*Market estimate, not provided by firm

The Euro Elite: Market overviews

Ireland

The Emerald Isle may be small – its two million-workforce delivers a tax take of just €50bn – but last year’s exceptional 6.7% GDP growth followed an equally strong 2017 and makes Ireland the standout performer among the EU27. All would be well were it not for another six-month delay to Brexit. ‘There was a noticeable nervousness in the lead up to the original Brexit date of 29 March; things have been very busy again since then,’ says Brian O’Gorman (pictured), managing partner at Arthur Cox.

‘The economy is buoyant and, for now, we’re getting a Brexit bounce without a Brexit burden,’ says Declan Black, managing partner of Mason Hayes & Curran, where 2018 revenues were up 6%. He points to energy (particularly renewables), technology and financial services as sectors that are doing particularly well.

Overall, performance has varied – from 4% revenue growth at William Fry to more than 10% at Matheson. ‘The first quarter of 2018 was a bit quieter than expected, but performance thereafter was very strong with activity in M&A and private equity,’ says William Fry’s managing partner Bryan Bourke. ‘It was a record year of growth – advances were made across all practice areas,’ says Michael Jackson, Matheson’s managing partner, who highlights technology, fintech, pharma/life sciences, energy and financial services as standout sectors.

Other large Irish independents also enjoyed a good year: Arthur Cox and A&L Goodbody both saw 5% growth. O’Gorman points to a strong performance in corporate, finance and dispute resolution, while Goodbody’s managing partner, Julian Yarr, says: ‘We had an excellent year in winning client mandates in a very competitive and uncertain market with good revenue growth across our core areas: litigation, corporate, property and financial services.’ The firm was involved in the majority of mandates in the renewable energy sector and was named International Law Firm of the Year at the 2019 Legal Business Awards.

‘There was noticeable nervousness in the lead up to the original Brexit date; things have been very busy since then.’

Brian O’Gorman, Arthur Cox

As evidence of its strength across the board, McCann FitzGerald managing partner Barry Devereux quotes the Irish Law Society report: ‘The star performer in 2018 was McCann FitzGerald, with an increase of 31 practitioners – probably the biggest single-year growth number for an Irish firm ever.’ Growth areas included: funds and asset management, aircraft finance, energy, real estate, tax and litigation, investigations and large commercial disputes.

More international firms have also been lured by Ireland’s potential. Clyde & Co, DLA Piper and Simmons & Simmons have all opened Dublin offices since January 2018, and have since expanded their footprint, while Fieldfisher recently entered a full-scale merger with Irish independent McDowell Purcell. In anticipation of Brexit, the impact of dual qualification has been significant. Of the 18,460 solicitors on the Irish roll, 2,200 first qualified in England and have joined since the referendum vote.

Demand for Irish lawyers is causing an inevitable spike in salaries. ‘One of the biggest challenges is the battle for talent,’ says Bourke. ‘The cheques being written to get people feels like when the US firms arrived in London.’

Black adds: ‘It’s a great time to be an Irish lawyer. The arrival of new entrants into the market is driving considerable wage inflation, because they are hiring local lawyers.’

Dominic Carman

Nordics

Nordic firms have good reasons for a cautious forecast for 2019 as expectations of an economic slowdown start to loom and last year’s lively private equity (PE) market shows some signs of cooling.

According to Arne Møllin Ottosen, managing partner for Copenhagen at Kromann Reumert, PE activity has slowed this year compared to the last three because price expectations on the sell side are too high. Paula Röttorp, managing partner of Hannes Snellman’s Stockholm office, notes a shift in investor focus away from PE to public M&A deals in the last year.

But if a downturn is on the horizon following a sustained period of steady economic growth in Europe, independent firms are yet to feel the pinch with many still reporting a healthy stream of M&A and transactional work. Fredrik Rydin, Roschier’s managing partner for Stockholm, says Helsinki in particular and the wider Nordic region’s growing reputation as a hub for tech unicorns has resulted in more M&A work for the firm. Last year Roschier acted for PayPal in its $2.2bn purchase of iZettle, a Swedish fintech company. ‘I’m surprised that the market has been this good for so long,’ adds Ottosen.

