After a year in which the courts sent clear signals on how collective and funded claims are likely to progress, the stage is set for 2026 to bring more cases that further push the limits of the UK disputes market.

As long-running disputes move to decisive phases, what matters is not just who wins, but whether the outcome justifies the scale and cost.

A tech showdown in the CAT: Epic Games v Alphabet and Google

A tech showdown in the CAT: Epic Games v Alphabet and Google

In autumn 2026, the Competition Appeal Tribunal will hear a consolidated trial of three claims against Google and its parent company, Alphabet, in what is shaping up to be the CAT’s most complex multi-party case to date.

The first, Epic Games v Alphabet, filed in 2020, saw the creator of Fortnite bring a claim alleging Google abused its dominance in the UK Android app distribution market by forcing app developers to use the Google Play store and its Google Pay billing system, which typically carries a commission of 30%.

The second claim, Elizabeth Coll v Alphabet & others, filed in 2021 by class representative Elizabeth Coll, represents nearly 19.5 million UK Android users in opt-out proceedings seeking over £1bn in damages for alleged overcharging on apps and in-app purchases, again alleging abuse of dominance in the Google Play store.

Lastly, in Rodger v Alphabet & others, Professor Barry Rodger is leading a collective action on behalf of roughly 2,200 UK app developers for similar anti-competitive practices by Google, including inflated commissions and exclusionary conduct.

The trial is listed for approximately 14 weeks from September 2026.

This case crystallises the CAT’s growing role as a forum for global tech disputes, with the current value of claims in the CAT against Google and Apple alone exceeding £30bn.

The outcome will inevitably dictate strategy for both claimant and defendant-side firms in future claims.

Beyond liability, the proceedings are ones to watch as management of aggregate damages methodologies will be tested, an area that drew criticism in early CAT litigation. The outcome of the two collective proceedings, Elizabeth Coll and Rodger, will be of particular interest to funders, for whom the question remains whether returns will match the time and capital required to sustain mega-claims through trial.

The legal line-up

For the claimants, class representative Elizabeth Helen Coll v Alphabet & others: Brick Court’s Mark Hoskins KC and Matthew Kennedy, Monckton’s Ronit Kreisberger KC and Antonia Fitzpatrick, One Essex Court’s Gideon Cohen and Fountain Court’s Hannah Bernstein, instructed by Hausfeld partners Lesley Hannah, Joanna Christoforou and Daniel Hunt.

For the claimants, Epic Games v Alphabet & others: Brick Court’s Colin West KC and David Scannell KC, instructed by Norton Rose Fulbright partners Caroline Thomas, Susanna Rogers and Mark Tricker.

For the class representative in the related case of Rodger v Alphabet & others: XXIV Old Buildings‘ Bethanie Chambers, Brick Court’s Robert O’Donoghue KC and Sarah O’Keeffe, Monckton’s Anneliese Blackwood, and Fountain Court’s Daniel Carall-Green, instructed by Geradin partners David Gallagher, Jennifer Reeves, Patrick Teague and Anthony Ojukwu.

For the defendants, Alphabet, Google, Google Ireland, Google Commerce and Google Payment (Google Asia Pacific and Google UK are also included as defendants in the Rodger v Alphabet & others proceedings): Monckton’s Josh Holmes KC, Kassie Smith KC, Jack Williams, Jenn Lawrence and Luke Kelly, and Hailsham Chambers’ Jamie Carpenter KC, instructed by RPC partners David Cran, Chris Ross and Rathi Thiagamoorthy.

Below the surface: Various investors v Glencore, Ivan Glasenberg and Steven Kalmin

Below the surface: Various investors v Glencore, Ivan Glasenberg and Steven Kalmin

The landmark shareholder group action claim against natural resources titan Glencore is set to reach a conclusion as investors head to the Commercial Court in October for a much-anticipated liability trial.

The UK-domiciled, Swiss-headquartered company and its subsidiaries first came under SFO scrutiny in 2019, following a co-ordinated global investigation into allegations of bribery, corruption, and fraudulent misconduct in South America, Africa and the US dating back to 2006.

For Glencore, this resulted in a 2022 indictment, a guilty plea to seven counts of unlawful activity, and over £1bn paid out in fines globally.

Now four sets of institutional investors are bringing multibillion-dollar ‘stock-drop’ claims under sections 90 and 90A of the Financial Services and Markets Act 2000 against the company, its former CEO Ivan Glasenberg and current CFO Steven Kalmin. The shareholder liability claim rests on alleged ‘untrue and misleading statements’ in the company’s prospectus and arose because of ‘Glencore’s failure to disclose that bribery, corruption and fraud were prevalent in the business activities of key operating subsidiaries.’

The case will be watched closely across the litigation market for what it indicates about the ever-evolving law of reliance; crucially, how proof of reliance may be established where passive investors relied on the integrity of the market and price formation.

