The Top 100 firms ranked by highest top of equity.

Ireland – Céad míle fáilte

Shanghai’s location at the estuary of the Yangtze River attracts rainfall for a third of the year. Lawyers from the region will feel at home in Ireland then, a country not renowned for its weather. Earlier this year, law firm A&L Goodbody officially launched its pioneering Chinese Lawyer Exchange Programme, signing agreements with 15 Chinese law firms and universities, such as Beijing’s King & Wood Mallesons and Shanghai’s East China University of Political Science and Law. The programme will provide six-month placements at the firm’s Dublin office as well as in-house experience with clients such as Pfizer, Bank of Ireland and Telefónica O2. Such is the initiative that Irish Prime Minister Enda Kenny applauded the firm for its ‘enterprise’ and ‘courage’.

The purpose of the project is to promote inbound and outbound investment between the two countries. Foreign direct investment (FDI) into Ireland has long been a bright spot for the Irish economy, with headline multinationals such as Microsoft and Google choosing Ireland to base their European operations during the 1990s. More recently, however, there has been a surge in momentum. Continue reading “Ireland – Céad míle fáilte”

Ireland – Court Appeal

Asked whether the Irish legal market is awash with contentious work, one leading litigator sighs deeply and quips: ‘Well, the country is certainly full of contention.’ Every dip in any economic cycle brings a raft of litigious work, but the spectacular collapse of Ireland’s banking and property sectors following the global credit crisis has brought unprecedented large-scale litigation, restructuring and administration (termed examinership in Ireland).

‘We are busier than we’ve ever been,’ confirms Liam Kennedy, head of dispute resolution at A&L Goodbody. ‘The first half of last year was all crisis litigation, but since then we’ve had a lot of big-ticket work, such as high-level restructuring, insolvency, regulatory and international asset tracing litigation.’ Continue reading “Ireland – Court Appeal”

Malta – Island Haven

Despite the ongoing European crisis, Malta has proved to be one of the best performers in the eurozone. LB asks Malta’s leading firms what is so special about this Mediterranean island.

Although Malta has shown resilience during the global downturn, it has not been bypassed completely. M&A volume has reduced and the island’s banking sector is more cautious than ever about credit exposure. Nonetheless, Malta’s own slowdown has been relatively painless when compared to other European jurisdictions. The island is fiscally conservative and its level of state debt is fairly low, with most of it held locally. Consumer debt is also low.

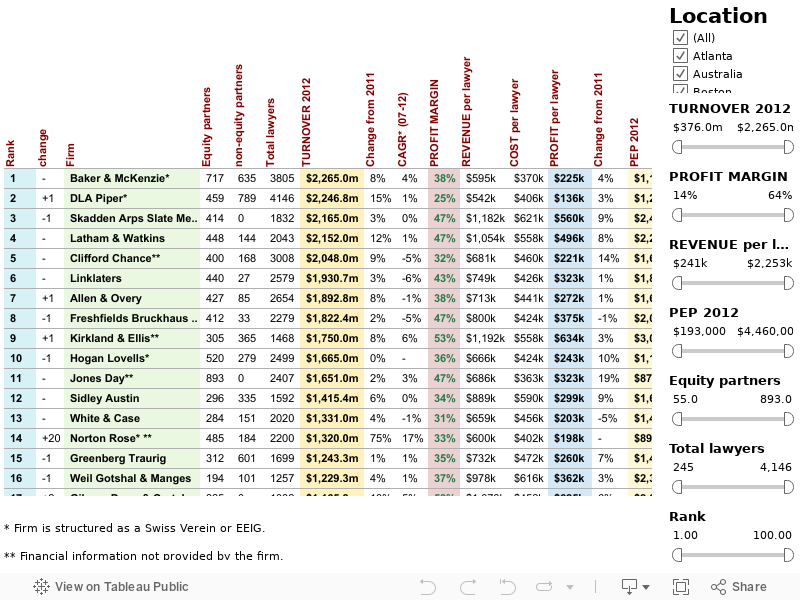

Global 100 2012: Interactive main table

THE GLOBAL 100: Legal Business examines the key financial data from the world’s top 100 law firms.

Wealth management – Filling big shoes

The global diversification of wealth continues to drive the efforts of law firms’ private client teams as the world’s population of affluent individuals continues to climb. LB tracks the latest developments.

The international private client teams at major law firms are thriving. The practice area, for decades regarded as the black sheep of the family, has now been warmly accepted into the fold. In some cases private client has become more than a much-loved practice area.

