- Herbert Smith Freehills’ (HSF) corporate practice saw a seasoned trio of partners quit in August for Morgan, Lewis & Bockius’s London arm. They were led by HSF’s head of London private equity Mark Geday, and included corporate partners Nicholas Moore and Tomasz Wozniak.

Disputes Eye: Hunting krakens – As finance and Russian work slows veteran litigators look to key trends and opportunities

As the torrent of post-financial crisis litigation continues to slow, litigators are increasingly wondering: ‘What next?’ Certainly, 2018 has so far been quieter than 2017 from a disputes perspective, across big-ticket and mid-level matters.

Canvassing industry veterans on the trends to watch, however, shows plenty of areas of opportunity litigators spy on the horizon. Perhaps the most talked-up area right now is the prospect of litigation linked to this year’s implementation of GDPR, the EU-wide regime updating data protection and privacy law. The complexity of the legislation, and potential fines of up to 4% of global turnover for companies that breach the new rules, unsurprisingly means many lawyers forecast plenty of compliance and enforcement-related work. Continue reading “Disputes Eye: Hunting krakens – As finance and Russian work slows veteran litigators look to key trends and opportunities”

High (street) stakes as Gaucho collapses into administration and House of Fraser saga takes yet another twist

‘There’s going to be a lot of distress on the high street,’ Weil, Gotshal & Manges partner Adam Plainer told Legal Business last autumn in an extended assessment of the City restructuring outlook. Given that insolvency lawyers have been confidently – and wrongly – predicting a flood of work since the banking crisis, such claims generally attract some scepticism. Yet the forces battering the high street did indeed in 2018 send a string of familiar names to the corporate vultures.

This summer’s collapse of Gaucho Group, the owner of premium Argentinian steak purveyors Gaucho and Cau, became only the latest casualty, amid a malaise that has seen dining and retail stalwarts struggle with shifting consumer behaviour and rising overheads. Continue reading “High (street) stakes as Gaucho collapses into administration and House of Fraser saga takes yet another twist”

The one true law – in conversation with Lord Neuberger

Richard Lissack QC: David, why a career in the law?

Lord Neuberger: It was after cancelling out other possibilities. I was a scientist at university – a chemist. I was influenced by my father, a successful scientist. I quickly proved to be an unsuccessful scientist. I went to career advisers. They said do law or go into the City. In those days the City involved no exams and law did, so I went into the City. Continue reading “The one true law – in conversation with Lord Neuberger”

Legal Business 100 2018: Core stats

LB100 averages

Average revenue £242.3m

Average revenue growth 10%

Revenue per lawyer £355,000

Profit per lawyer £112,000

Profit per equity partner £805,000

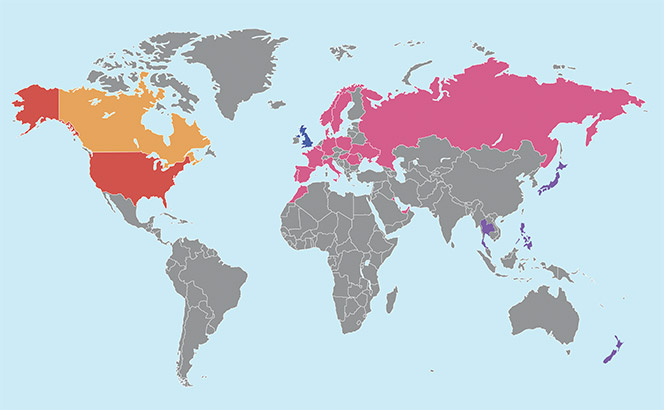

Legal 500 Data: The data behind the story

DLA Piper top-tier global rankings from The Legal 500

DLA Piper has topped this year’s Legal Business 100 with revenue of £1,799.5m, an increase of 7% from last year. See our full coverage of the Legal Business 100. Continue reading “Legal 500 Data: The data behind the story”

The Legal Business 100 – Contents

Sponsored by

Government letter reveals conditions of ex-SFO boss Green’s Slaughter and May role

Following the much-anticipated confirmation of David Green’s move to Slaughter and May earlier this week, a government document has revealed the extent of limitations on the ex-Serious Fraud Office (SFO) chief’s new role.