Keith Thomas, head of securities litigation at Stewarts, highlights its importance, saying that ‘the decisions on a number of key untried issues will move the whole jurisdiction forward’ – provided, he adds, that the case does not settle, a hallmark of 2025 securities claims.

The legal line-up

For the Legal & General claimants: Brick Court’s Mark Howard KC, Maitland’s David Mumford KC and James Kinman, 4 New Square’s Robert Marven KC, and 3VB’s Philip Hinks, instructed by BCLP partners Ravi Nayer, Ben Blacklock and Rhys Corbett.

For the claimant, Aabar Holdings: Fountain Court’s Bankim Thanki KC, Nicolas Damnjanovic, Kit Holliday and Sam Burns, and 3VB’s Adam Kramer KC, instructed by Quinn Emanuel partner Julianne Hughes-Jennett.

For the Stewarts claimants: 3VB’s Andrew Onslow KC, One Essex Court’s Richard Mott and Sabrina Nanchahal, and 4 New Square’s Usman Roohani, instructed by Stewarts partners Keith Thomas, Elaina Bailes, Harry McGowan and Joe Mitchell.

For the defendant, Glencore: 4 Stone Buildings’ Richard Hill KC and Greg Denton-Cox and Brick Court’s Tony Singla KC, Kyle Lawson and Jacob Rabinowitz, instructed by Clifford Chance partners Luke Tolaini and Kelwin Nicholls.

For the defendant, Glencore CFO Steven Kalmin: Fountain Court’s Patrick Goodall KC and Rebecca Loverage, instructed by Hogan Lovells partner Philip Parish.

For the defendant, former Glencore CEO Ivan Glasenberg: One Essex Court’s Laurence Rabinowitz KC, Alexander Polley KC and Andrew Lodder, instructed by Steptoe partners Zoe Osborne and Angus Rodger.

Controlling the flow: the Thames Water restructuring

Controlling the flow: the Thames Water restructuring

The long-running dispute over the Thames Water rescue returns to the courts in 2026, in one of the most complex restructurings to date.

After years of financial distress, last year Thames Water received a £3bn emergency financing package designed to stabilise the utility short term and avert insolvency. But the court-sanctioned plan was only a temporary solution.

This year, the utility is working toward a longer-term restructuring plan, seeking court approval for one that addresses underlying capital structure and more than £22bn in liabilities.

The first hearing, anticipated in spring 2026, will consider creditor class composition and jurisdiction. A second ‘sanction’ hearing, likely in summer 2026, will determine whether the restructuring plan should be approved and imposed.

The new plan is likely to be hotly contested. Key issues include creditor-on-creditor pressures, valuation disputes, allocation of losses between debt classes, and the extent to which public interest considerations and regulatory obligations should influence the court’s approach.

The stakes are high. Failure to secure approval revives the prospect of a Special Administration Regime (SAR), a route yet to be tested, and one that carries significant political and financial consequences. The outcome will have implications not only for Thames Water but its diverse stakeholders – including Ofwat, the Government, US hedge funds, environmental advocates, and two state-backed Chinese banks.

Other implications include complex valuation methodologies, class selection under Part 26A, and investor confidence in UK infrastructure.

The legal line-up

For the Class A ad hoc group of creditors: South Square’s Adam Al-Attar KC and Edoardo Lupi, instructed by Akin partners Barry Russell, Emma Simmonds, Emma Butler, Kambiz Larizadeh, Alex Harrison and Sam Brodie.

For the plan company, Thames Water Utilities Holdings: South Square’s Tom Smith KC, Charlotte Cooke and Andrew Shaw, instructed by Linklaters partners Rebecca Jarvis, Mark Nuttall, Max Krasner and Euan Clarke.

For the bank supporting creditors: South Square’s Stephen Robins KC, instructed by A&O Shearman partners Tim Conduit, Katrina Buckley and Nick Lister.

For Thames Water: Erskine Chambers’ Andrew Thornton KC and South Square’s Georgina Peters, instructed by Freshfields partners Neil Golding and Lindsay Hingston.

Show me the money: Municipio de Mariana v BHP, phase two

Show me the money: Municipio de Mariana v BHP, phase two

In a significant development for the UK mass tort landscape, BHP’s application for permission to appeal the High Court’s November 2025 liability ruling was recently refused, clearing the way for a quantum trial in October 2026.

The High Court last year found the natural resources giant liable for the 2015 collapse of the Fundão Dam in Brazil that killed 19 people and caused widespread environmental devastation.

Slaughter and May acted for BHP during the liability proceedings, while claimant boutique Pogust Goodhead secured victory for the 600,000 claimants in the largest opt-out class action claim to date and a decisive moment for parent-company liability claims brought in the UK in respect of overseas harm.

