Access your pdf edition of LB magazine – issue 318

We are providing more options for you to access your copy of Legal Business. Please see below for links to a limited version followed by a complete version. The complete version is only accessible to subscribers. Please make sure you are logged into the site to see the link.

Limited version Continue reading “Access your pdf edition of LB magazine – issue 318”

‘A fast-evolving phenomenon’: City partners on how GCs can get ahead of the ESG curve

‘ESG is a huge opportunity for lawyers, including in-house counsel, to play a different and more strategic role, and be really plugged into the business. But that is also big change and change can be quite difficult,’ asserts Rachel Barrett, environment and climate change partner at Linklaters. Continue reading “‘A fast-evolving phenomenon’: City partners on how GCs can get ahead of the ESG curve”

Building blocks – real estate lawyers on the property market’s foundations for growth

‘The mood of the commercial real estate market in 2023 was cautious – many investors were in pause mode. However, people seem to be more optimistic about 2024.’ Continue reading “Building blocks – real estate lawyers on the property market’s foundations for growth”

Sustainable real estate: unlocking the opportunity for greener and more profitable real estate in Indonesia

The real estate sector contributes to nearly 40% of the global carbon dioxide emissions and approximately 70% of those emissions are a result of building operations and the remaining comes from building constructions.

Seismic changes

At the advent of 2024, in-house lawyers and general counsel are cautiously observing the ramifications of Nick Ephgrave’s new leadership at the UK Serious Fraud Office with bated breath. The organisation has faced intense scrutiny in recent years due to unsuccessful prosecutions and overall inactivity. Yet, with the appointment of the former senior Metropolitan Police chief, new challenges are expected to emerge for corporations and their in-house teams from a rejuvenated enforcement authority. Continue reading “Seismic changes”

Revolving Doors: A&O bolsters City structured finance team with Milbank hires

Leading this week’s high-profile moves, Allen & Overy has appointed John Goldfinch as a partner in its global structured finance practice in advance of its planned merger with Shearman & Sterling. Previously at Milbank, Goldfinch has experience dealing with derivative products and securitisation asset classes including CLOs and CDOs (cash and synthetic), lease receivables, trade receivables, equity, credit rates, NPLs, covered bond transactions and secured structured lending.

Goldfinch brings with him a team of four senior associates from Milbank: Adrian Kwok, Peter West, Eleanor Cripps and Alexandra Wells. A&O has highlighted private capital as a key strategic focus for the firm, with its private capital revenue growing by over 60% over the past two years. Continue reading “Revolving Doors: A&O bolsters City structured finance team with Milbank hires”

Changing of the guard: DLA Piper elects next managing partner

DLA Piper has today (23 February) announced the election of Charles Severs as its next managing partner. His tenure will begin on 1 January 2025.

Severs moved to DLA Piper as a partner in 2003 from Herbert Smith Freehills. A Legal 500 Hall of Famer for M&A: Lower Mid-Market Deals, Severs has an impressive client book including John Menzies, Symphony Technology, Science Group, Elekta, Hexcel, Puretech and Keller Group. Continue reading “Changing of the guard: DLA Piper elects next managing partner”

‘Clients want to come to the best’: Quinn Emanuel breaks $2bn barrier with 26% revenue jump

Quinn Emanuel today announced its firmwide financial results for calendar year 2023, with the litigation powerhouse joining an elite band of firms to notch revenue over $2bn, with a 26% jump taking it from $1.65bn last year to $2.08bn.

The firm also broke $1bn in profit, which reached $1.35bn. Revenue per lawyer was up nearly 16% from $1.61m to $1.86m, despite an increase in total headcount of 108, to 1,120. The results are even more impressive on PEP, which rose 39% from $5.23m to $7.29m – higher than any firm in last year’s Global 100 apart from first-place Kirkland & Ells ($7.52m) and second-place Wachtell ($7.29m). Continue reading “‘Clients want to come to the best’: Quinn Emanuel breaks $2bn barrier with 26% revenue jump”

Dealwatch: US firms lead on household names The Body Shop and Yodel as restructuring returns

The long-dormant restructuring market has had a shot in the arm recently, with the City teams of US stalwarts winning lead mandates on the administration of The Body Shop and a rescue deal of Yodel.