Meanwhile, last year was a record year for Swedish firm Mannheimer Swartling, with revenue now standing at around €130m. ‘We’ve had a super strong start to the year, which has been 7% up over the last few months compared with January to April last year,’ comments the firm’s managing partner for Stockholm, Jan Dernestam.

‘DLA Piper came to Denmark last year, but no-one can see how one international firm can compensate for inbound referrals.’

Simon Evers Hjelmborg, Bech-Bruun

Competition from international law firms seems to be more of an ongoing expectation among Nordic independents than a pressing concern, but there are fears alternative legal providers could prove a more immediate threat to the future of major independent firms.

Ottosen says: ‘The Big Four have been building up their internal legal departments and setting up shop in Denmark. They could establish themselves at the lower end of the market but EY and PwC have stated their intentions to build up their legal services here and they’re huge players with over 1,000 lawyers.’

Bech-Bruun’s managing partner Simon Evers Hjelmborg observes: ‘DLA Piper came to Denmark last year and that was good for them, but no-one can see how one international firm can compensate for inbound referrals. There are rumours Dentons might set up here, but more in the mid-market.’

There has, however, been disruption in Sweden. Last year, well-established mid-tier law firm Lindahl was forced to separate its Stockholm office after two partners broke away to start their own firms. ‘Lindahl is an old firm and it was the talk of the town when it split its offices in two, which was a big deal,’ says Rydin. ‘The leading firms have taken a stronger position and smaller independent firms have been struggling to find their market. It’s difficult for mid-tier firms to find their spot.’

Anna Cole-Bailey

Iberia

Despite economic slowdown and political unrest in the Catalan region, those anticipating a year ago that international law firms would continue to ramp up their investment in Iberia have not been disappointed.

Spain and Portugal are still among the fastest-growing economies in western Europe, with GDP rising by 2.6% and 2.1% in 2018 respectively. Foreign investors, including private equity houses, keep bringing their money in and the crucial real estate sector remains active.

