Lawyer count passes 60,000 but profits fall at top UK firms

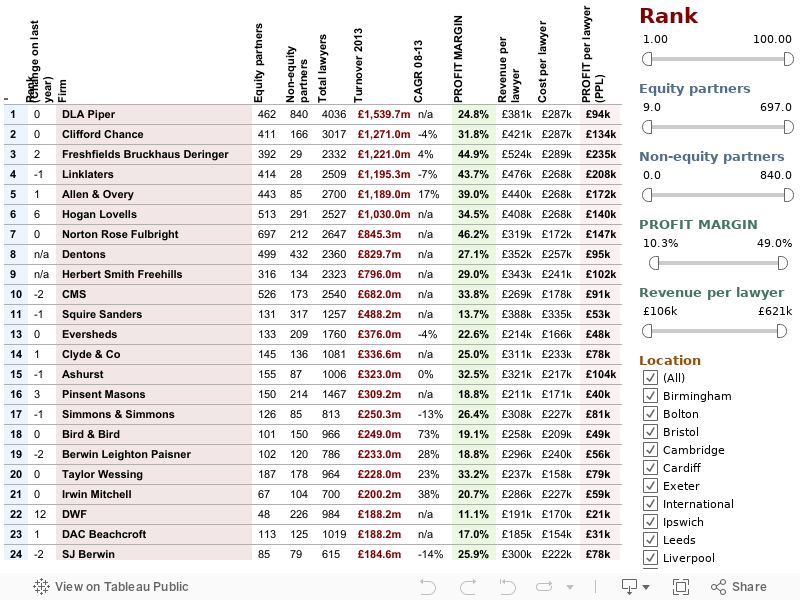

The latest Legal Business 100 results show the total revenue of the UK’s top 100 law firms has topped £19bn for the first time, while the number of lawyers across those firms has passed the 60,000 mark, also a first. However, this top-line growth is largely the result of another year of fervent merger activity, masking the fact that on a granular level many firms are struggling to achieve revenue and profit growth.

Total revenue for the LB100 for 2012/13 is £19.1bn, an increase of 8%, while total lawyer headcount swelled 10% to 61,299. However, average revenue per lawyer (RPL) is down 2% to £312,000, while profit per lawyer (PPL) and profits per equity partner (PEP) are down 2% and 4% to £95,000 and £622,000 respectively.

The primary cause for this year’s drop in RPL and PPL is the swathe of mergers over the past year, particularly among firms in the top 25.

Continue reading “Merger frenzy hikes LB100 income but growth masks another tough year”