In April last year, US-based tech services provider DXC Technology was formed following the merger of The Hewlett-Packard Company’s enterprise division with Computer Sciences Corporation. It was the ideal opportunity for general counsel Bill Deckelman to sit down with senior management and establish what the legal function should look like.

‘To put things simply, it’s too hard for a GC to focus on the administrative side of things while also doing all the strategic stuff,’ says Deckelman. ‘Both the administrative and strategic pieces of the puzzle are becoming more complex and more labour-intensive, and GCs desperately need to think themselves out of the legacy models they have inherited, which were designed to serve completely different business and legal challenges.’

As one of the founding members of AdvanceLaw, a GC-only forum that allows members to share reviews and advice on law firm appointments, Deckelman was interested in taking a new approach to procurement. ‘I realised that the considerations you need to make when appointing counsel have become so complicated that it would be necessary to bring in a full-time person to run the tendering process. The big change in how we are working is that once a panel is selected we will interact with the firms throughout the year, giving them constant feedback on their performance and our expectations.’

A similar approach has been developed by Barclays, says Stéphanie Hamon, head of external engagement for legal. ‘Like any relationship, the client-law firm one can only work on trust and dialogue. You have to set out what you want and give feedback to make sure the other side understands if they are not delivering on it. We should treat our law firms as we do our employees. They’ve got a capability framework that they need to deliver against and to do that we need to give them regular feedback.’

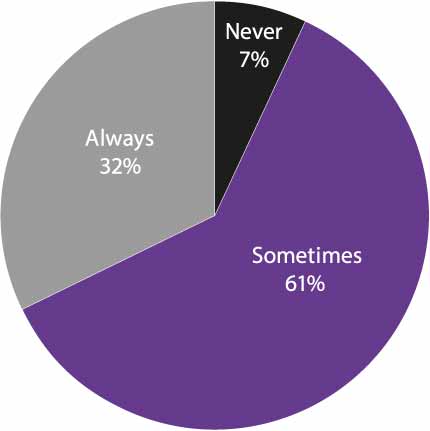

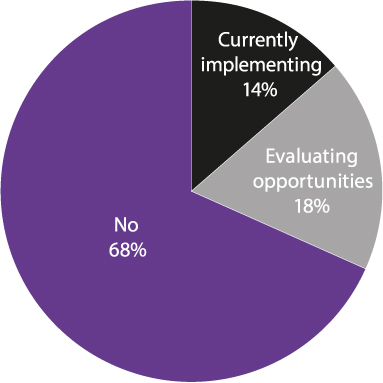

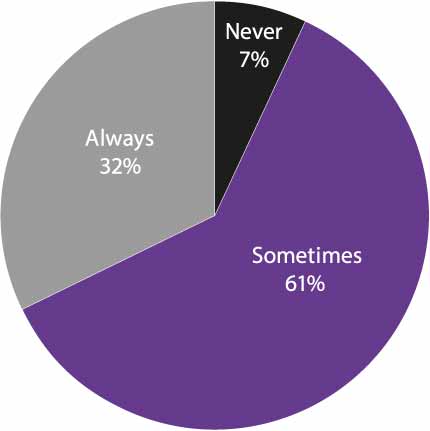

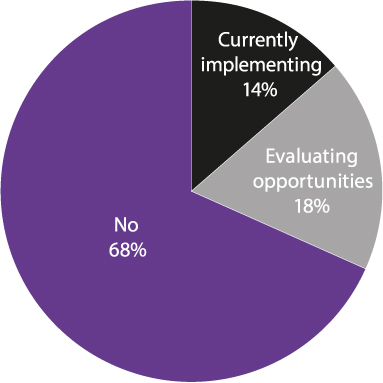

How often do you use alternative fee arrangements over hourly billing?