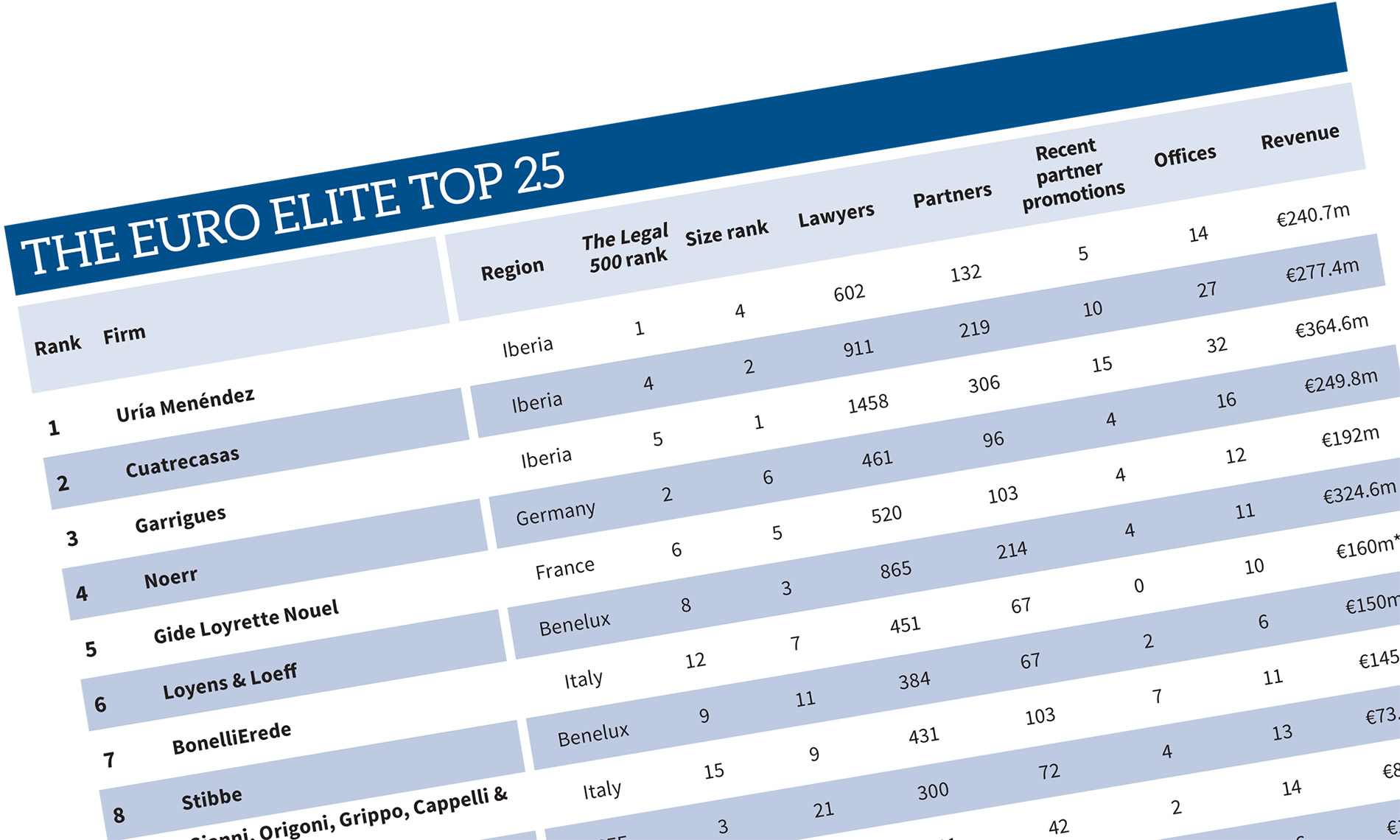

Undoubtedly, the year has not been without its challenges for the local champions. Uría Menéndez remains the top Spanish player for high-end work and leads Legal Business’ Euro Elite Top 25 table this year. It acted for domestic toll operator Abertis on its €16.5bn acquisition by a consortium of Italy’s Atlantia, Spain’s ACS and Germany’s HOCHTIEF. However, it recorded slower revenue growth of 2% to €240.7m in 2018 compared to 6% in 2017 due to a more difficult year in some Latin American jurisdictions, which remain a key component of the business of leading Spanish firms.

Continental Europe’s largest and highest-grossing firm, Garrigues, also increased revenue by 2% to €364.6m. Mandates included advising CVC Capital Partners in the €3.8bn acquisition of 20% of Gas Natural Fenosa from Repsol. But the challenges and enduring strengths of Spanish firms are best embodied by Barcelona-bred Cuatrecasas.

The status of Catalonia’s capital as a key legal centre is in question amid the unrest following the 2017 unconstitutional referendum in which a majority voted for the region’s independence. Cuatrecasas is now implementing a strategy to grow its Madrid business, with five laterals in the capital in the last 18 months, including Spain’s former deputy prime minister Soraya Sáenz de Santamaría. Last year’s financials provided a validation to the strategy, the firm hiking turnover 12% to €277.4m. ‘The events of 2017 brought a certain alarm. We had a very restrictive budget for 2018 and the reality is it’s been the best year,’ says managing partner Jorge Badía.

Meanwhile, the aggressive growth of a group of foreign firms has been triggering more action in a traditionally quiet lateral market. Since the headline-grabbing hire of DLA Piper’s senior partner Juan Picón at the end of 2017, Latham & Watkins has relentlessly grown its local ranks from 18 to almost 50, including three further laterals from DLA and one from Linklaters. DLA’s response hit Garrigues, which lost its M&A partner José María Gil-Robles in February.

But the list of international growth stories goes much wider, ranging from long-standing players Allen & Overy and Clifford Chance to new entrants Fieldfisher and Pinsent Masons. International interest in Iberia is strong enough to reach even Spain’s smaller neighbour, with Dentons said to be working on a merger in Portugal, a market traditionally pretty much ignored by the global elite.

