‘There’s a bunch of defensive mechanisms firms are using to shore up their stars – they could be lost to Paul Weiss or some other big firm if they don’t do something,’ says one US partner of the fierce war for talent at the very top of the legal market.

Just how global is the Global 100? LB looks beyond revenue to find some true global leaders

What does it take to be part of the global elite? When Legal Business unveiled the very first iteration of its ‘global elite’ back in 2003, 15 firms made the grade, of which six were headquartered in the UK.

They were selected based on criteria including: being a leader in their home jurisdiction in at least two of the three key practice areas of finance, M&A and litigation; being one of the 50 most profitable firms in the world; and being a leader in M&A or banking on both sides of the Atlantic.

But with law firms expanding rapidly around the world in the time since that first elite was created, the metrics they should be assessed on have come under increasing scrutiny.

Should the measure of success be firmwide revenue, international revenue, profitability, headcount or perhaps geographic spread? Or should the true global elite simply be a list of the very best law firms in the world? In which case, the likes of Slaughter and May and Wachtell would make the grade despite a decided lack of international reach.

Twenty-one years after that first 15-firm group was drawn up, despite having more data available to us than ever before, it is perhaps less clear now who should and shouldn’t be included in a global elite than it was then.

The Global 100 ranking in this issue is a prime example. US firms make up roughly 70% of the biggest firms in the world by revenue; while there are fewer than 20 UK or equal UK/US heritage firms in the list. And the sheer size of the US legal market means that its domination over UK and international firms only increases year on year.

Similarly, the difference in approach towards global expansion (with UK firms generally having larger numbers of lawyers in more international locations than their US peers) means the profitability gap also continues to grow.

But, despite their strong financial performance, many of the US firms in the global elite lack any significant international footprint, which inevitably means that our Global 100 rankings are not really as globally-focused as they should be.

So we have decided to go back to basics, and revisit the questions of what it really means to be global, and what it really means to be elite.

Thinking global

Ask managing partners what global means and responses inevitably differ depending on the profile of the firm.

For Justin D’Agostino, global CEO of Herbert Smith Freehills: ‘It’s the quality of clients, the quality of the work you’re doing for them, and the quality of your talent. You also need geographic reach in the major markets of the world. It’s about strength, profitability, and sufficient scale.’

Simon Levine, DLA’s global co-CEO and international managing partner, says being truly global is about being able to offer the biggest corporates in the world the full breadth of services – from life sciences, to disputes, to regulatory advice – across multiple jurisdictions.

He asks: ‘When major global organisations – like Unilever, GE, or HSBC – require critical global services such as restructuring, dispute resolution, or regulatory advice, do they need to turn to multiple firms, or can one firm manage everything?’ In his view: ‘Simply focusing on corporate, M&A, PE, and litigation isn’t enough.’

On the other hand, one London head at an elite US firm counters: ‘I don’t think just being big makes you global. It’s about which markets you’re deep in, combined with an element of profitability’.

The US conundrum

What everyone – including LB – is in agreement on is that being truly global requires a presence in the key financial centres around the world. That means London, the US, and major financial centres across Asia Pacific and EMEA such as Hong Kong and Frankfurt.

Here then, we’re presenting some new options for what it really means to be a globally elite firm by revisiting some of those 2003 criteria and combining them with definitive insight from our Legal 500 rankings.

Where UK and UK-heritage firms fare best is strong global coverage, as evidenced by their L500 rankings.

If we look at the global 100 firms by total number of L500 rankings worldwide, our top ten firms comprise: DLA Piper, Baker McKenzie, CMS, A&O Shearman, Dentons, Eversheds Sutherland, Clifford Chance, Hogan Lovells, White & Case and Norton Rose Fulbright.

Look at the best-performing global 100 firms by total number of top-tier Legal 500 rankings worldwide and the picture shifts slightly, but UK and UK-heritage firms still come out on top, with Bakers, A&O Shearman, CC, DLA Piper, CMS, Linklaters, Latham, Dentons, HSF and Pinsents making the grade.

But while UK-heritage firms are strong across key financial centres such as Hong Kong, Singapore and Frankfurt, to be truly global firms have to have a solid presence in all four L500 regions: UK, EMEA, APAC and the US.

