LB100 LAW FIRMS

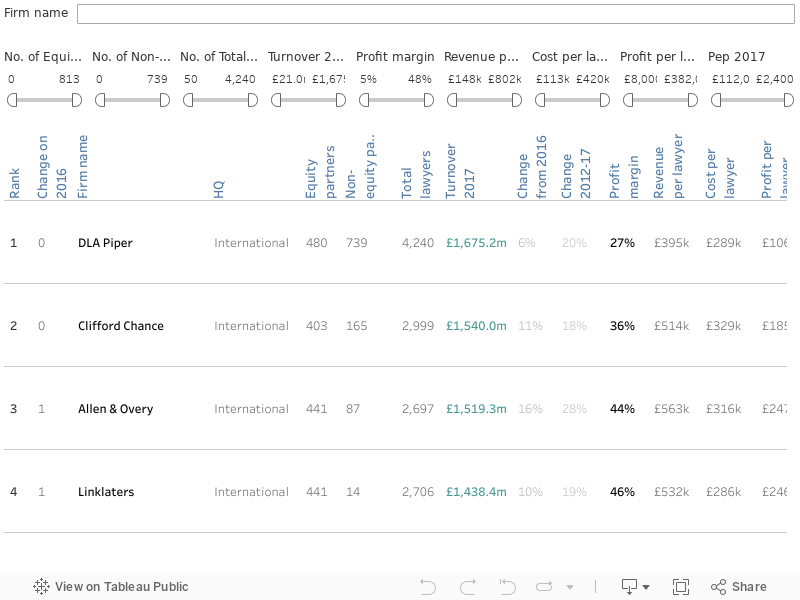

The firms that appear in the Legal Business 100 (LB100) are the top 100 law firms in the UK (usually LLP partnerships), ranked by gross fee income generated over the financial year 2016/17 – usually 1 May 2016 to 30 April 2017. We call these the 2017 results. Where firms have identical fee incomes, the firms are ranked according to highest profit per equity partner (PEP).

SOURCES

An overwhelming majority of firms that appear in the LB100 co-operate fully with its compilation (see ‘Transparency’) by providing our reporters with the required information. A limited number of firms choose not to co-operate officially with our data collection process and in these circumstances we rely on figures given to us by trusted but anonymous sources.

LAW FIRM STRUCTURES

We recognise that, as firms have expanded globally, they have developed a number of ways of structuring their businesses, for instance using Swiss Vereins, European Economic Interest Groups, and partial and full profit-sharing models. For consistency’s sake, we now publish the global firm-wide financials for all of the firms in the LB100, regardless of how they internally structure themselves or share profits. So the turnover, profitability, PEP and headcount figures published for Ashurst, CMS, Herbert Smith Freehills, Norton Rose Fulbright, Hogan Lovells, Taylor Wessing and DLA Piper are all global, firm-wide figures.

DEFINITIONS

Turnover/revenue/gross fees

Revenue figures do not include VAT, disbursements, interest or anything other than the worldwide fees generated by lawyers for their work during the last financial year.

Net income

We define net income as the total profits that are available to be shared among equity partners. We treat profit sharing with non-equity partners or fixed-share equity partners as an expense and it is therefore not included in the net income figure.

Total lawyers

Total lawyer numbers include partners, trainees, assistants, associates, of counsel and all other fully qualified lawyers, but do not include legal executives, paralegals or other support staff. We ask firms for actual full-time equivalent headcount at the end of the last financial year. Lawyer and partner numbers are rounded up to the nearest whole number.

Equity partners

We define full-equity partners as partners that are full participants in the firm’s profits. Fixed-share equity partners are considered non-equity partners for the purposes of this survey.

Non-equity partners

Non-equity partners, be they fixed-share, salaried, or laterals on probationary periods, are those that are not full participants in the firm’s profits, though they may have voting rights.