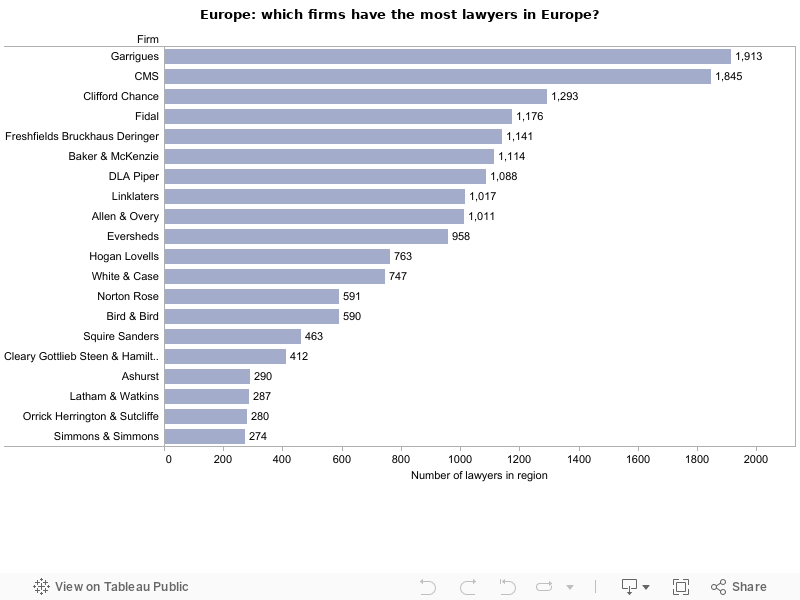

Global 100 – Global Elite – Hollow victory

The Global Elite continues to dominate the international legal market. But with ailing global markets and little to no M&A, not every firm has much to celebrate

Europe is in crisis, the UK has hit a double dip recession and US markets continue to fluctuate. Likewise the debt markets are closed, M&A sits on ice and big-ticket litigation is few and far between. But the Global Elite retains its dominant position. The world’s behemoths remain relatively unscathed by the knock-on effect of ailing global economic and financial markets.

Continue reading “Global 100 – Global Elite – Hollow victory”

Global 100 – Dewey & LeBoeuf – Lessons from a downfall

Dewey & LeBoeuf went from 26th in last year’s Global 100 to filing for bankruptcy in May this year. What can the Global 100 learn from the firm’s demise?

Finley, Kumble, Wagner, Underberg, Manley, Myerson & Casey; Brobeck, Phleger & Harrison; Heller Ehrman; and Howrey, the US legal market has quite a track record when it comes to large law firm failures.

Continue reading “Global 100 – Dewey & LeBoeuf – Lessons from a downfall”

The changing face of the profession

Long live the Verein. The overwhelming majority of firms in this year’s Global 100 report are still single-partnerships, but with seven of the top 100 firms in the world now comprising multiple partnerships, it’s clear that the mantra of ‘one partnership, one firm’ is being challenged.

Tough decisions needed for LG/FFW

Ahead of our LB100 report next month, one merger is on the table that requires some hard choices now to be a future success.

Lawrence Graham (LG) has confirmed it is ‘evaluating a merger’ with City rival Field Fisher Waterhouse (FFW). The deal would put the new firm comfortably in the top 25 of the LB100 with an expected turnover of over £150m. Continue reading “Tough decisions needed for LG/FFW”

The reality gap and the Global 100

There is a curious phenomenon that affects both the NHS and, now it seems, the legal sector. The reality gap. Ask a patient treated in hospital for a broken leg what their experience of the doctors and hospital was, and in the main it will be positive. But ask the same person what they think of the NHS on the whole, and usually they will say that the whole system is going to the dogs.

Magic Circle sees revenues up after muted financial year

Turnover at Magic Circle firms rose by a modest 2.6% this year, with the UK’s five Global Elite firms pulling in over £5.2bn of fees and £4.2bn worth of profit in the 2011/12 financial year.

As the UK’s financial reporting season kicks off, Allen & Overy emerges as one of the top performers after another strong year that saw turnover climb by 5% to reach £1.18bn, up from £1.12bn in 2010/11. The firm is one of the best performing in the group over the past five years, growing revenues by an average of 3% each year since 2008. Much of that can be attributed to the firm’s network in emerging markets, with around 15% of A&O’s lawyers now based in Asia.