Topping the list was a permanent restriction on Green drawing on any privileged information seen during his six-year SFO stint. Continue reading “Government letter reveals conditions of ex-SFO boss Green’s Slaughter and May role”

DWF revenue jumps to £236m ahead of stock exchange float

DWF has added 18% to its top line as the thrusting national operator gears up to become the largest UK law firm float yet.

Revenue at the top 25 firm for the year to 30 April, announced today (13 September), was £236m, up from £199m last year. The firm also said profit per equity partner (PEP) increased, without specifying a figure, but this year’s LB100 estimates it rose 9% to £327,000. Continue reading “DWF revenue jumps to £236m ahead of stock exchange float”

Comment: A decade since Lehman the profession still mired in the New Normal

Within days of this issue hitting desks, it will be ten years since Lehman Brothers’ collapse marked what swiftly became the great financial crisis. That event was only the clearest symptom of a disease that had been infecting the banking system for more than a year before Lehman filed for bankruptcy on 15 September 2008.

Yet the process unquestionably signalled changes that have reverberated through economies, politics, business and, yes, the legal profession ever since. By the summer of 2009 the UK profession had for the first time engaged in industrial-scale job cuts, axing more than 5,000 roles at top 100 UK firms alone. Through the lens of the LB100, the profession starkly divides into performance patterns pre and post-Lehman. During the long boom, London’s elite was utterly untouchable. Within the Circle they could falter and scrap for fleeting inter-club advantage. But as far as the rest of the industry was concerned, they were in a world of their own. The initial advances of major US law firms had by the mid-2000s been comprehensively repelled – what chance did mid-tier rivals have? Continue reading “Comment: A decade since Lehman the profession still mired in the New Normal”

Bircham Dyson and Pitmans seek reversal of revenue fortunes with £52m merger bid

The partnerships at City law firm Bircham Dyson Bell (BDB) and Reading headquartered Pitmans will this month vote on a proposed merger to create a £50m-plus firm.

A merger would be good for a partner headcount of 80, while overall staff numbers would be 404. A combined revenue of about £52m would put the merged firm close to the UK’s top 60 by revenue. A vote is set for 27 September. Continue reading “Bircham Dyson and Pitmans seek reversal of revenue fortunes with £52m merger bid”

‘No way a sign of retrenchment’: Ropes axes four partners amid London refocus

In what has been termed by one rival City partner as a ‘night of the long knives’, Ropes & Gray has axed four of its London real estate and restructuring partners.

The move comes as the firm shifts the focus of the real estate practice back to its prized client base of asset managers, hedge funds, credit funds and direct investors amid a recent drift. The firm’s restructuring – or ‘special situations’ – practice is also being repackaged to appeal to the desired client base. Continue reading “‘No way a sign of retrenchment’: Ropes axes four partners amid London refocus”

‘Natural fit’ – Slaughters confirms long-anticipated hire of ex-SFO boss Green

Slaughter and May’s high-profile move for former Serious Fraud Office (SFO) director David Green QC has finally been confirmed, following a drawn-out regulatory approval process.

Green will join the firm as a senior consultant on 22 October, six months after leaving the SFO. The firm says Green, who led the SFO for six years, will not work on any matters at the firm that he was involved with while at the SFO. Continue reading “‘Natural fit’ – Slaughters confirms long-anticipated hire of ex-SFO boss Green”

Another blow for Freshfields as highly-regarded QC leaves for litigation boutique

Freshfields Bruckhaus Deringer has fielded yet another blow in the City after litigation partner Reza Mohtashami QC quit for litigation boutique Three Crowns.