Making this a prerequisite for inclusion in a global elite proves to be almost as big a blocker for many UK-heritage firms today as it was in 2003 – but with a bigger profitability gap to navigate to fix the problem. For example, of those leading firms by T1 rankings, CMS, HSF, Linklaters and Pinsents all lack any T1 rankings in the US.

As D’Agostino admits: ‘the quality of [UK firms’] client base and our scale in major markets is still a force to be reckoned with, but all of us are focused on the US market and how to scale up.’

Duncan Weston, executive partner at CMS, comments: ‘Many law firms like to call themselves global, but they’re not. We don’t claim to be truly global yet, though we have those aspirations,’ he admits, pointing to CMS’s gaps in key markets like Asia and the US. Of course, T1 or not, not all L500 rankings are created equal. Echoing the approach LB took back in 2003, for elite status, let’s now consider only firms with at least one ‘prime’ L500 ranking (corporate/M&A, litigation, banking and finance) in major markets across all four core geographies – Asia Pacific, EMEA, the US and the UK. Again, UK-heritage firms still fare pretty well, with A&O Shearman, CC, DLA Piper, Linklaters, Hogan Lovells, Norton Rose Fulbright and polycentric Dentons all making the cut.

But now let’s add one of those other 2003 criteria: in addition to being global we want our list to be elite. So, for this, let’s add in the same profitability filter applied in 2003 –considering only the 50 most profitable global 100 firms.

Removing firms in the bottom half of the profitability table equates to a cut-off point of $2.38m based on this year’s financial results, meaning large but less profitable players like Bakers and Norton Rose Fulbright fall out.

So what are we left with? In total we end up with a list of around 20 firms, with UK or UK-heritage firms making up around six of the top ten by total ranking numbers (see tables below).

Of course, some may query the value placed on an EMEA and APAC presence – particularly given current scrutiny over whether a huge global footprint is as important as it once was. And others may query taking a volume-based approach to rankings.

But a true global elite needs to be made up of firms with broader horizons than just the US firms which make up so much of the Global 100. Otherwise it’s just a US elite.

Georgina Stanley and Anna Huntley

Global 100 firms with the most prime* L500 rankings across APAC, EMEA, UK and US (top 50 for PEP only)

| Firm | APAC | EMEA | UK | US | Total |

|---|---|---|---|---|---|

| A&O Shearman | 20 | 49 | 25 | 23 | 117 |

| Clifford Chance | 16 | 46 | 16 | 14 | 92 |

| DLA Piper | 14 | 49 | 14 | 15 | 92 |

| White & Case | 14 | 38 | 17 | 20 | 89 |

| Latham & Watkins | 13 | 24 | 15 | 27 | 79 |

| Linklaters | 11 | 43 | 17 | 5 | 76 |

| Hogan Lovells | 10 | 37 | 17 | 10 | 74 |

| Freshfields | 8 | 28 | 14 | 11 | 61 |

| Mayer Brown | 8 | 8 | 15 | 25 | 56 |

| Skadden | 11 | 5 | 10 | 25 | 51 |

Global 100 firms with the most T1 prime* l500 rankings across APAC, EMEA, UK and US (top 50 for PEP only)

| Firm | APAC | EMEA | UK | US | Total |

|---|---|---|---|---|---|

| A&O Shearman | 9 | 24 | 19 | 1 | 53 |

| Clifford Chance | 7 | 26 | 15 | 0 | 48 |

| Latham & Watkins | 3 | 8 | 6 | 21 | 38 |

| Linklaters | 6 | 17 | 11 | 0 | 34 |

| Kirkland & Ellis | 4 | 2 | 4 | 9 | 19 |

| White & Case | 3 | 9 | 4 | 2 | 18 |

| Simpson Thacher & Bartlett | 2 | 0 | 1 | 15 | 18 |

| Cleary Gottlieb Steen & Hamilton | 1 | 3 | 0 | 10 | 14 |

| Freshfields | 2 | 7 | 4 | 0 | 13 |

| Davis Polk & Wardwell | 1 | 0 | 0 | 12 | 13 |

* Prime = at least one core M&A/banking/litigation ranking

The Global 100 2024 – contents

Overview: G100 defy gloom to pass $150bn

While last year saw the Global 100 struggling against market headwinds, this year finds firms in much ruder health. But with transactional markets yet to make a full recovery, the legal sector could not rely on big deals alone – LB reports on how the world’s largest law firms beat the odds to hit new heights

