Tom Baker assesses attempts to revive the flagging Serious Fraud Agency amid a fractious political debate

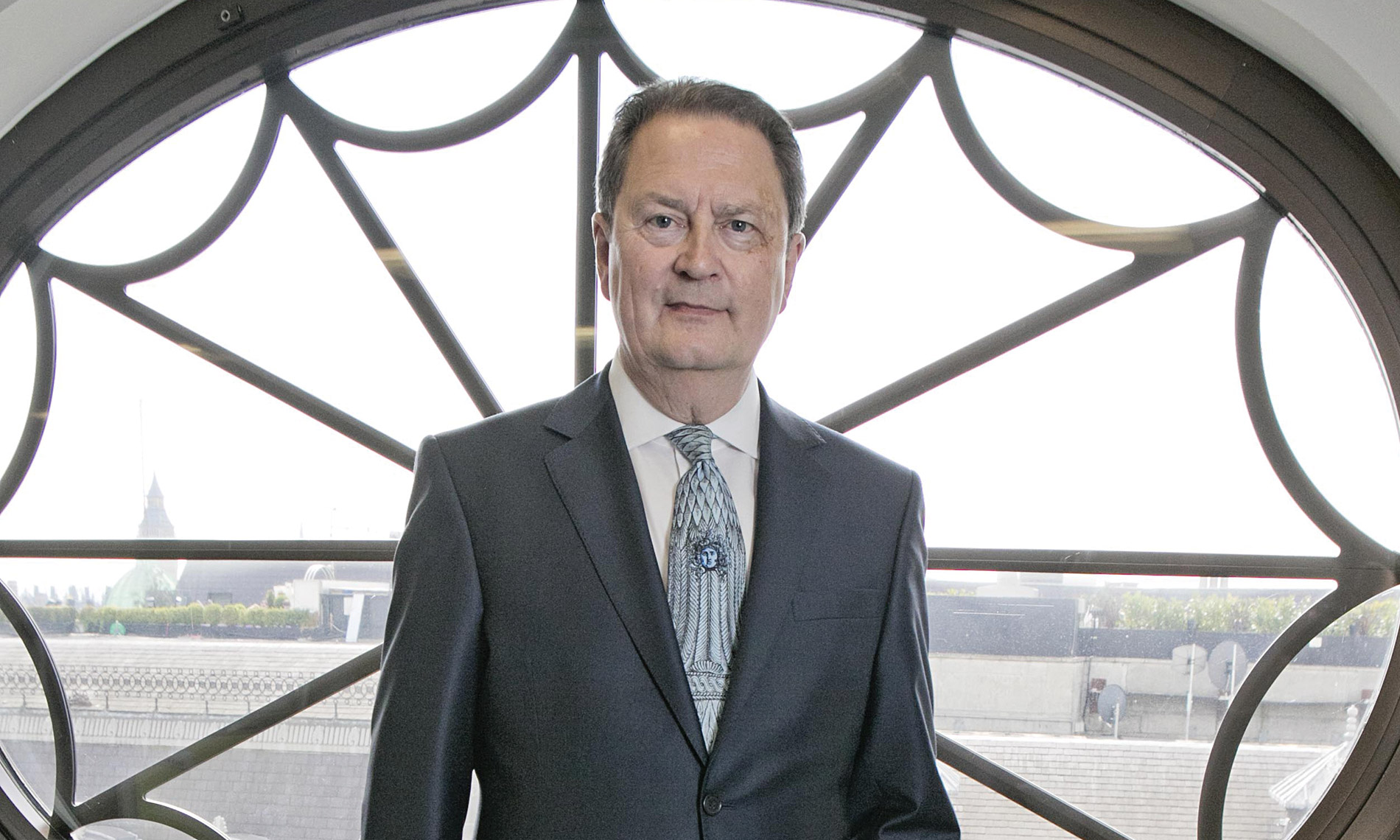

It is fair to say that David Green QC took over the Serious Fraud Office (SFO) in 2012 at what was, even for the frequently beleaguered agency, a low ebb. The good news is the consensus among hardened white-collar crime specialists is that the veteran silk has had considerable success turning around a body derided as toothless and operationally slack. The bad news is that the biggest remaining sceptic of the SFO happens to be the prime minister, with Theresa May having gone into this year’s general election with the pledge to disband the agency, rolling it into her own creation, the National Crime Agency (NCA). Continue reading “Under the sword”