With the appeal now closed off, October 2026 will see the claimants seek damages at a value of £36bn, facing off against BHP’s freshly mandated legal counsel, Herbert Smith Freehills Kramer, which replaced Slaughters in late December.

The hotly anticipated decision on quantum will be seismic for the future of the fashionable class action proceedings that populated both the High Court and the CAT in 2025.

Now we will see exactly how much the case was worth, testing not only valuation methodologies in mass tort litigation but the economic sustainability of class actions of this scale. If damages fall significantly short of topline figures, as occurred in Merricks v Mastercard, the outcome could force a recalibration of claimant strategy in future group actions.

The legal line-up

For the claimants: One Essex Court’s Alain Choo Choy KC; Twenty Essex’s Andrew Fulton KC, Alma Mozetic and Jonathan Ketcheson; Temple Garden’s Russell Hopkins and Anisa Kassamali; Cornerstone Barristers’ Hannah Taylor; Serle Court’s Jonathan McDonagh and Sophie Holcombe; and Blackstone Chambers’ Antonia Eklund instructed by Pogust Goodhead’s Jonathan Wheeler alongside Caroline Narvaez Leite, Tom Ainsworth and Rafaela Conte.

For the defendants: Herbert Smith Freehills Kramer, led by Alan Watts.

Dieselgate: Various claimants v Mercedes-Benz Group, Volkswagen, Ford Motor Company, Nissan Motor Co

Dieselgate: Various claimants v Mercedes-Benz Group, Volkswagen, Ford Motor Company, Nissan Motor Co

After nearly ten years of controversy, the Pan-NOx emissions group litigation – or ‘Dieselgate’ – is finally poised to see some movement in 2026.

The group action brought on behalf of over a million diesel car owners against five of the world’s largest car manufacturers accused of manipulating emissions tests kicked off in the High Court in October 2025, with liability to be decided in mid-2026.

The scale and breadth alone make this case one of the most closely watched group actions in recent years. If the claimants win, the compensation phase could lead to billions in payouts, and set an important precedent for consumer-environmental litigation.

Beyond quantum, the litigation is expected to test the effectiveness of the UK’s collective redress regime in handling complex data-heavy disputes involving multinational defendants and long-running regulatory investigations.

The legal line-up

For the claimants: Blackstone Chambers’ Tom de la Mare KC and Ben Jaffey; Henderson Chambers’ Oliver Campbell KC, Rachel Tandy and Freya Foster; 3VB’s Adam Kramer; 2 Temple Gardens’ Gareth Shires, Jessica van der Meer, Sam Stevens and Anna Dannreuther; and Matrix Chambers’ Joanna Buckley, Kate Boakes and Catherine Arnold instructed by Pogust Goodhead’s Anna Varga, Erika Saluzzo, Oliver Shipway, Matthew Newbould and Melissa Ferrari, Hausfeld’s Nicola Boyle, and partners from Milberg London and Leigh Day.

For the defendants: Brick Court’s Tom Adam KC, Richard Blakeley KC, Zahra Al-Rikabi and Camilla Cockerill instructed by HSFK’s Natasha Johnson, Alan Watts, David Bennett and Philip Lis for Mercedes-Benz Group; Blackstone Chambers’ Brian Kennelly KC and Rayan Fakhoury instructed by Freshfields partners James Roberts and Simon Duncombe for Volkswagen; Monckton’s George Peretz KC and 2 Temple Gardens’ Ben Phelps instructed by McGuireWoods partners William Boddy and Chloe Steele for Ford Motor Company; Monckton’s Anneli Howard KC and One Essex Court’s Stephen Auld KC and Simon Gilson instructed by Hogan Lovells partners Matthew Felwick and Valerie Kenyon for Nissan Motor Co; Fountain Court’s Leigh-Ann Mulcahy KC and Brick Court’s Charlotte Tan instructed by Cleary partners James Brady, Kathryn Collar and Pablo Mateos Rodriguez for Vauxhall; Crown Office Chambers’ Alexander Antelme KC and Richard Sage and Brick Court’s Fred Wilmot-Smith instructed by Signature partner Tom Snelling for Renault.