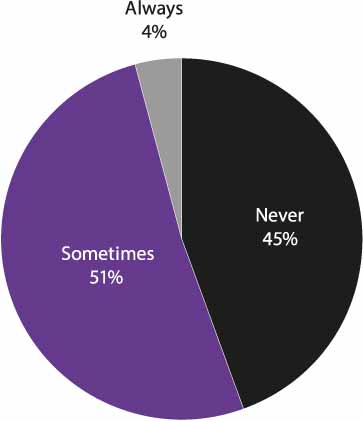

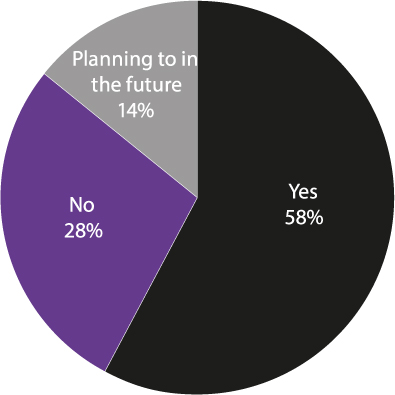

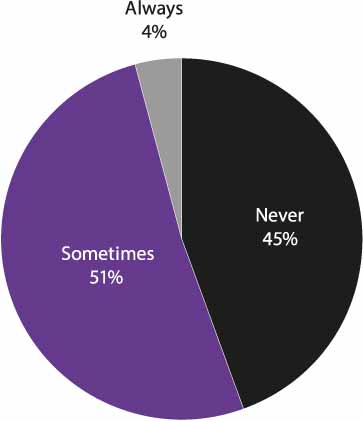

Do you use specialist pricing or procurement professionals in your legal team?

As a result, Barclays’ current panel review process will be its last. In its place, the bank will look to make a continuous assessment of its law firms.

While Barclays’ buying power is atypical, Hamon hopes the approach can be replicated by others. ‘The more we as a profession approach this in a standardised way, the more quickly the industry is likely to change.’ It is clear, however, that panels remain a popular means of assessing external firms.

Nearly two thirds (63%) of those surveyed had a formal panel in place, while a further 9% were planning to appoint one in the near future. It is also apparent that regular assessment of law firm performance remains a rarity. Nearly half (46%) of respondents said they evaluate outside counsel on an annual basis, while over a third (38%) evaluate performance only at the end of a particular matter. Just 14% said they conducted assessments every six months or more frequently.

“GCs desperately need to think themselves out of the models they have inherited, which were designed to serve different business and legal challenges. ”

Bill Deckelman, DXC

Alongside the push for more frequent evaluation of law firms, larger and more sophisticated legal teams are increasingly willing to enter into a more mature conversation about how matters are priced. ‘I have seen a lot more GCs lately abandoning the demand that firms should be more efficient, which is really just a veneer for demanding deeper discounts,’ comments Casey Flaherty, founder of legal technology consultancy Procertas. ‘If that’s all you’re doing, then legal becomes a mindless procurement function. Strategic sourcing does have a role to play, but it can’t just be about beating people up on price. There are not many tricks in that particular bag. Ultimately, pushing down on costs will erode law firm relationships and also erode the value of the legal team.’

Hamon agrees: ‘Everyone is cost conscious, but getting the cheapest price is not a useful way to procure sophisticated services. We need our law firms to be profitable so they can hire the best lawyers. It’s not about squeezing their margins but working with them to address how they can deliver services in a way that covers gaps in our own offering and adds value to the business.’

National Grid’s Mo Ajaz says clients need to get their own affairs in order before criticising advisers. ‘Poor selling practices are prevalent, but we can’t just look at what the firms are doing and blame them without taking any responsibility for the poor buying behaviour that is equally prevalent among legal teams. Law firms are willing to change the way they work and to put effort into making things better, but we need to be clear about what we want. If you outline the steps you want a firm to take or state with clarity what you want to achieve, they will help you. What’s really interesting is that the firms themselves are now looking to build up their own legal ops offering and provide training to their clients on which parts of the legal process can be done by alternative providers.’

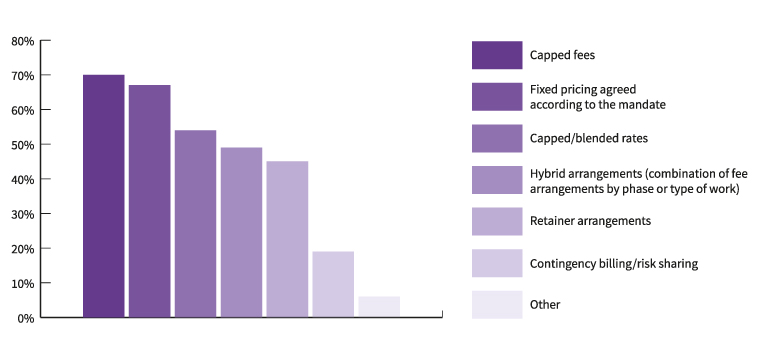

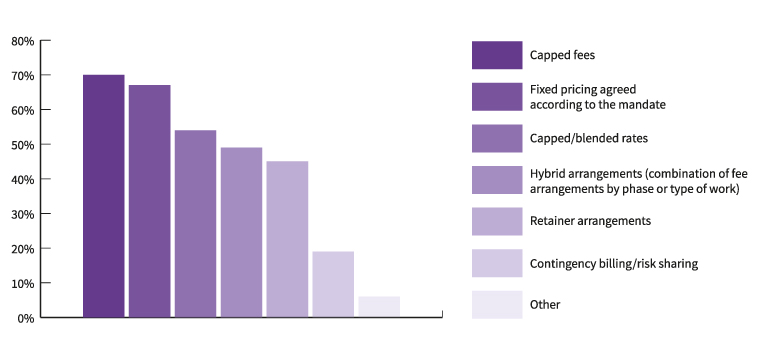

When using alternative fee arrangements, which models do you use?

