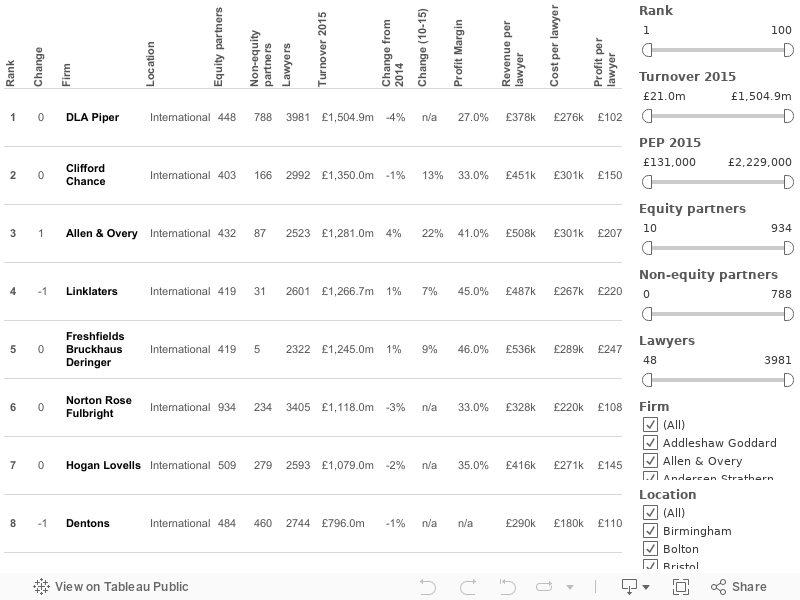

Continue reading “Legal Business 100 2015: Interactive main table”

LB100 2015: Partner Earnings

LB100 2015: Behind the numbers – profitability revealed

LB100 2015: Core Stats

LB100: The Second Quartile – The first shall be last…

The City’s mid-tiers defied the critics to achieve market-leading pace through 2015, cementing the gains of recent years. How big an upset can the tortoises deliver?

There are a few simple ideas that define the pecking order in the UK legal industry. The big boys are international, materially larger than the tiers below and two to three times as profitable as their mid-pack cousins.

Continue reading “LB100: The Second Quartile – The first shall be last…”

LB100: The Second 50 – More or less

Specialist practices and focused City firms in the second 50 thrived in what remained an uncertain market.

The second 50 is a hard place for any law firm without a strong claim on their chosen patch. Overall this section of the market saw a flat year despite the support of a relatively upbeat domestic economy and surging property market.

LB100: The Second 50 – The Lion & the Unicorn

Regional firms are experiencing mixed fortunes. Can they take advantage of a less London-focused client base?

Regional and national firms dominate the second half of the Legal Business 100 (LB100), but typically they do not enjoy the same success as the London-based firms that also occupy the lower end of the table. This year, 32 firms ranked 51-100 are regional or national law firms based outside London, totalling £1.2bn in revenue from 6,308 fee-earners.

Continue reading “LB100: The Second 50 – The Lion & the Unicorn”

LB100 2015: Methodology and notes

LB100 LAW FIRMS

The firms that appear in the Legal Business 100 (LB100) are the top 100 firms in the UK, ranked by gross fee income generated over the financial year 2014/15 – usually 1 May 2014 to 30 April 2015. We call these the 2015 results. Where firms have identical fee incomes, the firms are ranked alphabetically.

SOURCES

An overwhelming majority of firms that appear in the LB100 co-operate fully with its compilation (see ‘Transparency’, right) by providing our reporters with the required information. A limited number of firms choose not to co-operate officially with our data collection process and in these circumstances we rely on figures given to us by trusted but anonymous sources. Continue reading “LB100 2015: Methodology and notes”

The LB 100 2015 – Through the looking glass

Life during law: Peter Crossley, Squire Patton Boggs

I started life in South Africa mainly doing crime and divorce. Knowing something about criminal law, and the cut and thrust of the courtroom, is a good base for anybody who wants to do litigation.

I wanted to go to the Bar but my father was a bank manager in South Africa with a lot of barrister customers who weren’t doing very well so he basically said: ‘You’ll never make it so become a solicitor.’ Both my parents were English, my father was at Dunkirk and was badly wounded and captured so he emigrated to South Africa for health reasons. He was always a pretty strong character and was the sort of man who you couldn’t ignore!

Continue reading “Life during law: Peter Crossley, Squire Patton Boggs”

Keeping up with the Joneses – will A&O’s pay overhaul keep top talent?

Sarah Downey looks at the £20k pay boost and whether the market will follow suit

Allen & Overy (A&O)’s decision to award lucrative associate salaries similar to some US firms in July, as part of a wider overhaul of how it rewards junior lawyers, has sparked renewed debate in the City about how best to retain top talent.

Continue reading “Keeping up with the Joneses – will A&O’s pay overhaul keep top talent?”

The Finance View: Bigger, simpler, cheaper? How to position the modern securitisation counsel

Michael West assesses the impact of the ongoing rehabilitation of structured finance

Securitisation lawyers have been hard pressed since the financial crisis, diversifying their practices and often even ditching the S word. However, relief has been increasingly at hand in the last two years as the thinking of regulators and policy-makers has swung from seeing the financing tool as a cause of the banking crisis to key for getting more investment into the economy. Highlighting this shift at a speech to the Global ABS 2015 conference in Barcelona in June, the Bank of England’s executive director of prudential policy David Rule gave public backing to proposals to create EU-wide criteria for simple, standard and transparent (SST) products, a move he said would ‘play an essential role in de-stigmatising European securitisation, helping the market to develop on a sustainable track and attracting a broader investor base’.