Freshfields man and boy, Mohtashami joined the Magic Circle firm as an associate 19 years ago and was made up to partner in 2009. He worked in Paris, New York and Dubai before moving to London in 2014. He took silk in 2017. Continue reading “Another blow for Freshfields as highly-regarded QC leaves for litigation boutique”

Revolving doors: Holiday lull over with spate of lateral hires at home and abroad

In the most significant move of last week, Baker McKenzie has hired Sidley Austin’s former City managing partner Matthew Dening, who re-joins the firm after leaving as partner in 14 years ago.

As co-head of Sidley’s London finance team, the hire is a significant addition for Bakers as it sets about strengthening its structured capital markets offering. Dening will join the firm later this year, and features as part of its wider strategy of enhancing its corporate offering, which has resulted in an array of key lateral hires throughout 2018. Continue reading “Revolving doors: Holiday lull over with spate of lateral hires at home and abroad”

‘Litigation finance is here to stay’: Former A&O senior partner Morley joins Vannin ahead of IPO

Fast-growing litigation funder Vannin Capital has appointed former Allen & Overy senior partner David Morley as chair ahead of a planned IPO on the London Stock Exchange.

The company announced today (10 September) that it planned to issue £70m of new shares and sell part of the shares held by existing shareholders in a float expected to take place in October. Continue reading “‘Litigation finance is here to stay’: Former A&O senior partner Morley joins Vannin ahead of IPO”

A&O matches Magic Circle’s sluggish gender pay gap progress after finally releasing partner pay stats

Allen & Overy’s (A&O) response to criticism over its failure to disclose the pay gap between male and female partners has revealed slow progress on a par with its Magic Circle peers.

The UK pay gap report for 2018, published today (6 September), for the first time includes the disparity between A&O’s female and male partnership and reveals men at the firm are overall paid on average 61.2% more than women. When taken on a median basis, the 2018 disparity is reduced to 39%. Continue reading “A&O matches Magic Circle’s sluggish gender pay gap progress after finally releasing partner pay stats”

A victory for legal privilege as ENRC triumphs in landmark SFO case

City litigators uttered a collective sigh of relief as legal professional privilege (LPP) was upheld in the judgment of the highly-anticipated Eurasian Natural Resources Corporation (ENRC) case against the Serious Fraud Office (SFO).

The decision has wide-ranging implications for businesses and litigators alike as to what information from internal investigations is protected by privilege, after the Court of Appeal today (5 September) ruled the ENRC is not obliged to disclose a series of documents which had been requested by the SFO. Continue reading “A victory for legal privilege as ENRC triumphs in landmark SFO case”

Start me up: Highly-rated legal AI platform Kira secures a record $50m in private equity backing

In a significant benchmark for the legal tech sector, leading AI platform Kira Systems has sealed $50m of private equity backing from New York-based Insight Venture Partners, as legal tech companies continue to prime for growth.

The investment, announced today (5 September), is the first external backing the AI company has received since its inception in 2011, with ex-Weil Gotshal & Manges associate and co-founder Noah Waisberg and Kira CTO Alexander Hudek initially funding the start-up themselves. The company saw year-on-year revenue growth of more than 100% for 2017. Continue reading “Start me up: Highly-rated legal AI platform Kira secures a record $50m in private equity backing”

Ominous signs for western firms in Russia as Akin Gump team quits to launch local independent

The latest sign that life in Russia is getting tough for international firms came today (5 September) as two of Akin Gump Strauss Hauer & Feld’s key Moscow partners quit to launch an independent firm.

Heavyweight litigator Ilya Rybalkin and corporate veteran Suren Gortsunyan have launched Rybalkin, Gortsunyan & Partners (RGP) alongside 11 associates, counsel and paralegals from the US firm – a team which claims to have been involved in transactions cumulatively worth over $80bn. Continue reading “Ominous signs for western firms in Russia as Akin Gump team quits to launch local independent”