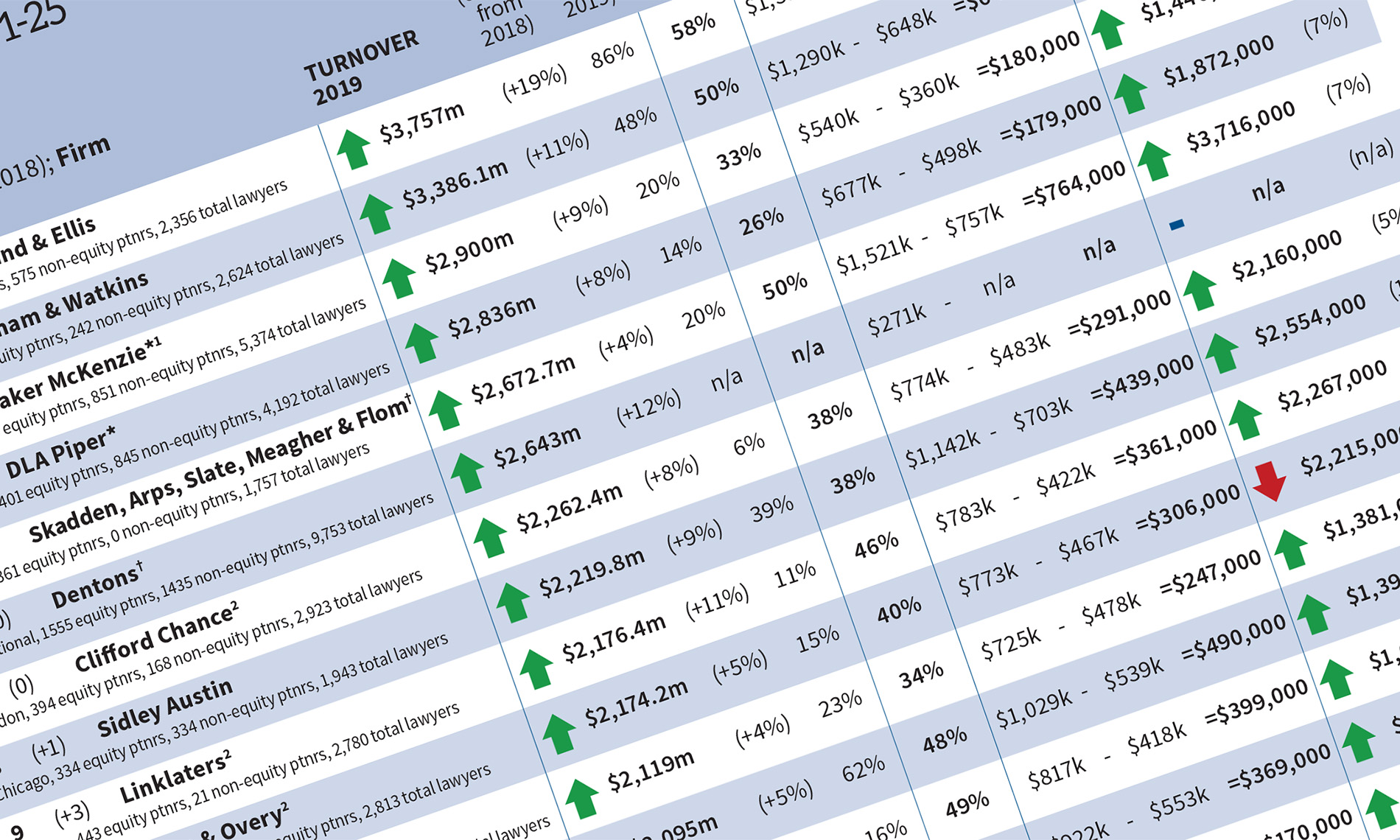

For reporters used to the profession’s usual cautious pronouncements, it is striking how enthusiastic California lawyers are about the outlook; in the Bay Area you can forget the caveats that still dominate in New York and London. ‘We are in this extraordinary period of extended boom,’ says Cooley’s San Francisco corporate partner Rachel Proffitt. ‘We see equal strength in capital markets and M&A and that’s because there is so much capital. All indicators point to a continued strong year.’

The list of bullish quotes collected in a dozen interviews with the West Coast legal elite is certainly lengthy. Many note the much-touted fact that if the state was a country, California would be the world’s fifth-largest economy (now larger than the UK). It is also America’s most populous state and third-largest by land mass, measuring 770 miles at its longest point. Others simply invite you to drive down the 101 route from San Jose to San Francisco and look around at the offices of the Sunshine State’s corporate titans like eBay, PayPal, Google, Visa, Intel, Oracle, Twitter… the full list of tech giants remaking multiple industries on a global level. Continue reading “Global 100 – Letter from Silicon Valley”