A&O and Freshfields win work on Bwin’s bidding battle

888 looks set to strike £900m deal

Deal lawyers took little respite over the summer as the traditional lull failed to materialise. One deal that kept teams at Magic Circle duo Allen & Overy (A&O) and Freshfields Bruckhaus Deringer busy was the bidding battle between 888 and GVC Holdings for online gambling company Bwin.Party Digital Entertainment.

Continue reading “A&O and Freshfields win work on Bwin’s bidding battle”

Host of Global 100 firms advise on Coke bottler’s $31bn three-way merger

Over ten firms were involved in the complex cross-border merger that saw three of The Coca-Cola Company’s bottlers unite to create the world’s largest independent bottler for the soft drink maker.

Combining the operations of Coca-Cola Enterprises (CCE), Coca-Cola Iberian Partners (CCIP) and Coca-Cola Erfrischungsgetränke (CCEAG), Coca-Cola European Partners will be headquartered in London and serve over 300 million consumers across 13 countries. The new company is expected to have net revenues of $12.6bn and a value of around $31bn.

Continue reading “Host of Global 100 firms advise on Coke bottler’s $31bn three-way merger”

Deal watch: Corporate activity in July and August 2015

PEARSON TURNS TO FRESHFIELDS ON SUMMER FT AND ECONOMIST SELL-OFF

Freshfields Bruckhaus Deringer advised Pearson twice over the summer. The publisher sold the Financial Times to Skadden, Arps, Slate, Meagher & Flom client Nikkei and split its 50% stake in The Economist Group between Macfarlanes client and co-shareholder Exor, while Linklaters acted for The Economist.

Continue reading “Deal watch: Corporate activity in July and August 2015”

DLA splits from SA alliance firm Cliffe Dekker over integration and branding issues

Last month saw DLA Piper and South African firm Cliffe Dekker Hofmeyr end their ten-year formal alliance over integration and branding issues, with the international firm making plans to open a greenfield site in Johannesburg to preserve a presence in the market.

DLA wanted Cliffe Dekker, which carries the DLA branding, to become more closely integrated with the firm. However, the majority of the partnership at Cliffe Dekker felt they would lose too much independence and freedom to operate as a result. At the time the duo said they would continue to maintain a relationship to support existing client relationships and refer clients where appropriate.

Greenberg makes a splash in Europe after two mass summer hires in Berlin and Warsaw

Greenberg Traurig has made a concerted push into Europe this summer. Having recruited a 12-lawyer real estate team in May from Allen & Overy and Norton Rose Fulbright in Poland, including both firms’ former local real estate heads, in July Greenberg acquired Olswang’s entire Berlin office, comprising a 14-partner team, to launch its first German outpost.

Greenberg’s German base will open its doors on 1 October 2015, as the firm’s fourth European office after London, Amsterdam and Warsaw. The group hire included taking Olswang’s managing partner in Germany, Christian Schede, who will serve as the German managing shareholder for Greenberg, as well as a team that Olswang has been building since it first set up shop in Berlin in 2007. It had hired from Magic Circle firms Linklaters and Freshfields Bruckhaus Deringer to build a practice that was ranked second tier for real estate in The Legal 500.

The wellness crisis for in-house counsel – you must sort it out

Paul Gilbert argues that general counsel’s failure to act as a team has heaped a rising burden on stressed in-house lawyers

As a consultant spending most of my professional time working with general counsel (GCs), so concerned have I become at the pressures and strain on the mental health of in-house counsel, that this summer I authored a report on what I see as the crisis in well-being in-house. In this article I won’t repeat those concerns – nor dwell on how poorly I believe some GCs are addressing the issue – but I will try to identify the root causes of the problems I have found and some simple steps to rectify them.

Continue reading “The wellness crisis for in-house counsel – you must sort it out”

Case study: Allen & Overy

Amid a challenging year for London’s top firms, Allen & Overy (A&O) managed to hit its stride with revenue growth of 4% to £1.28bn, while profits per equity partner (PEP) came in at £1.21m, a rise of 8%.

The result was significantly ahead of A&O’s London peers, which have also seen their sterling results impacted by weakness in the euro and the inroads of US law firms in City deal work (in constant currency, A&O estimates its revenue growth at 8%). Continue reading “Case study: Allen & Overy”

Case Study: Simmons & Simmons

Life for a financial services-heavy law firm competing with larger rivals was always going to be challenging after the banking crisis, but Simmons & Simmons suffered more than most as it wrestled with abortive merger talks, plunging turnover and strategic discord.

This makes its revival in the last two years all the more welcome. Following a torrid 2012/13, with memories still fresh from its divisive merger bid with Mayer Brown, the firm was left with revenues £40m below its boom-time peak in 2008 but its previous high has finally been passed with an 8% rise in revenues this year and profits per equity partner (PEP) up 17% to £649,000, making its performance one of the strongest in the UK top 25 this year and by far the best by a ‘chasing pack’ firm. Continue reading “Case Study: Simmons & Simmons”