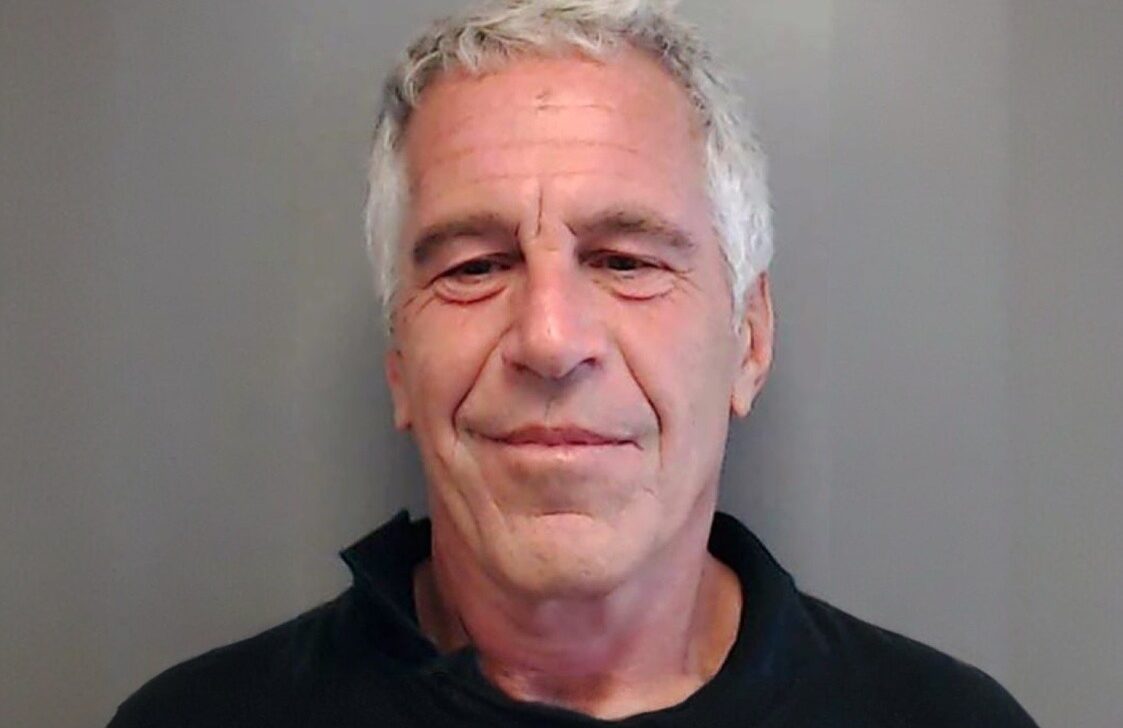

In the email conversation – which took place seven years after Epstein was first jailed for sex offences, including one charge relating to a minor – Karp (pictured) describes his time at Epstein’s house as ‘truly “once in a lifetime” in every way.’

In the email conversation – which took place seven years after Epstein was first jailed for sex offences, including one charge relating to a minor – Karp (pictured) describes his time at Epstein’s house as ‘truly “once in a lifetime” in every way.’ The emails also contain email correspondence from Ruemmler (pictured). After a Christmas Day 2015 message in which Epstein asked his assistant to organise a trip for her, Ruemmler says in a subsequent email: ‘Jeffrey is just being wonderful Jeffrey… I adore him. It’s like having an older brother!’

The emails also contain email correspondence from Ruemmler (pictured). After a Christmas Day 2015 message in which Epstein asked his assistant to organise a trip for her, Ruemmler says in a subsequent email: ‘Jeffrey is just being wonderful Jeffrey… I adore him. It’s like having an older brother!’

A tech showdown in the CAT: Epic Games v Alphabet and Google

A tech showdown in the CAT: Epic Games v Alphabet and Google Below the surface: Various investors v Glencore, Ivan Glasenberg and Steven Kalmin

Below the surface: Various investors v Glencore, Ivan Glasenberg and Steven Kalmin  Controlling the flow: the Thames Water restructuring

Controlling the flow: the Thames Water restructuring Show me the money: Municipio de Mariana v BHP, phase two

Show me the money: Municipio de Mariana v BHP, phase two Dieselgate: Various claimants v Mercedes-Benz Group, Volkswagen, Ford Motor Company, Nissan Motor Co

Dieselgate: Various claimants v Mercedes-Benz Group, Volkswagen, Ford Motor Company, Nissan Motor Co

Commercial knowledge

Commercial knowledge Quality of partners

Quality of partners Overall client service

Overall client service

Ravi Aswani, 36 Stone

Ravi Aswani, 36 Stone Rosemary Davidson, 6KBW College Hill

Rosemary Davidson, 6KBW College Hill Timothy Killen, 3 Verulam Buildings

Timothy Killen, 3 Verulam Buildings Christopher Knight, 11KBW

Christopher Knight, 11KBW Alasdair Mackenzie, Doughty Street Chambers

Alasdair Mackenzie, Doughty Street Chambers Laura Newton, Brick Court Chambers

Laura Newton, Brick Court Chambers Caroline Pounds, Quadrant Chambers

Caroline Pounds, Quadrant Chambers Nehali Shah, One Essex Court

Nehali Shah, One Essex Court Professor Philippa Webb, Twenty Essex

Professor Philippa Webb, Twenty Essex Nicholas Wilkinson, 1 Hare Court

Nicholas Wilkinson, 1 Hare Court