Jones Day and White & Case are handling the administration of cosmetic group The Body Shop, while Dechert and Weil advised parcel delivery business Yodel to secure a rescue deal backed by one of its rivals. Continue reading “Dealwatch: US firms lead on household names The Body Shop and Yodel as restructuring returns”

Resistance is agile – Euro Elite firms adapt to survive amid global turbulence

Last year, our annual Euro Elite survey of 100 leading independent firms across more than 40 jurisdictions found partners in a positive mindset but nervous about the potentially bleak outlook for 2023. Those fears had some foundation.

Key market players – both new and old – said that the continent’s law firms would be remiss to forget that geopolitical conflict, the energy market crisis, the tightening of monetary policy and economic contraction loomed around the corner. The subsequent belt-tightening and inertia in the European deals market over the past 12 months has shown this has come to pass. Firms generally are quieter in terms of major corporate mandates and have a larger headcount than the boom year of 2021. This has inevitably taken its toll. Continue reading “Resistance is agile – Euro Elite firms adapt to survive amid global turbulence”

Breaking barriers: Garrigues tops €450m revenue in milestone for Euro Elite firms

Spanish leader Garrigues has continued its pacesetting reputation among the Euro Elite firms by becoming the first in the group to break the €450m turnover barrier.

The results, announced on Tuesday (20 February) continue a decade-long purple patch for the firm, with a 2.5% revenue increase on last year to €454.3m marking a banner year. Continue reading “Breaking barriers: Garrigues tops €450m revenue in milestone for Euro Elite firms”

Legal Business Global London survey – submissions close soon

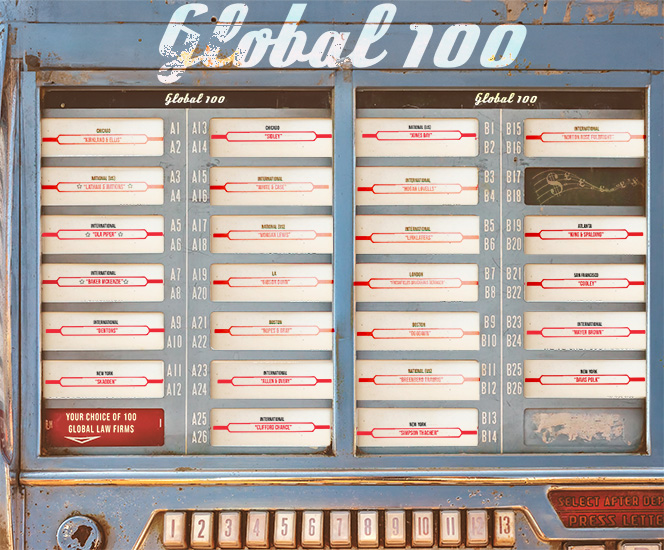

The Global London survey window will be closing on Friday 1 March. We invite all participating firms to complete the survey.

Global London is an annual report on the performance of US and international firms in London, which appears in the March/April issue of Legal Business. Continue reading “Legal Business Global London survey – submissions close soon”

Financial Regulatory and Disputes Summit: Stranger than fiction

Even amid a stellar agenda at Legal Business’ Financial Regulatory and Disputes Summit 2023 last November, CMS’ session – Shams and charades: Lessons learned from abusive litigation against banks – made shockwaves around the auditorium of the Queen Elizabeth II Centre in London’s Westminster.

Indeed, it’s not often that a panel discussion elicits gasps of astonishment from delegates, but that’s exactly what happened when CMS’ finance disputes partners Tom Dane and Vanessa Whitman (pictured) sat down with Neil Kitchener KC of One Essex Court to discuss their experience representing Allied Irish Banks in the curious case of Kallakis v AIB. Continue reading “Financial Regulatory and Disputes Summit: Stranger than fiction”

Paul Hastings scores double win from Latham after recent London losses

Paul Hastings has hired litigation and trial partners Oliver Browne and Stuart Alford KC from Latham & Watkins, just days after it lost structured finance partner Blake Jones to Clifford Chance. Paul Hastings confirmed the moves today (16 February).

