how IP can be leveraged in the sustainable chemical and material inventions space to help create and scale-up sustainable polymers, nature-based materials, plant-based foods, battery materials, sustainable refrigerants, and carbon capture and storage.

As part of this expertise, Maciver coordinated the firm’s 2023 Green Channel report, which explored key trends and takeaways from the UK’s green IP pathways. As a thought leader in the cleantech and IP spaces, she has authored insights into topics including the European Patent Office’s cleantech commercialisation and financing report and delivered a green IP masterclass for the Royal Society of Chemistry.

Osborne Clarke: James Watson

At Osborne Clarke, James Watson serves as head of decarbonisation, leading an international team in assisting clients across ESG law and net zero strategies to help create a technology-driven, sustainable, and decarbonised economy. Bringing clients over 20 years’ experience in renewable energy transactions, he is a longstanding advisor to investors, funds, banks, and developers on development, transactional, and finance mandates in the renewable energy, battery storage, hydrogen, bio-energy, and cleantech spaces.

Also serving as international co-head of ESG, Watson helps clients shape and implement their ESG strategies, advising on horizon scanning, reporting obligations, and risk management. He complements this by conducting training sessions for legal and business teams on topics including greenwashing and product labelling, sustainability due diligence, and the voluntary carbon markets.

Supporting the firm’s thought leadership output in this space, Watson takes a leading position within the firm’s ESG Knowledge Update series and was a key speaker in its Decarbonisation Week webinar programme, which provided expert overviews concerning sustainable innovation, climate finance, and greenwashing risk.

Osborne Clarke: Hugo Lidbetter

Energy expert Hugo Lidbetter serves as head of sustainable infrastructure at Osborne Clarke, providing key expertise for domestic and international clients on legal and policy issues surrounding the decarbonisation of the energy sector. Lidbetter’s particular expertise is in development, construction, and operation mandates concerning electricity delivery projects and renewable and zero-carbon power generation.

As a key voice in the firm’s thought leadership offering, Lidbetter has co-authored insights into topics including barriers surrounding the UK grid connection process, the impact of the Contracts for Difference regime on the offshore wind sector, and the implications of UK political changes on the attainment of net zero carbon emissions.

Helping further boost sustainability discourse, Lidbetter wrote a LinkedIn Pulse news article on the potential impact of the Great British Energy policy in delivering additional renewable energy and making an effective contribution to the country’s decarbonisation targets.

Osborne Clarke: Matthew Germain

As Osborne Clarke’s environment and sustainability practice head, Matthew Germain advises general counsel, boards, and senior leadership teams on risk, law, and compliance concerning sustainability due diligence, climate change, natural capital, supply chain impacts, waste, and the circular economy.

Germain leads the firm’s internal net zero and sustainability strategy as chair of its executive sustainability steering group. Within the role, and making a leading contribution within the Osborne Clarke for Good initiative, he leads the firm’s efforts to achieve its science-based target and reduce all carbon emissions by 50% by 2030.

Leveraging the experience gained as part of the firm’s ESG service group and as co-lead of net zero policy and regulation, Germain is a key author in the firm’s monthly ESG regulatory outlook, which offers timely insights into issues including Biodiversity Net Gain requirements, CSDD and SFDR regulation, and the FCA guidance on ESG and sustainable investment funds. Supplementing these regular insights, he has co-published articles on topics including the EU CSDDD and how businesses and investors can gain a first-mover advantage in the natural capital space.

As Wynne Lawrence (pictured), who founded Clyde & Co’s climate risk and resilience practice, says: ‘we are growing the first generation of dedicated ESG lawyers in a corporate world that increasingly requires true ESG experience and understanding of business sustainability and its implications.’

As Wynne Lawrence (pictured), who founded Clyde & Co’s climate risk and resilience practice, says: ‘we are growing the first generation of dedicated ESG lawyers in a corporate world that increasingly requires true ESG experience and understanding of business sustainability and its implications.’ For Gummer (pictured), it was a realisation that ‘traditional legal frameworks and firms weren’t just outdated; they were part of the problem.

For Gummer (pictured), it was a realisation that ‘traditional legal frameworks and firms weren’t just outdated; they were part of the problem.  It’s a position that Susan Mac Cormac (pictured), San Francisco-based co-chair of Morrison Foerster’s ESG + Sustainability group, agrees with. She points out: ‘lawyers that focus solely on advising companies and investors on regulation and compliance will not have a positive impact in the long run; in 10 years, we will still be heading for the cliff that is climate change’.

It’s a position that Susan Mac Cormac (pictured), San Francisco-based co-chair of Morrison Foerster’s ESG + Sustainability group, agrees with. She points out: ‘lawyers that focus solely on advising companies and investors on regulation and compliance will not have a positive impact in the long run; in 10 years, we will still be heading for the cliff that is climate change’.