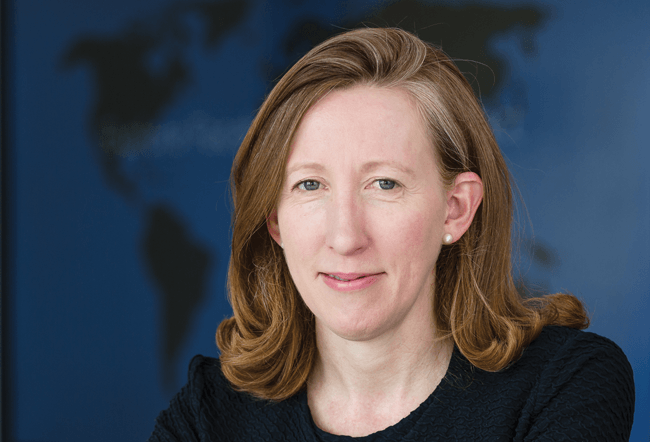

Severn Trent group general counsel (GC) Bronagh Kennedy (pictured) is keeping an open mind as to how many firms will be appointed to its £8m legal panel, with Eversheds Sutherland currently the company’s sole adviser.

The FTSE 100 water company has opened a tender process for the legal panel it last reviewed in 2015, when Eversheds extended the sole-adviser mandate it has held since 2010. The existing panel covers five lots but the new panel will be divided into three, covering all the companies in the Severn Trent Group. Continue reading “In-house: Severn Trent open to extending panel beyond Eversheds’ sole-adviser role”