Continue reading “Magic Circle sees revenues up after muted financial year”

Creditors draw battle lines over Dewey & LeBoeuf assets

An intense and long-running battle is set to begin over the assets of Dewey & LeBoeuf which, as many observers had long predicted, filed for Chapter 11 bankruptcy protection in the US Bankruptcy Court in Manhattan on 28 May.

The filing sets the stage for a struggle between creditors that experts predict could run for years in a process that one observer likened to ‘bear-baiting’.

Continue reading “Creditors draw battle lines over Dewey & LeBoeuf assets”

Scottish fire sale continues as DWF snaps up Biggart Baillie

Merger fever continues to grip the Scottish legal market after veteran firm Biggart Baillie announced in June that it would be joining forces with ambitious Major UK firm DWF on 1 July.

The merger between Biggart Baillie, a Scottish blueblood which can trace its origins back to 1894, and LB’s 2011 National/Regional firm of the Year DWF, is the fifth Anglo-Scottish union since the start of the year. It follows a joint venture between DAC Beachcroft and Andersons, which was announced in March; the acquisition of niche Scottish practice Anderson Fyfe by TLT, which takes effect in July; the announcement in June that Shoosmiths would acquire Archibald Campbell & Harley; and the high-profile merger of Pinsent Masons and McGrigors, which went live on 1 May.

Continue reading “Scottish fire sale continues as DWF snaps up Biggart Baillie”

Emerging market specialist Salans dealt a blow by Asia exits

Salans has been left with no partners in China after Shanghai office managing partner Bernd-Uwe Stucken and corporate partner Wei Liu left to join Pinsent Masons in June.

Continue reading “Emerging market specialist Salans dealt a blow by Asia exits”

Shakespeares and Harvey Ingram announce merger

Acquisitive Birmingham firm Shakespeares has continued its explosive growth of the last few years by announcing that it is set to combine with Leicester-based stalwart Harvey Ingram on 1 August 2012.

At press time both firms were expected to vote overwhelmingly in favour of a union in a partners’ ballot at each firm at the end of June, according to Shakespeares’ commercial director Hamish Munro.

Continue reading “Shakespeares and Harvey Ingram announce merger”

Ashurst pushes ahead with Beijing and Seoul launches

Ashurst is preparing to move into Seoul and is applying for a licence to practise in Beijing, as the firm looks to leverage off its recent tie-up with Australian firm Blake Dawson to bulk up in Asia.

Geoffrey Green, managing partner of Ashurst Asia, said it was vital to grow the firm’s Asian presence. ‘Ashurst has been relatively lightly represented in Asia. Compared to our competitors we are pretty underweight in Asia and given the fact the world is moving further east, that’s where the growth opportunities are,’ he said.

Continue reading “Ashurst pushes ahead with Beijing and Seoul launches”

Power brokers

As all eyes turn to energy as the safe hedge in a turbulent market, there is no doubt that the sector’s general counsel are in an excellent bargaining position

In terms of legal spend, an energy company is a particularly lucrative client. To begin with, the acquisitive nature of these cash-rich corporates means that transactional advice is clearly a must. Also, as the recent BP oil spill all too effectively demonstrated, the high-risk nature of the industry provides a fair flow of environmental and litigation instructions too.

Global 100 – Podium Standings

The world’s 100 largest law firms have faced another challenging year of depressed economic markets and little to no transactional work. So how have they fared? LB finds out

The combined revenues of the 100 biggest law firms in the world reached new heights this year. Setting a five-year Global 100 record, combined turnover came to over $81bn, greater than the Olympian levels the market reached in the boom year of 2007. In broad strokes it has been another year of single digit rises in revenues, profits and lawyer numbers. But with inflation running at around 3% in the UK and the US, performance in real terms has been more muted than those top-line figures suggest. The past financial year was essentially a flat market, a solid performance but nothing to set the world alight.

Global 100 – The state of the union

After a series of shocks to the global economy, followed by Dewey & LeBoeuf’s downfall, there’s plenty of concern for US firms

American managing partners have become accustomed to false dawns and 2011 had a depressingly familiar feel to it. The start of the year was promising, with counter-cyclical workflows in litigation and bankruptcy joined by an uptick in corporate deal activity, but this came to a familiar halt over the summer. The continuing crisis in the eurozone and uncertainty over America’s debt ceiling undermined any hope that the activity through the first half of the year would continue for the second six months.