‘I never saw this as impossible’ – Mishcons’ Shaistah Akhtar on the case that won her Commercial Litigation Team of the Year

Mishcon de Reya‘s hard-fought victory for Nigeria in Nigeria v P&ID saw the firm take home Commercial Team of the Year at…

Mishcon de Reya‘s hard-fought victory for Nigeria in Nigeria v P&ID saw the firm take home Commercial Team of the Year at…

On the eve of a general election that looks set to promise a wipeout for the Conservative Party and the…

What made you decide to become a lawyer and why practise family law? I’m naturally a problem solver, and I’ve…

Macfarlanes has today (24 July) posted results that show declines in turnover, profit, and PEP for the past financial year.…

When Legal Business last took a deep dive into the firm’s then ‘unrivalled financial success’ in 2016, the entrepreneurial reputation…

A former Mishcon de Reya partner has accepted a £17,500 penalty for his conduct which contributed to the record £232,500…

In an unflattering revelation ahead of its planned IPO, Mishcon de Reya yesterday (5 January) received the highest-ever financial penalty…

After reviewing the evidence for dozens of candidates, we are delighted to reveal our Lawyer of the Year for the…

Herbert Smith Freehills (HSF) has ensured victory for the Financial Conduct Authority (FCA) in a landmark test case intended to…

Mishcon de Reya has become the latest firm in the LB100 to resist the economic onslaught of Covid-19 in its…

Greenberg Traurig has hired a pair of disputes partners from Mishcon de Reya, in an uncommon departure for the litigation…

Mishcon de Reya has called it quits in Manhattan after ten years as the firm’s three remaining partners jumped ship…

US & City firms saw a steady influx of lateral hires across sectors as Latham & Watkins, Allen & Overy…

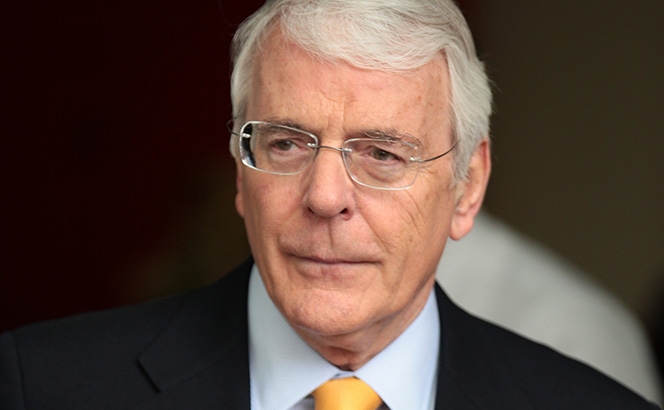

Sir John Major (pictured) has instructed litigation heavyweight Herbert Smith Freehills (HSF) as the former Prime Minister looks to join investment…

Mishcon de Reya has maintained steady revenue growth in its 2018/19 financial results, increasing its top line by 10% to £177.8m,…

Mishcon de Reya is considering options for raising capital in a bid to fund its ‘ambitious plans’ for growth, including…

City firms welcomed a host of new partners over Easter, with Quinn Emanuel Urquhart & Sullivan, Ropes & Gray and Mishcon…

Allen & Overy (A&O) client Pfizer has lost a landmark Supreme Court battle against a host of manufacturers, leaving it vulnerable…

In what has been a strong reporting year already for a number of mid-market pacesetters, it is perhaps surprising to…

In a quiet east London street off the bustling Brick Lane, a few doors from a sign tagged ‘Vegan Hair…