Main table

Key financials for the top 100 firms

Late bloomer: how Paul Weiss made up for lost time on the global stage

In a year of standout performances, Paul Weiss has made more headlines than most with a new international strategy that has shaken up the market, as LB reports

Laws of attraction – how elite firms are ramping up their talent retention tactics

With the battle to recruit and retain star partners becoming ever more intense, the world’s top firms are going to new lengths to fend off the competition. From partnership and lockstep shakeups to spiralling pay packages, LB looks at the measures elite firms are taking to keep rivals at bay.

Methodology and end notes

The Last Word: Global vision

As part of our Global 100 survey, top lawyers share their thoughts on the global market

Last Word: Global vision

‘To use a mountain biking analogy: coasting downhill might be fun in the moment, but when you reach the bottom, you’re lower than where you started. Climbing uphill is a grind, but it’s what gets you further.’ Ira Coleman, McDermott

As part of our Global 100 survey, top lawyers share their thoughts on the global market

Linklaters and Clifford Chance continue US push as A&O Shearman merger beds in

While the US legal market is rarely quiet, post-merger settling at A&O Shearman seems to be driving a spate of activity, with magic circle firm Linklaters among those capitalising on departures to expand their US presence.

Continue reading “Linklaters and Clifford Chance continue US push as A&O Shearman merger beds in”

Insights from HSF’s private equity team

How does the HSF private equity team differentiate itself in the market?

John Taylor, partner and the head of the private equity practice in London: We have a multi-capability private equity practice, advising clients across the full lifecycle of investments from fundraising and capital deployment, supporting their investments all the way to exit. We work across all capital structures and execute extremely complex transactions and strategies in multiple jurisdictions. Our private capital team leverages our full-service offering and the multiple sector strengths within our wider firm.

Our team continues to grow strategically. In the past 12 months, our hires of Eleanor Shanks as head of international private equity in London, venture and growth capital partner Dylan Doran Kennett and leveraged finance partner Ambarish Dash have bolstered our private capital practice in London.

Dr Christoph Nawroth, partner, Düsseldorf: In Continental Europe, recent hires include private equity and venture capital partner Gregor Klenk in Frankfurt, as well as finance partners Dr Fritz Kleweta, Sergio Cires and Laure Bonin into our Frankfurt, Madrid and Paris offices respectively. The teams in continental Europe and London are fully integrated and offer our clients seamless advice wherever this is needed.

We’ve a strong client portfolio, advising the likes of EQT, Aquiline Capital Partners, H.I.G. Capital, GIC, and CPPIB on deals ranging across the likes of energy/renewables, infrastructure, TMT, life-sciences, and financial services.

Can you discuss some of the trends that are impacting your clients?

Joseph Dennis, partner, London (JD): In the UK, the recent stabilisation of interest rates has resulted in cautious optimism for sellers to begin work on exits that have been sitting patiently in the pipeline. As rates begin to ease, we expect to see the gap in pricing expectations beginning to close.

Christopher Theris, partner, Paris: In continental Europe, the sheer number of elections and similar political events has resulted in a cautious market. We’re also seeing the use of bilateral processes at the inception of deals, moving away from a more typical auction or auction/bilateral hybrid arrangement.

‘The City of London is arguably the top global financial centre and has a huge range of intrinsic advantages.’

JD: Our private equity team were first movers in identifying the trend towards funds specialising along sector lines. Some years ago, we positioned our private equity practice to be closely aligned with our top-tier sector focused M&A practices, along the same sector lines as our key sponsor clients and targets. We are now well positioned to advise multi-strategy and multi-geography sponsors active through their full investment lifecycle across each of the geographies in which we operate, and we and our clients are really benefiting from this approach.

What role do you see for continuation funds?

