Followers of the tussle between UK and US private equity practices for European mandates were last month rewarded with an instruction to both camps by leading buyout house CVC Capital Partners in its acquisitions of Domestic & General (D&G) and Campbell Soup.

Advent International agreed to sell extended warranty provider D&G to CVC in a deal thought to be worth about $1.2bn, according to The New York Times, although this sum has not been officially disclosed.

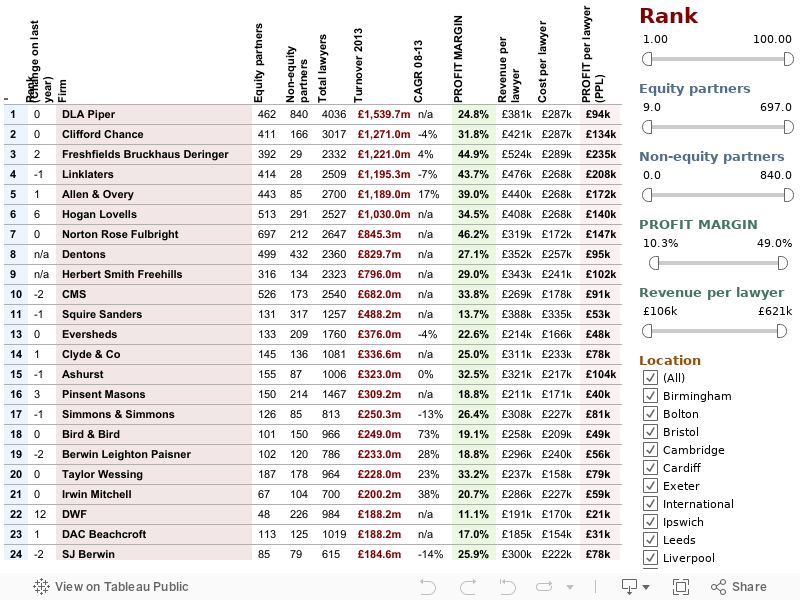

Clifford Chance (CC) advised CVC, with a team led by Kem Ihenacho, co-head of the firm’s Africa practice and one of its private equity stars. He was assisted by M&A partner Brendan Moylan and insurance partner Hilary Evenett.

Continue reading “Private equity: CVC gifts Clifford Chance and Cleary with two major European mandates”