Browne leaves Latham after 18 years, having most recently served as the London co-chair of the litigation and trial department. He advises on cross-border disputes, both in court and arbitration, spanning various sectors and involving high-net-worth individuals. Continue reading “Paul Hastings scores double win from Latham after recent London losses”

‘Bolder, pragmatic, more proactive’: Regulators bare teeth, but will they bite?

2024 started with uncharacteristically decisive action from the Solicitors Disciplinary Tribunal (SDT), when in January it issued its joint highest-ever fine against Clyde & Co, following a slew of anti-money laundering breaches. It was a bold move from the regulator, which in recent months has drawn criticism over its perceived lack of action during the collapse of Axiom Ince.

As the fallout from Axiom Ince continues, both the Solicitors Regulation Authority (SRA) and the Legal Service Board (LSB) have announced reviews into the handling of Axiom Ince in the run up to the SRA’s intervention. Both regulators have highlighted the need to centre consumer protection in their regulatory approach, as the scandal threatens to derail confidence in the profession. Continue reading “‘Bolder, pragmatic, more proactive’: Regulators bare teeth, but will they bite?”

Revolving Doors: Fried Frank expands London team with Goodwin trio as Orrick faces global losses

Leading the high-profile moves this week, Fried Frank has strengthened its London private equity practice with a triple hire from Goodwin. Christian Iwasko , Michelle Tong, and Priya Rupal have departed from Goodwin after a three-year stint, and bring with them experience at Sidley and Kirkland & Ellis.

Elsewhere in the City, Clifford Chance has bolstered its finance team with the addition of Blake Jones from Paul Hastings. Jones departs from Paul Hastings after five years, bringing extensive expertise in structured finance, having previously worked at Linklaters earlier in his career. Continue reading “Revolving Doors: Fried Frank expands London team with Goodwin trio as Orrick faces global losses”

‘Firing on all cylinders’: Akin sees double-digit growth in revenue and PEP

In keeping with Hogan Lovells’ recently released financial results, Akin has reported strong financials for 2023, contradicting fears of diminished returns for the global elite.

Revenue at the firm is up 11% to $1.37bn from $1.23bn, while profit per equity partner (PEP) has jumped 22% to $3.15m from $2.58m. This follows a sluggish 2022 for the firm, which saw global revenue grow by only 1% and PEP drop by 17%.

The firm highlighted its financial restructuring, private credit, traditional energy, energy transition, international trade and litigation practices as particularly high performers over the last financial year. Continue reading “‘Firing on all cylinders’: Akin sees double-digit growth in revenue and PEP”

Simpson Thacher unveils new London head as office posts double-digit revenue growth

Simpson Thacher has announced that Wheatly MacNamara will take over from Jason Glover as London managing partner in October. Glover, who has led the office since 2016, will remain at the firm in a strategic role. The news comes as the City office recorded a 23% rise in revenue for 2023.

MacNamara (pictured), whose practice focuses on real estate acquisitions, dispositions and joint ventures, joined the firm in 2005 and has been a partner since 2016. Her client book includes Blackstone, KKR, KSL, Apollo and Northwood. Continue reading “Simpson Thacher unveils new London head as office posts double-digit revenue growth”

‘It’s a differentiating year’: Hogan Lovells sees double-digit growth in revenue and PEP

As financial reporting season kicks off in earnest, Hogan Lovells has today (13 February) reported a 10% boost in global revenue to $2.68bn as profit per equity partner (PEP) jumped 20% to $2.74m.

This performance represents a $250m increase in the firm’s top line, contrasting with a $174m decline last year. After a 7% drop in revenue and an 8% decrease in PEP in 2022/23, this year’s double-digit growth strikes an optimistic tone for other Global 100 players. Continue reading “‘It’s a differentiating year’: Hogan Lovells sees double-digit growth in revenue and PEP”