Jonathan Blake, head of international private funds strategy, London: Continuation funds are part of a broader growth trend in secondary opportunities. Although the global economy is showing positive signs of stability, achieving the exit multiples that GPs would expect for their high-performing assets is still uncertain in current market conditions.

Stephen Newby, partner, London: The structure of a continuation fund offers LPs an opportunity to either liquidate or continue to hold their position. It also offers an opportunity for secondaries investors to participate, often with one ‘anchor’ investor that underwrites the existing LPs that decide not to rollover.

These options give GPs a good alternative to a full exit, especially where the GP is confident in its ability to add further value to an asset that will help to achieve even greater returns over the medium term.

Michael Jacobs (MJ), partner, London:To compliment continuation funds, we are seeing more structured pre-exit syndication and introducing a wider pool of investors into later stage assets – in part to drive liquidity and partial exits, and also a consequence of the broader ‘private for longer’ theme. The ‘private IPO’ concept is part of this trend.

How is the industry reacting to the change in government and the new policies that affect private capital?

Eleanor Shanks, partner and head of international private equity in London: The private equity industry as a whole wants to play its part and will continue to make the case to governments of the sector’s significant contribution to the whole economy, including to growth and productivity. It is a significant driver of private investment in the UK as it is globally.

There are some specific tax policy proposals that were in Labour’s manifesto that the government are currently considering, and we all appreciate the complexity balancing the incentives and the country’s fiscal position – in driving that investment and growth which in turn drives receipts for the revenue.

MJ: The City of London is arguably the top global financial centre and has a huge range of intrinsic advantages – its competitiveness has been boosted in recent years with the Financial Services and Markets Act and the Edinburgh and Mansion House reforms, alongside the UK’s listing regime reboot. While it is hard for any individual policy decision to change this, we would caution the government to not take the City for granted.

Subject to unexpected circumstances, what might we expect for deal activity at the start of 2025?

David D’Souza, partner, London: The focus on Distribution to Paid-In Capital (DPI) means the UK pipeline continues to deepen. Reassuringly, it is also widening across sectors which may have been slower in the last few years.

Alberto Frasquet, regional head of corporate EMEA, Madrid: In Continental Europe, private equity funds are likely to continue to look at assets in the pharmaceutical/healthcare, infrastructure and energy (particularly data centres), education and software sectors – these appear to be the most attractive for investment.

For more information, please contact:

Herbert Smith Freehills

Exchange House

12 Primrose Street

London

EC2A 2EG

T: 020 7374 8000

‘More uncertainty than any other recent election’ – US partners on what the Trump-Harris race means for Big Law

The comparison between City partners’ attitudes to the UK general election in July and US partners’ attitudes to next Tuesday’s elections could not be starker. Then, not one partner interviewed doubted that Labour would emerge the winner. Now, it’s a coinflip – with even more uncertainty around what either candidate would do in office.

LB checked in with partners at leading US firms to learn how lawyers and clients are navigating this uncertainty.

‘Setting ourselves up for the future’ – McDermott ups London trainee pay to £70k

McDermott Will & Emery has followed Davis Polk’s lead, raising its London trainee pay to match the highest market rates.

Continue reading “‘Setting ourselves up for the future’ – McDermott ups London trainee pay to £70k”

‘I never saw this as impossible’ – Mishcons’ Shaistah Akhtar on the case that won her Commercial Litigation Team of the Year

Mishcon de Reya‘s hard-fought victory for Nigeria in Nigeria v P&ID saw the firm take home Commercial Team of the Year at the Legal Business Awards in September. The team assisted Nigeria in challenging a $6.6bn arbitral award made in favour of BVI-incorporated shell company Process & Industrial Developments Limited (P&ID) in 2017. With interest accruing at $1m a day, the team sought to overturn the award on the basis of fraud.

But, when the firm was instructed in 2019, Nigeria was almost three years past the deadline to bring the set-aside challenge. Before the team could even begin to present its fraud case (the result of a massive global investigation effort), it had to fight to extend the deadline – and achieved an unprecedented extension, granted in July 2020.