‘2017 was the first year people acknowledged Portugal had come out of the crisis: suddenly everyone was doing things. The good news is that’s continuing,’ says Morais Leitão, Galvão Teles, Soares da Silva & Associados (MLGTS) partner Filipe Lowndes Marques. MLGTS and Vieira de Almeida & Associados had slower revenue growth than previous years partly due to economic and political turmoil in Portuguese-speaking Africa. But the third Portuguese champion, PLMJ, hiked turnover by 11%. All three remain around the €50m turnover mark.

Iberian firms will have to get used to more competition from abroad and less helpful news from local politics and economy. But there is still enough money flowing into Spain and Portugal to keep many players happy.

Marco Cillario

Switzerland

Given the economic and political uncertainty elsewhere in Europe, Switzerland has few obvious concerns and so do its law firms. ‘It was a very good year with record turnover,’ says Daniel Hochstrasser, senior partner at Bär & Karrer, where revenues rose by 6%. Financing transaction partner Martin Anderson and financial products partner Frédéric Bétrisey joined the firm from Baker McKenzie in Geneva last September.

A similar performance applied at Homburger, which saw a 5% revenue increase. ‘In this zero-inflation, zero-interest rate environment, that is pretty decent – our profits per partner are getting better and better as well,’ says Daniel Daeniker, the firm’s managing partner. Switzerland, he argues, is a remarkable success story. Largely unhindered by international competition, these two heavyweight firms continue to feature in major corporate and transactional work. But without any major Swiss deals taking place last year, mid-sized M&A predominated.

Growth among other independents focused on developing wider market share was more dramatic: with revenues of €95m, Walder Wyss experienced a 15% uplift. ‘This was a huge increase in a special year: it will be a challenge to sustain that level of growth,’ says partner Hans Rudolf Trüeb. ‘2018 was like 2007 – a stellar year for Swiss firms, with an abundance of transactions just before the financial crisis hit. The party may yet go on for another year or two.’ Tax partner Fouad Sayegh joined the firm from Oberson Abels last May. Since 2013, the Walder Wyss lawyer headcount has doubled to 210, of whom 55 are partners, making it the second-largest Swiss firm. Meanwhile, a recent merger has created a new Swiss entrant to the Euro Elite – the creation of Kellerhals Carrard in 2015 follows the prominent merger of two independents.

‘2018 was a stellar year for Swiss firms. The party may yet go on for another year or two.’

Hans Rudolf Trüeb, Walder Wyss

For Lenz & Staehelin, still Switzerland’s largest firm, tax has been the standout, according to managing partner Guy Vermeil. ‘The tax department people are working day and night,’ he says, adding that M&A has also been strong. Meanwhile, Pestalozzi, which had a revenue decline in 2017, recovered to see double-digit growth in 2018. ‘Finance, in particular commodity trade finance, and technology were strong,’ says managing partner Urs Kloeti. ‘Litigation was also active and we had several arbitrations.’ In international arbitration, some Swiss independents ‘act as sub-contractors to the major international players, such as Freshfields,’ notes one managing partner.

Hochstrasser points to ‘busy practices across the board with some big investigations in banking and insurance, triggered primarily by foreign authorities requesting information from Swiss enterprises – probably the most important driver for a very good year’. Deals apart, Homburger was similarly busy, acting for Raiffeisen Bank in what Daeniker describes as ‘a most spectacular piece of investigation work’. Trüeb suggests that at Walder Wyss, IT/IP and asset-backed financing were particularly strong.

The yes vote in the recent referendum on a new corporate tax regime prevented what the Swiss finance minister had termed an existential threat to the country’s role as a business hub. ‘This is very important for Switzerland,’ says Vermeil. Although managing partners expect a strong 2019, one problem persists. ‘We need to get our institutional relationship with the EU in order,’ says Daeniker. ‘Brexit discussions have made this more rather than less difficult.’

Dominic Carman

Germany

The German economy grew by a modest 1.5% in 2018 – its weakest performance in five years. But while revenues at some large independents only increased in line with this figure – Gleiss Lutz was up from €195m to €200.1m, while Hengeler Mueller remained stable at around €265m – elsewhere they increased dramatically. Noerr’s revenues swelled by 12% to €249.8m while Heuking Kühn Lüer Wojtek reported an 18% increase to €177m.