Deckelman, who recently introduced a legal operations group run by finance professionals to DXC, has seen a similar change in the US. ‘Law firms are beginning to step up by bringing in their own internal budgeting people, often with a finance and accounting rather than a legal background. This trend has come a long way in the last year and will get stronger as law firms figure out that clients are not necessarily demanding lower costs but more rigorous methodologies when it comes to budgeting.’

“In the US, more lawyers are employed by commercial organisations than the 200 largest law firms.”

Casey Flaherty, Procertas

The trend toward measuring law firm performance will also help legal teams reflect on their own work, says Michael Shaw, GC of The Royal Bank of Scotland: ‘In-house lawyers do not normally speak the same language as our business colleagues. They do not necessarily appreciate what great work we do, because we have not been able to communicate that well. Having metrics and processes, driving efficiency, being able to show what we are doing to others has been a real sea change that has professionalised the function.’

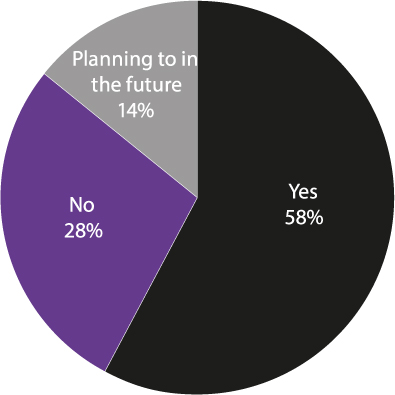

Are you currently or planning to conduct legal service delivery redesign projects?

Do you use alternative legal providers?

And, as Flaherty adds, it may be that the in-house wave is about to break. ‘The growth of in-house has been a prominent feature of the legal industry over the past decade or so, but it can’t continue. In the US, more lawyers are employed by commercial organisations than across the 200 largest law firms. We are now looking at huge payrolls for corporate legal teams and we need to ask whether there might be smarter ways of bending the cost curve.’

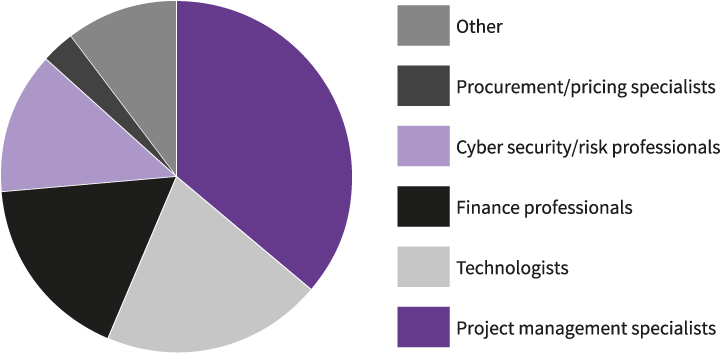

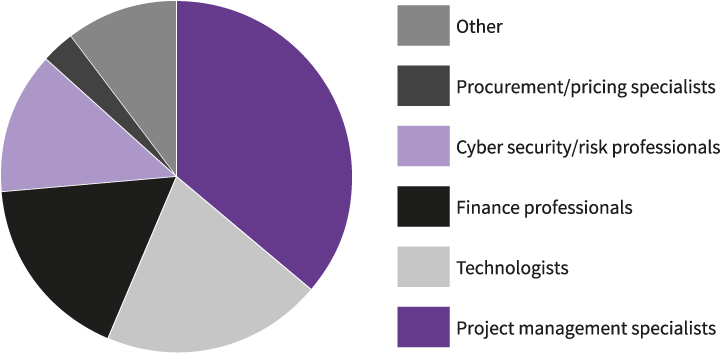

Which non-legal professionals would be most useful to your team?

Maurus Schreyvogel, chief legal innovation officer at Novartis, believes a symbiotic relationship between law firms, in-house teams and alternative providers will become the norm. ‘Even a company the size of Novartis will need law firms to control big events in M&A and litigation, because it is not cost efficient to have a lot of subject-matter expertise as regular members of the team. However, the same is likely to be true of the more commoditised legal work we handle. We have had good experience with alternative providers who use technology to resource legal work and I believe the market is finally mature enough for this to become the norm. That means the capability of law firms to deploy technology or work alongside outsourcers will become

the key decision criteria when we come to assess their ability to provide legal advice.’