The team’s hard work paid off. On 23 October 2023, judgment was handed down in Nigeria’s favour by Mr Justice Knowles. It was found that P&ID had obtained the award, now worth over $11bn, by fraud.

Shaistah Akhtar, partner in Mishcons’ dispute resolution group, spoke to LB about getting the call from Nigeria, the biggest hurdles the team overcame, and the pressures of a case with national and international repercussions.

Life During Law – Simon Levine

I didn’t grow up with law in my life. I come from a non-professional background and my parents didn’t go to university. When it came to choosing what to study at university, I was passionate about history, but my dad told me a history degree would limit me to teaching. Young and naïve, I took his word and explored other options. Continue reading “Life During Law – Simon Levine”

Staying active

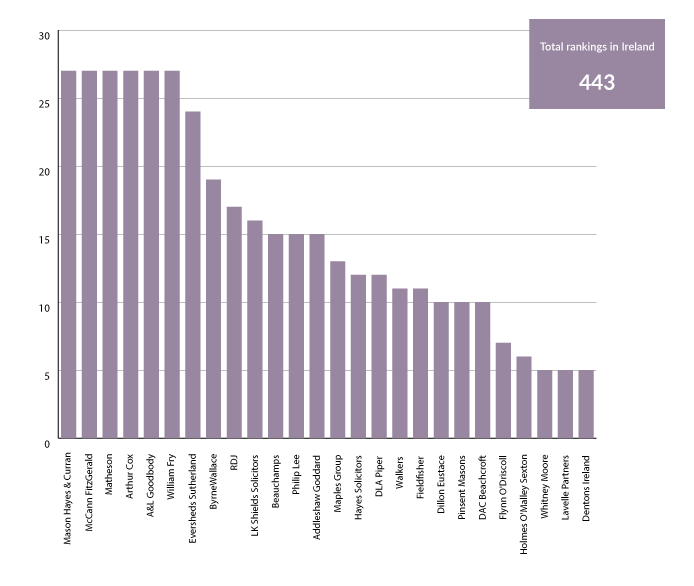

Ronan McLoughlin and Lisa Broderick report on DACB Dublin’s recent growth, with a busy last year and new hires, as well as the opportunities and issues expected for Irish law firms in the future

Kirkland adds first structured finance partner in London as Cravath hires Linklaters lev fin duo

US firms are once again on the march in London, with Kirkland and Cravath leading the moves of the last few weeks with hires from legal tech Harvey and Linklaters respectively.

Bryan Cave Leighton Paisner: The Client’s View

Bryan Cave Leighton Paisner

Lawyers and

Team Quality

81.93

Quality of partners 84.52

Quality of associates 74.14

Partner availability and engagement 83.99

What do clients really think about the service they receive from law firms? At Legal 500, we hear from hundreds of thousands of clients every year, rating firms on key metrics such as lawyer quality and availability, billing, and levels of communication and expertise.

The answers we receive allow us to evaluate firms using a set of client service data scores, covering Lawyers and Team Quality, Value: Billing and Efficiency, and Sector and Industry Knowledge – all of which combine to produce an overall Client Service Score.

This article focuses on Lawyers and Team Quality, for which Bryan Cave Leighton Paisner scores 81.93. (The rest of this article is available to logged-in users only. If you are unable to log in above right, please click ‘Forgot your password?’ below to gain access to the full article). Continue reading “Bryan Cave Leighton Paisner: The Client’s View”

Latham & Watkins: The Client’s View

Latham & Watkins

Lawyers and

Team Quality

85.21

Quality of partners 88.73

Quality of associates 81.14

Partner availability and engagement 86.01

What do clients really think about the service they receive from law firms? At Legal 500, we hear from hundreds of thousands of clients every year, rating firms on key metrics such as lawyer quality and availability, billing, and levels of communication and expertise.

The answers we receive allow us to evaluate firms using a set of client service data scores, covering Lawyers and Team Quality, Value: Billing and Efficiency, and Sector and Industry Knowledge – all of which combine to produce an overall Client Service Score.