‘We continued the dynamic growth that we’ve experienced over the past decade – our firm has perhaps the best growth story in the market, which has been good for major firms, not just us,’ says Alexander Ritvay, Noerr’s co-managing partner. ‘The market has been solid and we don’t feel any impact of a slowdown yet.’

Alexander Schwarz, managing partner of Gleiss Lutz, says: ‘It was our third record year in a row – the first time we exceeded €200m in turnover and all other indicators are at a record high.’ Andreas Urban, managing partner of Heuking, comments: ‘It was a very good year, our best ever. In Germany, there was a lot of business.’

So what were the drivers of growth? ‘Corporate and M&A to a significant extent, but equally litigation and digital transformation,’ says Ritvay. ‘Litigation was the biggest practice area last year – we have a lot of class action-type disputes,’ says Urban. In this realm, ‘dieselgate’ remains a prominent feature. ‘We have been advising Volkswagen and Audi,’ says Schwarz, adding that compliance and antitrust work have also been very strong.

In M&A, Hengeler remained at the forefront of big deals, advising Linde in its $90bn merger of equals with Praxair, innogy on the sale of RWE’s 77% stake in its business to E.ON in a $53bn deal, and Finnish energy company Fortum Oyi in its $8bn acquisition of Uniper. ‘We have been deeply entrenched in the energy market,’ says Rainer Krause, Hengeler’s managing partner. Gleiss and Hengeler were on opposite sides in the recently-aborted merger of Deutsche Bank and Commerzbank.

Lateral moves continue unabated: Noerr recently hired tax partner Elmar Bindl from Linklaters and real estate partner Christoph Hons from Jones Day, while Gleiss hired M&A/corporate partner Andreas Löhdefink from Shearman & Sterling, further underlining Shearman’s continued retrenchment in the German market.

But other international firms continue to pose a significant challenge. Despite its long-term plan to reduce its German partner headcount from 100 to 80 by next year, the strongest remains Freshfields Bruckhaus Deringer, while independents also point to Linklaters as a strong rival in Germany. Elsewhere, Latham & Watkins has been on a near-continuous German hiring spree, most recently taking banking partner Thomas Weitkamp from Clifford Chance and corporate partner Tobias Larisch from Freshfields. Schwarz refers to Latham’s extensive recent lateral hiring spree as ‘brave but also risky’.

Krause adds: ‘It is the depth of the bench that really makes the difference. Some US firms have established a footprint in Germany. But when it comes to complex transactions, you need to give the full range of advice across multiple practice areas.’

Dominic Carman

The Euro Elite Methodology

Legal Business’ Euro Elite comprises independent law firms based in more than 40 European jurisdictions, rather than the local offices of international firms.

To compile the 100 firms featured in this report Legal Business analysed more than 150 of the largest law firms in Europe by the number of lawyers, as well as more than 150 of the top-ranking firms in the current edition of The Legal 500 EMEA. A combined score was given for the size of the firm and its Legal 500 rankings, providing a qualitative as well as a quantitative analysis. The 100 firms with the highest combined score make The Euro Elite. Continue reading “The Euro Elite Methodology”

The Euro Elite 100

Baltics

Benelux

CEE

France

Germany

Iberia

Ireland

Italy

Nordics

Russia and CIS

Southern Europe

Switzerland

The Euro Elite: France – La vie en rose

Any conversation with a French lawyer these days turns at some point to the volatility of the market and the unpredictability of the future. But there is more substance to these words this time around than a reflection of the industry’s traditional caution.

In just over two years, France has gone from an election that might have ended up with a populist anti-EU leader to the enthusiasm for the victory of business-friendly, pro-European Emmanuel Macron… and then to the rude awakening of social unrest and economic slowdown. Continue reading “The Euro Elite: France – La vie en rose”

Client Service Awards – What clients really want

Stewarts, Mishcon de Reya and Weil, Gotshal & Manges have emerged among the top-performing law firms for client service in the UK, according to brand new Legal 500 research assessing what clients really think about their external advisers.

