In a margin-conscious environment it is tough for advisers to catch a client’s eye, but according to flagship research into GC attitudes, a group of quality City law firms are standing out from the crowd through cutting-edge service delivery.

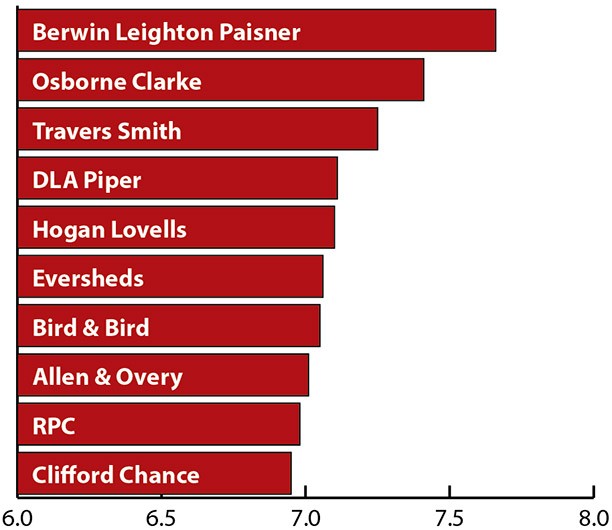

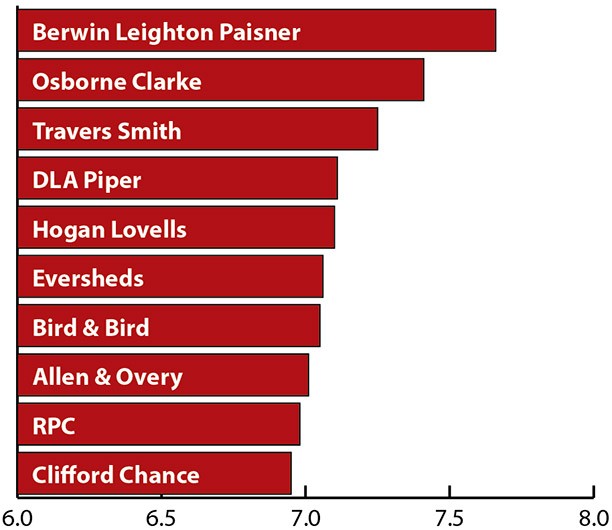

Drawing on responses from more than 9,000 buyers of legal services, the Client Intelligence Report (CIR) found Berwin Leighton Paisner (BLP), Osborne Clarke (OC), Travers Smith and Hogan Lovells, among the standout City players for adopting innovative working methods.

BLP was the highest-ranked law firm for innovation out of the UK top 50, scoring a 7.66/10 in the poll of in-house counsel, against a group average of 6.84/10.

The firm has turned heads with its Lawyers On Demand (LOD) business, which has pioneered the flexi-lawyer model in the UK. LOD last year expanded into Asia with the acquisition of AdventBalance and launched an Uber-style online platform dubbed Spoke.

‘For LOD, and NewLaw generally, innovation has to be a constant process rather than the occasional big bang. It’s something where the whole team has to contribute,’ said LOD co-founder Simon Harper.

Other highly-ranked City firms include OC, Travers Smith, DLA Piper and Hogan Lovells. Allen & Overy and Clifford Chance both scored above the top 50 average, though elite City firms were generally indifferent performers on the innovation front. Freshfields Bruckhaus Deringer, Linklaters and Slaughter and May all clustered together moderately below par.

Other top 50 law firms scoring poorly on innovation included Trowers & Hamlins, Charles Russell Speechlys and Fieldfisher.

In contrast, a number of regionally-bred players posted strong results, with Shoosmiths, Weightmans and Hill Dickinson all securing high scores.

Innovation – top-ranked City firms

Client score out of ten

NB: UK top 50 average score: 6.84/10

Telefonica UK law chief Ed Smith (pictured) said that he wants to see innovation focused on better service rather than cost. ‘I am GC of a company that turns over £5.7bn a year. Legal fees in the scheme of that are very low [but] the issues that lawyers advise on are hugely important to us. Innovation I would like to see only in terms of better outcomes. If a law firm could tell me that I could generate better management information or make better decisions, then I’m interested.’

The annual client report, a major initiative from Legal Business sister brand The Legal 500, is based on responses from 9,096 buyers of legal services globally including more than 4,000 general counsel (GCs) or heads of legal. The survey – the largest poll of the buyers of legal services ever undertaken – includes responses from 79% of the FTSE 100 and 81% of the Fortune 100.

The risk agenda

In a wider context, key findings in the report underline the subdued state of the corporate legal market as GCs come under intense pressure to contain costs.

Clients in the UK, Europe and US all reported narrowly rising legal spend in the aggregate. In the UK, 24% of GCs said they were increasing their external budgets over the next year, against 16% expecting a decrease and 60% forecasting stable spend. Similar proportions were evident across Europe and the US.

The research indicates that clients in western economies are still routinely bringing work in-house via expanding legal teams to cope with high demand for legal services. Only 6% of 2,453 respondents in the UK said their teams were expected to decrease in size over the next 12 months, against 23% set to increase and 71% forecasting stable headcount. The pattern was closely repeated across European teams as a whole.

Complexity and corporate risk are still driving the client agenda. Asked to cite the greatest challenge for their companies over the next 12 months, the biggest concern was ‘increased regulation’, cited by 30% of UK clients. Likewise, the most popular class of matter to outsource was litigation.

Telefonica’s Smith echoed the finding commenting: ‘I would say sectorial regulation is my number one concern, I would massively agree with that.’

Charlotte Heiss, group chief legal officer at RSA Group, commented: ‘It doesn’t surprise me to see regulation featuring as the top concern. It can be easy to underestimate how much work it can be to properly embed compliance with a new piece of legislation into a business and it always necessitates leaning on already stretched resource.’

Only one in five UK clients intend to use a non-traditional provider in the next 12 months. But if law firms feel complacent, they should note that larger clients are more progressively minded; 25% of clients with revenues over $500m were planning to trial an alternative provider over the next 12 months. This rises to 27% for companies with revenues of $1bn-plus.

Heiss cited pressure on many large companies to more robustly manage legal budgets. ‘RSA has been going been through a turnaround with a strong focus on cutting costs; every department plays its part in this and we have reduced both headcount and external spend.’

The findings come from a wealth of online data produced in the CIR, which asked clients 47 questions to produce an interactive grid map of client attitudes and law firm benchmarking data.

alex.novarese@legalease.co.uk

For more information on the Client Intelligence Report, email dominic.williams@legalease.co.uk