This article focuses on Lawyers and Team Quality, for which Latham & Watkins scores 85.21. (The rest of this article is available to logged-in users only. If you are unable to log in above right, please click ‘Forgot your password?’ below to gain access to the full article). Continue reading “Latham & Watkins: The Client’s View”

Hogan Lovells: The Client’s View

Hogan Lovells

Lawyers and

Team Quality

81.20

Quality of partners 84.08

Quality of associates 76.19

Partner availability and engagement 83.46

What do clients really think about the service they receive from law firms? At Legal 500, we hear from hundreds of thousands of clients every year, rating firms on key metrics such as lawyer quality and availability, billing, and levels of communication and expertise.

The answers we receive allow us to evaluate firms using a set of client service data scores, covering Lawyers and Team Quality, Value: Billing and Efficiency, and Sector and Industry Knowledge – all of which combine to produce an overall Client Service Score.

This article focuses on Lawyers and Team Quality, for which Hogan Lovells scores 81.20. (The rest of this article is available to logged-in users only. If you are unable to log in above right, please click ‘Forgot your password?’ below to gain access to the full article). Continue reading “Hogan Lovells: The Client’s View”

Ashurst: The Client’s View

Ashurst

Lawyers and

Team Quality

79.59

Quality of partners 83.47

Quality of associates 75.76

Partner availability and engagement 83.18

What do clients really think about the service they receive from law firms? At Legal 500, we hear from hundreds of thousands of clients every year, rating firms on key metrics such as lawyer quality and availability, billing, and levels of communication and expertise.

The answers we receive allow us to evaluate firms using a set of client service data scores, covering Lawyers and Team Quality, Value: Billing and Efficiency, and Sector and Industry Knowledge – all of which combine to produce an overall Client Service Score.

This article focuses on Lawyers and Team Quality, for which Ashurst scores 79.59. (The rest of this article is available to logged-in users only. If you are unable to log in above right, please click ‘Forgot your password?’ below to gain access to the full article). Continue reading “Ashurst: The Client’s View”

Herbert Smith Freehills: The Client’s View

Herbert Smith Freehills

Lawyers and

Team Quality

82.30

Quality of partners 85.21

Quality of associates 78.16

Partner availability and engagement 83.46

What do clients really think about the service they receive from law firms? At Legal 500, we hear from hundreds of thousands of clients every year, rating firms on key metrics such as lawyer quality and availability, billing, and levels of communication and expertise.

The answers we receive allow us to evaluate firms using a set of client service data scores, covering Lawyers and Team Quality, Value: Billing and Efficiency, and Sector and Industry Knowledge – all of which combine to produce an overall Client Service Score.

This article focuses on Lawyers and Team Quality, for which Herbert Smith Freehills scores 82.30. (The rest of this article is available to logged-in users only. If you are unable to log in above right, please click ‘Forgot your password?’ below to gain access to the full article). Continue reading “Herbert Smith Freehills: The Client’s View”

Life During Law – Penny Angell

In my second year studying law at university, I fell in love twice. Not only did I meet my future husband, but I also did a vacation scheme at pre-merger Lovells and realised I had also found my career soulmate. Last year was quite special, as I celebrated my 30th anniversary at Hogan Lovells and my 25th wedding anniversary. Continue reading “Life During Law – Penny Angell”

Glasses half full

Geoff Moore, managing partner of Ireland’s Arthur Cox, is looking at life with his glass very much half full, and he is not alone. ‘Notwithstanding the awfulness going on around the world – two full-blown wars, geopolitical tensions, election uncertainty, and more – the underlying domestic economy in Ireland is actually performing very strongly,’ says Moore. ‘Things have remained robust.’

Vodafone UK head of legal Karen Thorpe on winning LB’s In-House Team of the Year and Vodafone’s ‘once in a lifetime’ merger with Three

With work including the proposed merger of Vodafone and Three’s UK businesses – a deal that would create the largest mobile operator in the UK; the successful defence of the £1bn Phones 4u litigation – the culmination of a decade’s worth of work for Vodafone’s legal team; and the launch of a major in-house transformation project, it’s fair to say that Vodafone’s lawyers have been keeping themselves busy.

Legal Business caught up with Vodafone UK’s head of legal, Karen Thorpe (pictured, sixth from left), to discuss an award-winning year.