The trio are among a host of leading US and UK firms to have been recognised by our new research project, which is the culmination of one of the most comprehensive surveys of law firm clients ever. Continue reading “Client Service Awards – What clients really want”

The Last Word: Elite forces

As part of our annual Euro Elite report, management at independent firms in Europe give their views on today’s market challenges

International focus

‘In 2017 we had a record performance. 2018 was a year of big investment to consolidate our development in Africa and the Middle East but we did it halfway through the year. We are going to continue and consolidate our strategy. A lot of attention and energy will be on the international development. Our strategy is still to become a leader in the Mediterranean area, Africa and the Middle East. For now we are optimistic but from the second half of 2018 we have seen a decrease of investment in M&A.’ Continue reading “The Last Word: Elite forces”

Sponsored briefing: With great funding comes great responsibility!

Jacqueline Young from Augusta Ventures discusses the challenge litigation funders face to balance support for access to justice with more commercial considerations

We operate in a strong and growing legal environment. The UK legal services industry is going from strength to strength. A recent report valued the market at £35bn in 2018, with growth forecast at 5% in the coming years. Continue reading “Sponsored briefing: With great funding comes great responsibility!”

Eversheds records double-digit growth as ‘uncertainty barometer’ rises

Eversheds Sutherland (International) has built on its 2017 transatlantic merger with a second year of strong revenue and profit growth.

However, chief executive Lee Ranson (pictured) has cautioned that the ‘uncertainty barometer is increasing’, although this will not dampen the firm’s appetite for further investment. Continue reading “Eversheds records double-digit growth as ‘uncertainty barometer’ rises”

Herbert Smith Freehills partner reported to SRA for threatening sexual harassment claimant

A woman who filed a sexual harassment case against her employer was allegedly told by a Herbert Smith Freehills (HSF) lawyer the case would end her career.

City finance associate Nathalie Abildgaard was awarded £270,000 in April after settling a sexual harassment case against her employer IFM Investors. However Abilgaard wrote in a submission to the Women and Equalities Committee a HSF lawyer had engaged in ‘aggressive and intimidating behaviour.’ Continue reading “Herbert Smith Freehills partner reported to SRA for threatening sexual harassment claimant”

No Buzz Lightyear complex as Kennedys’ revenue tops £200m for the first time

Kennedys senior partner Nick Thomas will be ‘very disappointed’ if the firm does not have another year of double-digit growth after its revenue broke through £200m for the first time this year.

Global turnover at the insurance and shipping specialist for the year to 30 April 2019 grew 11% to £218m, as fee-earner headcount grew 7% to exceed 2,000 for the first time. The firm made a number of lateral hires last year, most recently a 10-lawyer team – including two partners – from Norton Rose Fulbright. Continue reading “No Buzz Lightyear complex as Kennedys’ revenue tops £200m for the first time”

At best, murky: MPs slam ‘legally sanctioned secrecy’ of gagging orders in discrimination cases

A parliamentary select committee has condemned the ‘routine cover-up’ of discrimination allegations by employers as calls for a clampdown on non-disclosure agreements (NDAs) reach a new pitch.

The report by the Women and Equalities Committee on discrimination and harassment in the workplace, published today (11 June), is the culmination of an enquiry launched by MPs in the wake of the #MeToo movement that saw the legal profession’s handling of gagging orders thrown into the spotlight. Continue reading “At best, murky: MPs slam ‘legally sanctioned secrecy’ of gagging orders in discrimination cases”

Ashurst dismisses board member under cloud of misconduct

The board of Ashurst has asked Bernd Egbers, a Munich-based board member, to leave the firm ‘as a result of ‘conduct which is contrary to [the firm’s] values’.

Announcing the move on Tuesday (11 June), the firm would not divulge the nature of the misconduct, only that there was no connection to any client or client matter. Continue reading “Ashurst dismisses board member under cloud of misconduct”

CC follows Freshfields with £100k package for junior lawyers as pay war with US rivals intensifies

Clifford Chance (CC) has become the second Magic Circle law firm to raise the starting pay for its associates to £100,000, a month after City rival Freshfields Bruckhaus Deringer announced a similar increase.