HOW WE CRUNCH THE NUMBERS

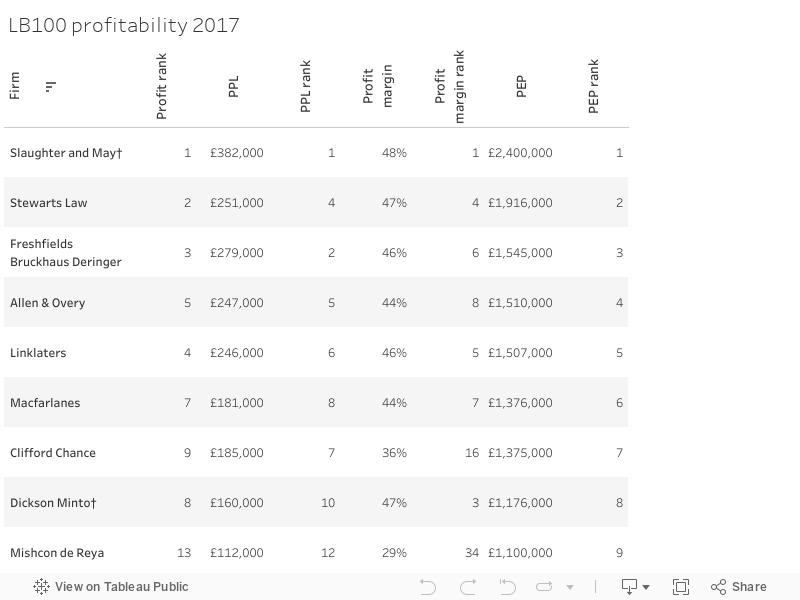

Profit per equity partner

We calculate PEP by dividing net income by the whole number of full equity partners at the end of the last financial year. PEP is an average figure used to benchmark the profitability of firms, which is not necessarily the same as saying that any partners take home this amount of money.

Revenue per lawyer (RPL)/profit per lawyer (PPL)

RPL is calculated by dividing turnover by the total number of lawyers at the end of the last financial year. PPL is calculated by dividing net income by the total number of lawyers.

Profit margin

Profit margin is net income as a percentage of turnover.

Change 2012-17

This figure is the simple percentage change in revenue between the 2011/12 financial year (as reported in the 2012 LB100) and the 2016/17 financial year.

FOOTNOTES

- DLA Piper and Sacker & Partners operate a year-end to 31 December 2016.

- On 1 May 2017, CMS Cameron McKenna, Nabarro and Olswang merged to form a UK LLP named CMS Cameron McKenna Nabarro Olswang. For the 2017 LB100, each legacy firm is treated separately for the full 2016/17 financial year. Figures for CMS Cameron McKenna are global financials for the CMS group as a whole. Data for Nabarro and Olswang was supplied by neither firm nor CMS.

- Eversheds Sutherland – on 1 February 2017, Eversheds and Sutherland Asbill & Brennan formed a UK company limited by guarantee. Data in the report refers to legacy Eversheds only.

- Gowling WLG – in February 2016, Wragge Lawrence Graham & Co merged with Gowlings to form Gowling WLG. Headcount and revenue information here is for the global entity combined, while profit calculations are based on the WLG UK LLP only.

- Taylor Wessing – as the firm operates separate profit pools in each jurisdiction, the PEP figure provided is illustrative rather than actual and is based on a global net income figure of £99.8m.

- Irwin Mitchell does not operate a traditional law firm partnership and partners are remunerated according to salaries and bonuses, not profit shares. The PEP figure is illustrative for the purposes of the LB100 and is not supplied by the firm.

- Gateley became the UK’s first listed law firm in 2015. In June 2017 HBJ Gateley, the firm’s Scottish arm, spun off to become Addleshaw Goddard in Scotland. Revenue figures published here are for Gateley plc only and year-on-year comparisons on key financial metrics are not possible. Gateley does not operate a traditional law firm partnership and profit is not distributed among equity partners. As such, the figure for PEP published in the table is for published net profit per partner and is not provided by the firm.

- Royds Withy King – on 1 September 2016, Bath-based Withy King merged with London practice Royds to form Royds Withy King. Data supplied here includes additional revenue and headcount from the combination, making a year-on-year comparison unrealistic.

Click here to return to the Legal Business 100 menu

Transparency

Legal Business takes the compilation of the LB100 very seriously. We make every effort to ensure that the figures we publish are accurate.

The overwhelming majority of firms co-operate fully with us in this regard. Among the 100 firms featured in the survey, seven declined to provide any financial information formally. These were: Dickson Minto; Digby Brown; Keoghs; Nabarro; Olswang; Slaughter and May; and Thompsons.

A further nine firms did not disclose profitability and/or equity partner numbers. These were: Browne Jacobson; Gateley; Gowling WLG; Ince & Co; Irwin Mitchell; Norton Rose Fulbright; Payne Hicks Beach; Winckworth Sherwood; and Veale Wasbrough Vizards.

A further ten firms were unable to provide us with their top and bottom of equity: Ashurst; BLM; Clifford Chance; DAC Beachcroft; DLA Piper; Hogan Lovells; Simmons & Simmons; Macfarlanes; Mishcon de Reya; and Travers Smith.

The following ten firms did not provide UK fee income: Allen & Overy; Bird & Bird; CMS; DLA Piper; Freshfields Bruckhaus Deringer; Hogan Lovells; Linklaters; RPC; Simmons & Simmons; and Travers Smith.