In a move signalling the widening impact of the pressure for talent from US firms on the City elite, CC has raised its compensation for newly qualified (NQ) solicitors from £91,000 including bonuses. Continue reading “CC follows Freshfields with £100k package for junior lawyers as pay war with US rivals intensifies”

Deal watch: City teams fly on £4.6bn Rolls-Royce pension deal as Kirkland and Goodwin take multi-billion dollar mandates

Big-ticket deals have been fuelling the market in pensions, private equity and fundraising recently with UK top-10 firms and US rivals alike taking the controls on significant mandates.

Legal & General (L&G) handed a joint mandate to CMS and Eversheds Sutherland to advise on its £4.6bn buy-in to buy-out with the Rolls-Royce UK Pension Fund (RRPF), a deal which is billed as the UK’s largest ever bulk annuity and which saw Linklaters act for the trustees. Continue reading “Deal watch: City teams fly on £4.6bn Rolls-Royce pension deal as Kirkland and Goodwin take multi-billion dollar mandates”

Clydes senior partner Konsta to step down as firm grows revenue 11% in 2018/19

Clyde & Co senior partner Simon Konsta (pictured) is to step down from his role in October just over half way into his five-year term.

The firm announced today (10 June) that Konsta will hand over to arbitration co-chair Peter Hirst, as it reported its 21st consecutive year of revenue growth to £611m in the year to 30 April, up 11% on £551.3m last year. Continue reading “Clydes senior partner Konsta to step down as firm grows revenue 11% in 2018/19”

Revolving doors: Freshfields hire to leave DWF managed services role after less than a year

DWF’s New Law credentials have been dealt a blow as its managed services chief executive is set to leave the firm less than a year after his arrival in the first major exit since the firm completed its IPO in March.

Anup Kollanethu was initially hired from Freshfields Bruckhaus Deringer, where he led the Magic Circle firm’s Manchester office for over three years and established himself as a well-regarded chief of business operations. Continue reading “Revolving doors: Freshfields hire to leave DWF managed services role after less than a year”

Government ushers in emergency pay boost for judges amid mounting staff shortages

The Ministry of Justice (MoJ) has ushered in an emergency boost to senior judges’ remuneration as an unprecedented recruitment crisis continues to grip the Bench. The move, announced on Wednesday (5 June), is in response to a review by the Senior Salaries Review Body (SSRB) and will see High Court judges handed a 25% annual bonus and circuit and upper tribunal judges a 15% raise.

As part of a two-year temporary ‘bonus’, High Court judges will receive £47,225 on top of their £188,901 yearly pay in addition to a 2% pay rise. Circuit and upper tribunal judges will be paid £21,043 in addition to a £140,289 salary. Continue reading “Government ushers in emergency pay boost for judges amid mounting staff shortages”

Cash in hand: Slaughter and May to pocket £6m in fees for advice on failed hostile bid

Slaughter and May is set to receive over £6m in fees after advising sub-prime lender Non-Standard Finance (NSF) on its failed £1.3bn takeover of doorstep lender Provident Financial, which collapsed on Tuesday night (4 June) due to insufficient regulatory capital and a lack of shareholder support.

The mandate for Slaughters was led by corporate head Andy Ryde alongside fellow partner Paul Mudie, with the hostile bid being launched in February of this year. However the Prudential Regulation Authority decided the combined entity would not carry sufficient capital at the point of completion, and therefore blocked the deal. Slaughters did not advise the client on capital or shareholder-related issues. Continue reading “Cash in hand: Slaughter and May to pocket £6m in fees for advice on failed hostile bid”

Herbert Smith Freehills to scale back German operation with Berlin office closure

Herbert Smith Freehills (HSF) will be closing its Berlin office by the end of the year, reducing the firm’s German footprint to Frankfurt and Düsseldorf.

The 10-lawyer office was first opened in 2013 and is currently led by corporate partners Dirk Hamann and Ralf Thaeter. All associates, trainees and business services staff in Berlin have been given the option to transfer to the firm’s other German offices. Continue reading “Herbert Smith Freehills to scale back German operation with Berlin office closure”